A new online bank is seeking to convert millions of pounds of spare cash languishing in bank accounts into investments.

N26 argues that the money is earning nothing in the bank but can gain a much better return from stocks and bonds.

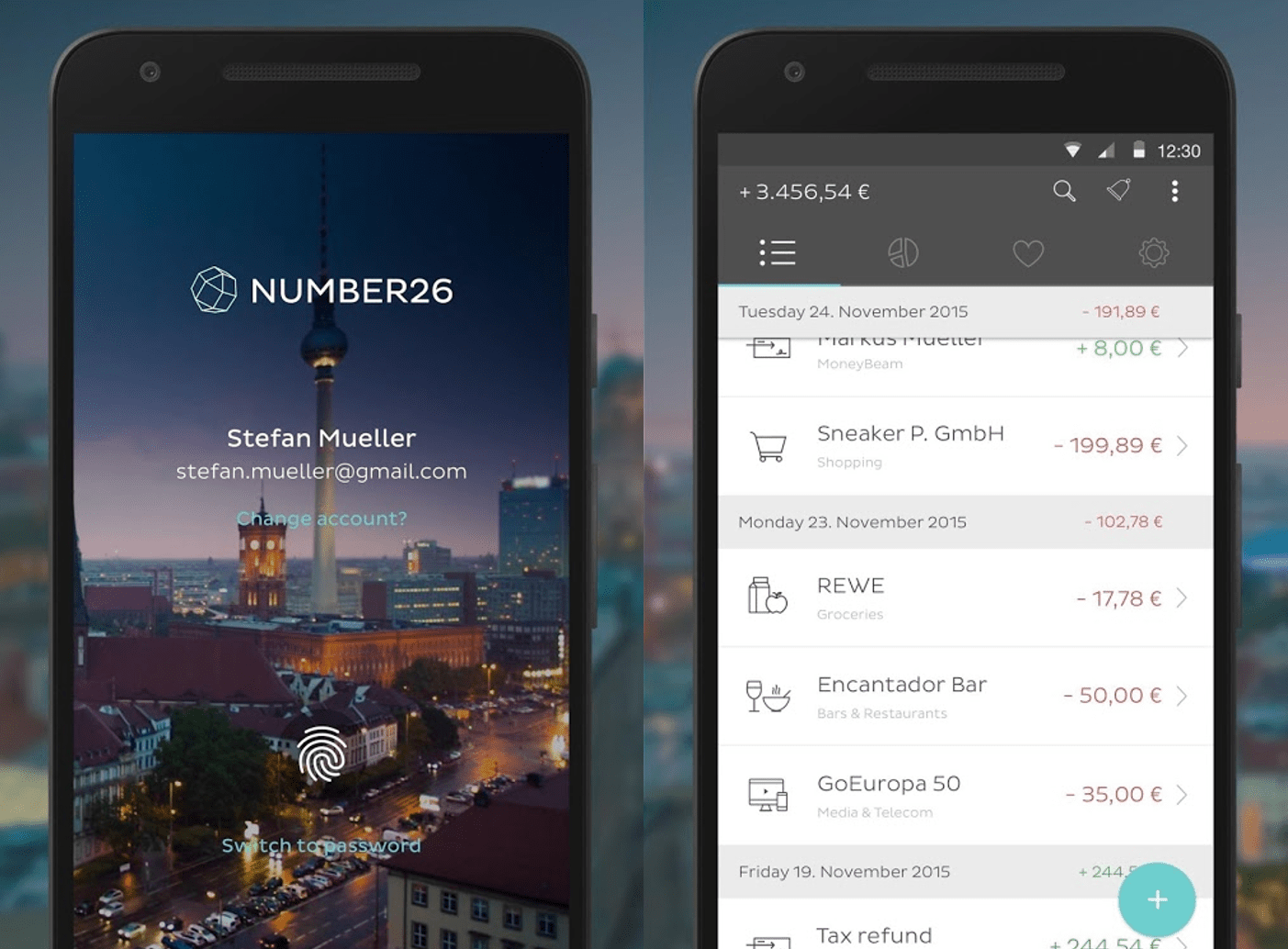

The German-based bank aims to give access to online services that offer cheaper and more effective services than traditional banks.

“Millions of Euros lie unused in German checking accounts. In a period of low interest rates, that effectively means a financial loss,” said N26 founder and CEO Maximilian Tayenthal.

“With N26 Invest our customers have the possibility to easily put their excess funds to work.”

The bank says an easy-to-use app lets users make ‘sophisticated’ financial decisions without the need for a professional adviser.

No hidden charges

N26 customers can pay cash into their accounts at dedicated deposit desks, while money can be withdrawn from cash points.

As the start-up has a banking licence, N26 can offer savings accounts, credit, insurance and investment advice.

The app offers a list of online services to compare and an N26 option.

Fees are based on a percentage of the value of invested funds – with a minimum charge of 1.9 euros a month.

The bank promises to display all fees and not to have hidden charges.

“With N26 Invest our customers can invest with just a few taps, and no paperwork, right on their phones. Traditional investment processes are complicated and no fun. We’re changing that with N26 Invest,” said Tayenthal.

Real-time banking

Since opening for business in January 2015, N26 has taken on more than 200,000 customers in eight countries.

N26 coasts that investment in technology allows customers access to real-time banking information.

Customers have carried out more than 212,000 financial transactions involving almost 15 million euros.

Most of the transactions take place in the German cities of Berlin, Munich and Cologne. Outside Germany, Vienna, Austria, is the busiest city for N26 customers.

Holding a banking licence allows the bank to expand across the rest of the European Union.

The only serious glitch in the bank’s processes was the sudden cancellation of 400 accounts where customers were withdrawing cash from ATMs regularly, for which the bank had to pay expensive fees.