Any good businessman or accountant is likely to argue keep an eye on expenses is a good way to improve profits without boosting sales.

The same goes for investments – fund charges can make a big dent in the return from a portfolio and are almost an unseen cost for many.

Some IFAs charge up to 4% of fund value a year to manage wealth, while the average is 1.8%.

Often, these hidden fees are not clearly explained and investors find tracking them down elusive.

Some new funds and wealth managers offer cheaper prices as they strive to make an impact on the market.

Lean operations

Many are lean operations that trim costs to the bone, charging 1% or less to look after money.

Research from manager Netwealth suggests that moving money to a challenger that charges a lower fee can make a significant difference to how long a pension fund will last after retirement.

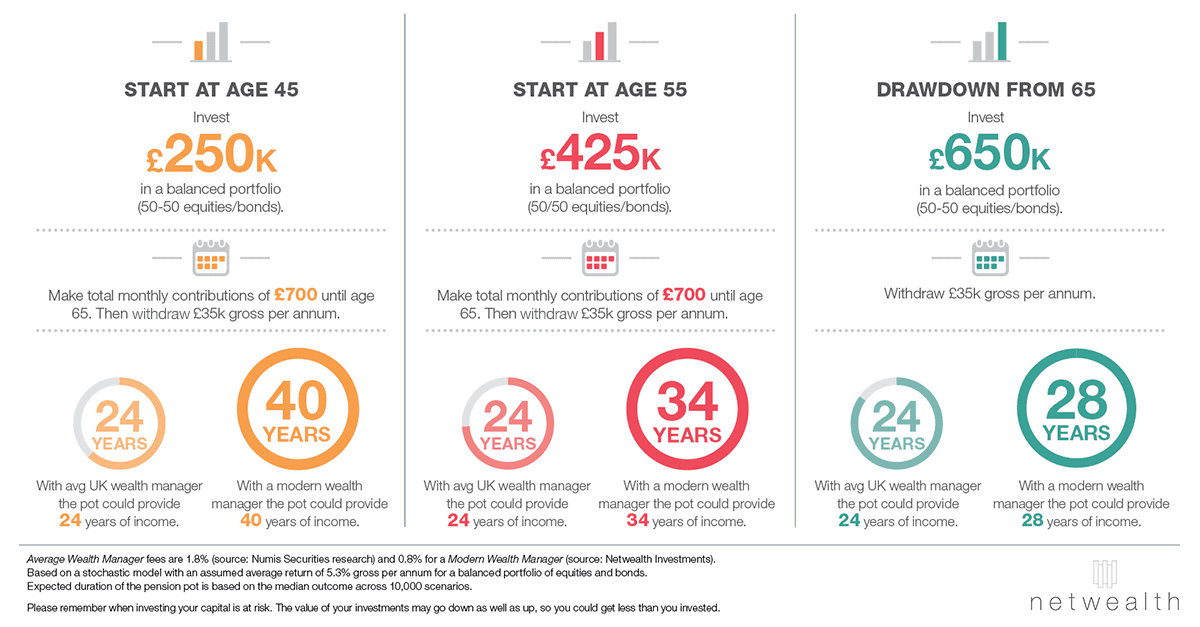

The firm worked out a 65 year old retiring with a £650,000 pension fund could expect the money to last for 24 years at a withdrawal rate of £35,000 a year with an annual management fee of 1.8% and replacement rate of 5.3% a year.

Switching to a wealth manager charging 0.8% would eke the fund out for another four years to give 28 years of retirement income lasting until the saver was 93 years old instead of 89.

How the numbers pan out

Netwealth also crunched the numbers for workers drawing a pension at 45 and 55 years old.

“Challenger investment services such as Netwealth are able to hold down costs by using a combination of qualified advisers and investment managers with online technology. Netwealth dispenses the extraneous stuff – wood-panelled rooms, salespeople and golf days – which do so much to drive up traditional costs,” said CEO and founder Thomas Salter.

“The effect of low charges could be even more powerful if used in combination with other strategies for sustainable saving. For instance, an investor could choose to draw down a little less income every year, or to adjust drawdown regularly to reflect the changing value of the pension pot.”