Tracking pension transfer values is a good way to see if your retirement savings are on track.

One of the leading monitors posts data about the movements of fund values of direct benefit or final salary workplace pensions for the previous month.

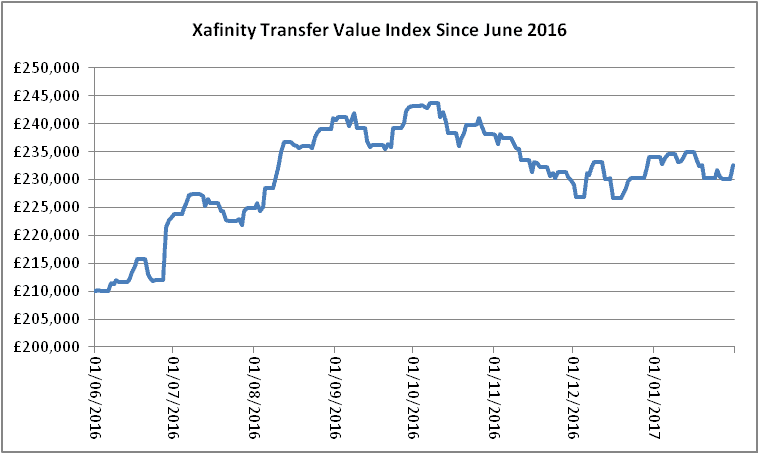

The latest figures for January show for 64 year olds entitled to £10,000 a year index-linked pensions starting on their next birthday would need a fund of £232,600.

During the month, the amount floated between £230,000 and £235,000, according to pension consultants Xafinity.

The figure at the end of December 2016 was £234,000.

Fund movements cancelled out by changes

Paul Darlow, head of proposition development at Xafinity said: “Transfer values in January 2017 were fairly stable. We saw increases in gilt yields largely matched by increases in inflation expectations. The two movements mostly cancelled each other out, leaving transfer values for inflation-linked benefits largely unchanged over the month.

“I wouldn’t want to second-guess the next move for transfer values – but it will be interesting to see how markets react to the triggering of Article 50 and a UK move away from Europe.”

The index started 2016 at £203,000, but posted a 15% increase during the year.

“Last year was dramatic for transfer values. It feels like there has been an increase in transfer activity since the Brexit vote, and I have seen some extremely large transfers paid out recently,2 said Darlow.

“Increasingly “partial transfers” are requested and it seems likely that more schemes will need to consider if this is something that they wish to offer.”

Benchmarking pension savings

Based on the Xafinity index, a single retirement saver with a full state pension entitlement and an average final salary transfer value would pick up a pension of £18,300 a year from April 2017. The payment would be index linked.

A couple should expect a payment of £26,600 a year.

The figures are a useful benchmark for retirement savers to aim at.