Qualifying Recognised Overseas Pension Schemes (QROPS) have surged to a remarkable success from a standing start.

QROPS passed the eight year milestone on April 6, 2014 after they were introduced on A-Day 2006.

A-Day was the date of a pension shake-up that introduced many changes for retirement savers.

The aim of QROPS was to allow British expats and international workers with UK pension savings to port their pensions if they moved to another European Union country as part of their right to freedom of movement within the EU.

Since then, QROPS have developed into a global pension plan with 42 financial jurisdictions offering more than 3,364 schemes.

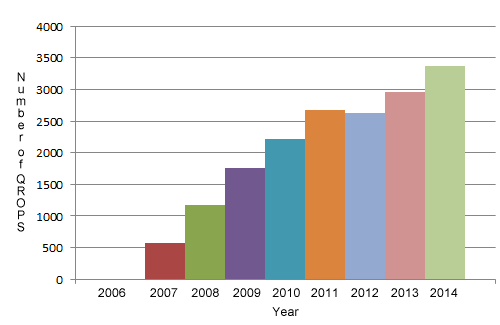

The chart below shows how the number of QROPS has grown worldwide.

QROPS by numbers

The figures speak for themselves. On April 6, 2006 – A-Day – no QROPS were available. Then the number started to soar:

- April 2006 – 0

- April 2007 – 567

- April 2008 – 1,174

- April 2009 – 1,755

- April 2010 – 2,216

- April 2011 – 2,671

- April 2012 – 2,633

- April 2013 – 2,963

- April 2014 – 3,364

The number dropped back in April 2012 when HM Revenue & Customs (HMRC) revised QROPS qualification rules. As a result more than 300 pensions in Guernsey, New Zealand and the Isle of Man were suspended from receiving new transfers from British onshore pensions.

From the start, Australia and Ireland have always been the main two QROPS financial centres, taking an average two-thirds of the market by number of pensions.

According to the latest HMRC figures, an average 10,000 funds are transferred out of British funds to a QROPS every year.

The tax man also reckons nearly £3 billion has been switched to the overseas pensions since 2006.

QROPS advantage

Ireland is the main destination for many corporate QROPS, with names like Vodaphone, Volvo, Tesco, Reuters, Microsoft, IBM, Hewlett-Packard and Aviva hosting pensions in the country.

QROPS are not just tax-efficient retirement options for multinational corporations and the fabulously wealthy.

Many of the pensions cater for less well-off investors and offer tax-free growth, flexible investments and foreign currency exchange safeguards.

The FX advantage is most QROPS pay out in one of several major currencies rather than Sterling, so pension payments can be made direct to personal bank accounts in local currency without losing money to conversion rates and costs.

QROPS rules do not lay down any minimum transfer requirement, although in practice, many providers set limits as switching small pots to some schemes may not be cost-effective.

Another bonus for many expats is some financial centres offer enhanced 30% tax-free lump-sum pay outs.

How QROPS have grown since 2006

Source: HMRC