Civil servants and public workers transferring their pensions to Qualifying Recognised Overseas Pension Scheme (QROPS) face a race against time as the government moves to change the law.

Public sector pension savers were banned from switching their funds to an offshore QROPS as part of Chancellor George Osborne’s pension overhaul in April that introduced flexible access to retirement funds.

The move affected thousands of civil servants, teachers and workers in the health service and those serving in the armed forces.

Osborne took away their option to transfer final salary schemes to QROPS because their pensions are unfunded and every transfer would have seen cash siphoned out of Treasury coffers.

However, the government has now revealed that the rules were poorly drafted and left a QROPS transfer open to these workers if their switch was to a QROPS within the European Economic Area (EEA).

New rules on the way

Several countries offer QROPS within the EEA– notably Malta, Ireland, France, Spain and Germany.

The Treasury has had to admit that loose wording of the rules has left a back-door open for transferring civil service and public sector workers to move their money offshore.

“The intention was for all unfunded civil and public pension transfers offshore to be banned,” said a Treasury spokesman.

“However, the rules as drafted do not reflect this intention. We are talking to pension providers about this ahead of issuing new legislation to stop these transfers.”

No timescale has been put on when the new rules may come into force, so anyone contemplating a transfer of funds from a civil service or public sector pension scheme to a QROPS needs to act quickly.

QROPS list

HM Revenue & Customs (HMRC) and The Treasury have a chequered track record with introducing new QROPS legislation.

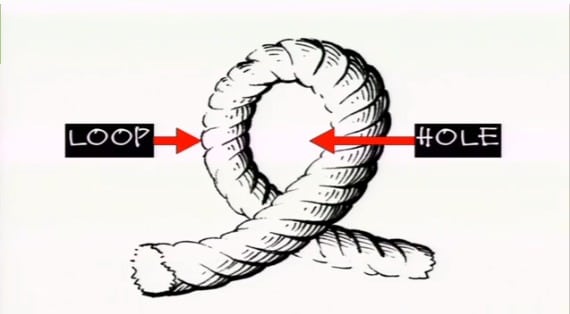

The rules governing the offshore pensions have been regularly revised, but some providers seem to find loopholes that remain open for a short time.

HMRC is quick to act to delist QROPS schemes deemed to be breaking the rules.

The last major revamp of the rules was in June, when hundreds of QROPS were delisted because they had overlooked complying with the new pension age test introduced in April stopping anyone aged less than 55 years old from accessing their retirement savings except in special circumstances.

The new test saw around 3,000 QROPS delisted for breaching the rules.