British expats should read the small print of double taxation treaties between Britain and the country where they now live as they might have the chance of cashing out their pensions tax-free.

Lawyers and accountants are combing the treaties – also known as DTAs – after expat financial provider Old Mutual Wealth revealed a treaty between Britain and the United Arab Emirates allows retirement savers to take all the money in their pensions without paying tax.

The DTA has a clause which allows former British taxpayers aged over 55 years old now resident in the UAE to draw their full pension benefits with the advantage of paying local tax on the cash.

The rate of income tax in the UAE is 0%, so no tax is due.

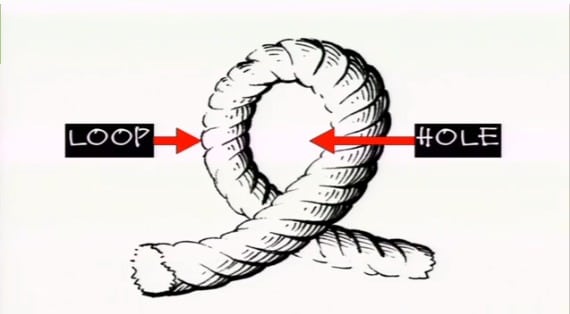

Loophole is in other tax treaties

Several other DTAs contain the same clause, but pension cash cannot be taken tax-free because the local rate is higher than 0%.

However, the clause offers a saving if the rate is lower than the tiered UK income tax rates of 20%/40% and 45%.

Old Mutual Wealth explained that retirement savers who want to take advantage of the DTA loophole must check that they are not UK resident for tax when accessing their pension cash, but are UAE tax resident, otherwise the terms of the DTA do not apply.

The DTA arrangement does not only apply to the Qualifying Recognised Overseas Pension Scheme (QROPS) but other UK registered pensions, such as self-invested personal pensions (SIPPS), personal pensions and small self-administered schemes (SSAS).

How QROPS are affected

QROPS follow different rules as they cannot be held by UK tax resident retirement savers and a 25% tax charge may apply to new transfers as the UAE is outside the European Economic Area (EEA) and Dubai has no local QROPS providers.

Under the DTA, many expats may be able to draw their pensions in the UAE without first transferring to a QROPS.

“Until the start of the treaty, British expats in the UAE would have had to transfer their pensions to a QROPS to take advantage of the tax-free regime,” said an Old Mutual spokesman.

HM Revenue and Customs (HMRC) publishes full versions of double taxation agreements with dozens of countries.