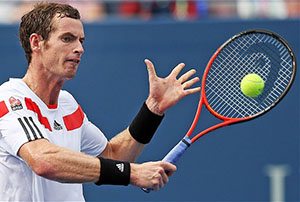

UK number one and world-ranked number three tennis star Andy Murray is serving up advice on health, fitness, sport and wearable tech industries for crowdfunding platform Seedrs.

In between tennis matches, Murray will sit on the platform’s advisory board but the firm stresses he will not offering professional advice to entrepreneurs.

Murray has indicated he will invest some of his £26 million career winnings in startups and incubator businesses through the platform and promoting the company’s services overseas.

“I’m interested in investing and relish rolling up my sleeves to work in an innovative way with entrepreneurs and new businesses,” said Murray.

Filling a gap

Online takeaway food delivery service Hungr has picked up a £362,000 seed capital investment.

The company is ready to open in berlin, Germany, later in June and then set to expand into other European cities.

Consumers want three things from us – easy ordering, good food and fast delivery,” said a spokesman.

“We want to achieve that by offering curated restaurant options that gives a better service than our rivals.”

Community challenge

Community projects could pick up a much-needed fillip from a new crowdfunding concept.

Crowdfunder UK has unveiled community shares, a mix of owning and donating to charities and community projects.

The results are social rather than financial, says the platform, which has launched the joint venture with The Community Shares Company.

Crowdfunder’s Jessica Ratty said: “This is a new concept that allows communities to band together to fund projects that mean something to them without the expectation of a financial reward.

“This can make a project more sustainable and gives the community a social benefit. This platform allows community groups to promote their projects and engage with their community to raise the money so many groups desperately need to keep going.”

Lending to business

Crowdstacker is a new peer to peer lending platform aiming to offer finance to larger businesses than traditional peer to peer outfits.

The platform is seeking to attract larger ticket funding of up to £50 million from companies with strong trading track records who can prove a solid return on investment.

“We want to help established businesses rather than startups,” said a spokesman. “Candidates will have a proven business model, a strong track record and ran experienced management team.”

Crowdstacker’s first deal is with Quanta Loans, a buy to sell firm planning to spend £3 million on refurbishing and selling up to 10 properties.