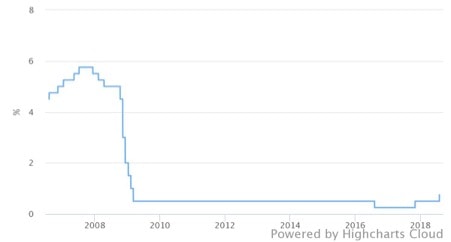

The Bank of England has put interest rates on hold after moving them up last month to the highest level since the financial crisis.

After the influential Monetary Policy Committee met, the Bank released a statement confirming the rate will hold at 0.75% – the highest the figure has hit since 2009.

The committee, chaired by governor Mark Carney, explained the UK economy was marginally stronger than expected after GDP expanded by 0.6% in the three months to July and inflation stayed lower than anticipated.

But the Bank has not ruled out further rate hikes at ‘a gradual pace and to a limited extent’.

“The MPC continues to recognise that the economic outlook could be influenced significantly by the response of households, businesses and financial markets to developments related to the process of European Union withdrawal,” said the Bank.

Brexit uncertainty

“Since the committee’s previous meeting, there have been indications, most prominently in financial markets, of greater uncertainty about future developments in the withdrawal process.

“The committee judges that, were the economy to continue to develop broadly in line with the August Inflation Report projections, an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to the 2% target at a conventional horizon.

“As before, these projections were conditioned on the expectation of a smooth adjustment to the average of a range of possible outcomes for the United Kingdom’s eventual trading relationship with the European Union. At this meeting, the committee judged that the current stance of monetary policy remained appropriate. Any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent.”

Bank of England interest rates over the past 10 years

Source: Bloomberg