Shopping has changed forever thanks to COVID-19 lockdowns that have forced retailers to rethink the way they deliver their goods to customers.

A recent survey across nine countries revealed shoppers go online more often to browse and buy everyday items as well as one-off gifts and purchases – and the signs are this online shopping bonanza is set to grow even more.

As an investor, you have an opportunity to profit from this online revolution with the Four-Year Autocall Reverse Convertible on e-commerce and payments from deVere Group.

Paying 9% a year fixed interest, the fixed income convertible tracks three of the most exciting stocks in the sector.

What Is The Four-Year Autocall Reverse Convertible?

The Four-Year Autocall Reverse Convertible on e-commerce and payments is a fixed income instrument.

Basically, that means investors are paid a fixed return based on the performance of the underlying stocks, providing clear parameters set at the start are maintained.

Credit rating

- The Four-Year Autocall Reverse Convertible on e-commerce and payments is rated ‘A3’ by Moody’s, ‘BBB+’ by Standard & Poor’s and ‘A’ by Fitch

The return

- The coupon pays fixed income of 9% interest a year, split into quarterly payments of 2.25%

- The maturity date is set at four years

Capital protection

- Your full investment is returned at maturity providing none of the underlying stocks have not lost 25% or more of their value

Autocall and early redemption

- An autocall triggers early redemption if all the stocks trade at or above their initial price. The autocall takes effect after six months and is tested at market close quarterly for the rest of the term

- Stock values are calculated from the strike date – the day the investment starts the four-year term

Investment

- The minimum investment is US$1,000

Underlying stocks

- Alibaba Grp-Adr (BABA UN)

- Alliance Data (ADS UN)

- Mercado Libre Inc (MELI UW)

The Opportunity

Online shopping and payments companies are attractive investments.

Amazon has seen 80% growth to around US$3,140 a share in the past 12 months and 70% growth year-to-date as one of the leading online traders.

Amazon is one of the world’s largest companies with a market capitalisation of US$1.57 trillion.

The company is one of a cluster of online retailers and payment portals posting phenomenal returns.

The COVID-19 pandemic has only seen the sector grow faster as shoppers have moved online as brick-and-mortar stores were forced to close.

Even with an effective vaccine, shopper behaviour has changed and is likely to continue to boost the sector.

The Stocks

The Four-Year Autocall Reverse Convertible on e-commerce and payments is a basket of three major stocks:

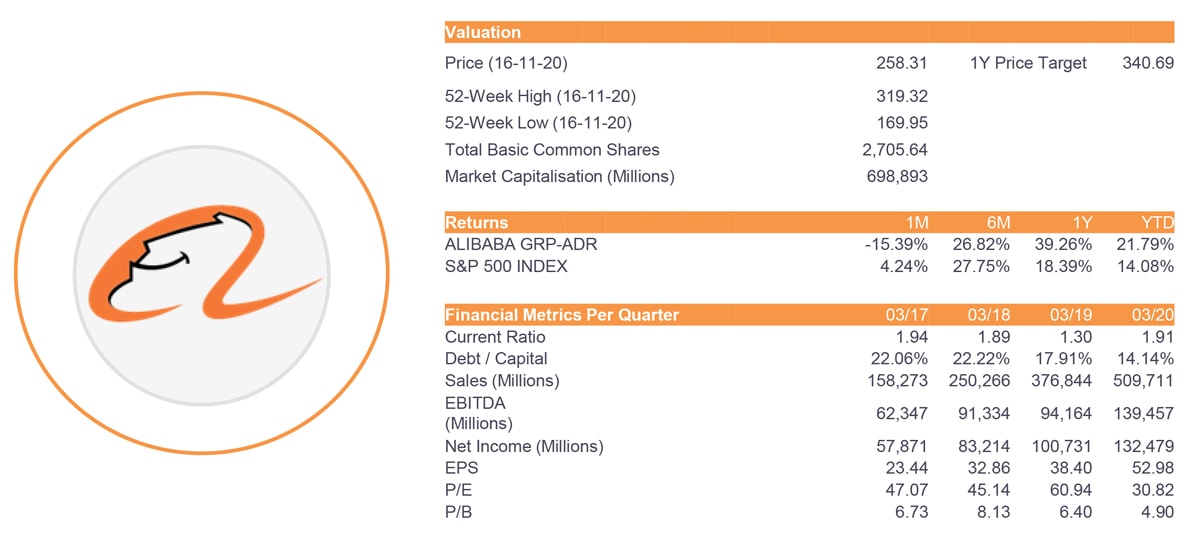

Alibaba

Alibaba is China’s Amazon offering an online marketplace and web services to millions of customers.

The company dominates online shopping in the world’s most populous country and reaches beyond the borders as a major force in retail globally.

Alibaba is expected to profit from China government policy as the country seeks to become a leading technology provider.

Alibaba stock data (USD$)

Alliance Data Systems (USD$)

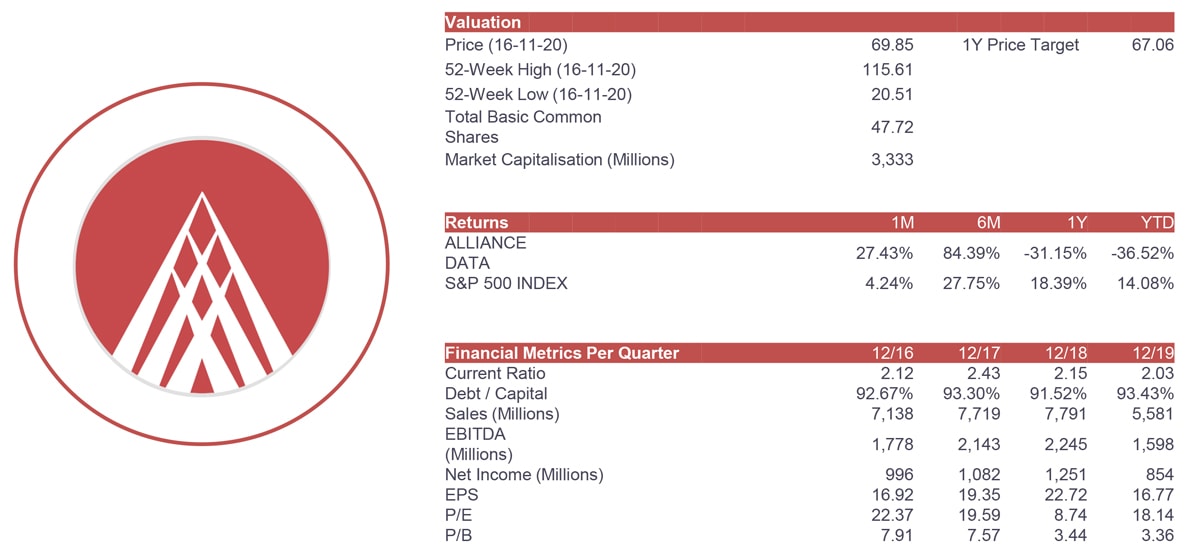

Alliance Data Systems is the processing power behind nearly 150 online brands.

The company captures and analyses sales transaction data for reward programs run by firms like Ulta Beauty and Pottery Barn.

deVere Group analysts predict the Alliance Data Systems share price is ripe for a rally after slipping 38% this year due to the impact of COVID-19 on the world economy.

The company also has a new management team working to reposition the business. The policy is already chalking up results as operating expenses have dropped by a third while revenues have climbed back to more than a $1 billion.

Alliance Data Systems stock data

Mercado Libre (USD$)

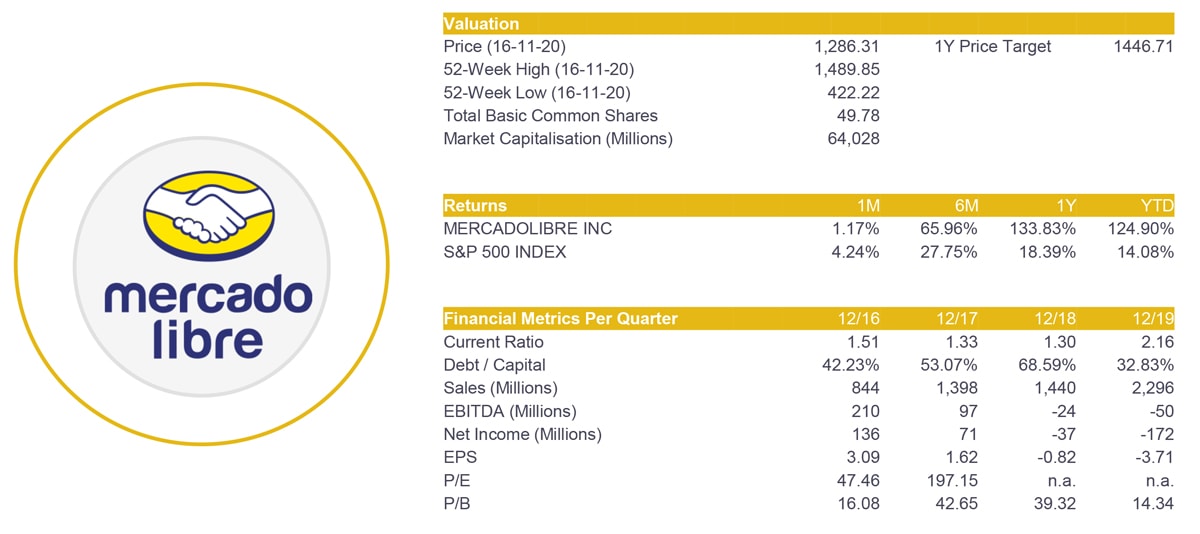

Mercado Libre is a big e-commerce player in Latin America and a top three performer on New York’s NASDAQ this year.

The firm is expanding in Brazil, a huge online shopping market, with a new logistics hub.

Mercado Libre has recently doubled active users from 39.6 million to 76.1 million, while sales are 62% up year-on-year to $5.9 billion.

Mercado Libre stock data

Find out more about the Four-Year Autocall Reverse Convertible on e-commerce and payments

The fastest and easiest way to buy this investment is through the deVere Investment app.

About deVere Group

deVere Group is one of the world’s leading financial advice firms for expats and international investors.

Founded by CEO Nigel Green in 2002, deVere Group looks after more than $10 billion under investment from 80,000 clients living in 100 countries.

This financial clout allows deVere Group to collaborate on exclusive investment opportunities with many leading global banking and investment brands, like the Four-Year Autocall Reverse Convertible on e-commerce and payments.

Related Information

Below is a list of related articles you may find of interest.