Young investors are shunning artificial intelligence and robo-advice in favour of face-to-face interaction with a real person, according to new research.

Only 1 in 20 millennials – investors aged between 22 and 37 years old – prefer to take advice from a machine, says the UK Investors Survey by research firm GlobalData.

Sergel Woldemichael, a wealth management analyst at GlobalData said: ‘‘Digital services provides advantages for wealth managers, as a robo-advisor can reach new demographics such as the mass affluent, as well as offering operational efficiencies through the automation of tasks.

“Our survey data shows that most of the more digitally advanced younger generations still require human interaction and expertise before they will make an investment decision.’’

He also doubts robo-advisers have the experience to weather a financial storm, such as a recession or market volatility.

“Pigeonholing the next generation into a digital chamber is the wrong way to view millennials,” said Woldemichael.

What is robo-advice?

“Mobile investment apps are unable to cater to the emotional needs of humans when seeking financial advice. A hybrid model is the best bet for the moment, and for the near future. Evidently, these digital natives are still seeking a human to collaborate with and gain valuable insight from.”

Robo-advisers come in a variety of formats– from bots running live chat slots online to investment advisers – and are a hot topic in the financial advice industry.

For providers, the attraction is the low-cost of a robo-advice service.

The software accesses pre-built algorithms to give advice and recommendations based on how customers answer a set of questions.

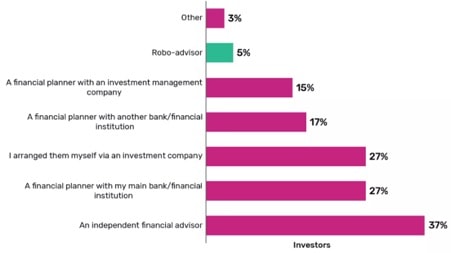

Although millennials seem to distrust robo-advice, 37% of investors voiced a preference to speak to an independent financial adviser, compared to 5% who were satisfied to take robo investment advice.

How do millennials arrange investments?

Source: GlobalData