Investing in stock markets has nothing to do with right and wrong – only the winning or losing count, according to a leading fund manager.

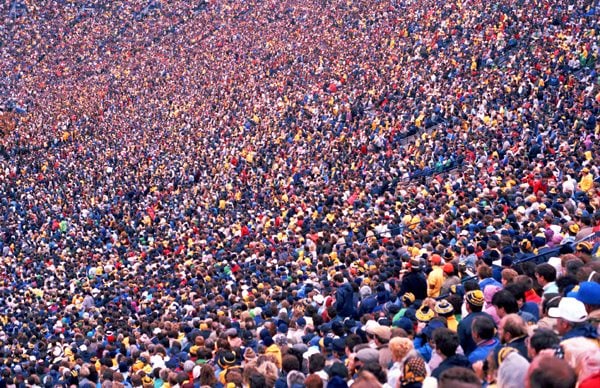

Joe Le Jehan, a fund manager who works with the Schroders Multi-Manager team argues that investors should not follow the crowd because the collective view of where markets are heading is not necessarily the best way to go.

The collective view is markets are stagnating because of the combined impact of low growth and low inflation, which are the result of monetary easing and currency devaluations.

Le Jehan explains that the crowd sees the current global market stuck in a rut and a place where:

- The US dollar continues to gain in strength

- Companies defending stable growth remain popular

- China’s slowing GDP puts a damper on energy and commodity stocks and shares

However, he also believes this world view is not the only one for investors.

Nothing is certain

“Investors are convinced the dollar will stay strong, but where a strong US dollar was considered as good for the world economy, investors are starting to believe otherwise,” said Le Jehan.

“Many investors have a skewed view about the dollar and may have to rethink their position even if a weaker dollar means less growth in the USA.”

Rising inflation has got to happen at some time, explains Le Jehan, and some believe inflation has already reached the end of a downward cycle.

“Nothing is certain at the moment,” he said. “Investors are shunning energy and commodity companies at the moment but the crowded sectors look fully valued while these sectors are priced to reflect the risk.

World economy on a tightrope

“This could open up some tremendous opportunities in the sectors investors currently do not want to be part of.”

Le Jehan revealed that is team feels the world economy is on a tightrope and could jump either way.

“Equity markets offer some value, but investors believe monetary easing generates economic growth, but this is not necessarily true,” he said.

“Bond markets are not attractive either and investors seem to ignore the possibility inflation and economic growth improving, even if the chance looks small.

“That’s why we have an underweight exposure to equities and a large cash amount in our fund.”