Two out of three retirement savers who take all the money from their pension pay more tax than they should because they do not follow financial advice.

In the last financial year, 9,085 of 15,413 savers withdrew all the cash in a pension worth £50,000 or more without financial advice, says the Financial Conduct Authority (FCA).

The figure is on a par with the year before, when 9,035 savers out of 14,979 took £50,000 or more from their pensions without taking advice.

The way tax on pension withdrawals works, 25% of the pot is tax free and the rest is added to their other taxable income. Total income above £50,000 is taxed at 40%

Sean McCann, a chartered financial planner at NFU Mutual, said: “Those cashing in their pension funds in full may not only suffer a significant income tax charge, they also lose the protection from tax on any future growth and inheritance tax should they die.

“Some cash in their pension funds without a clear idea of what they plan to do with the money, often putting it into a bank account. If investors are concerned about market volatility, talking to their pension provider about lower risk funds may help them avoid an unnecessary tax bill.

“Although it sounds counter intuitive, for those that can afford to, pensions should be the last investment they access in retirement, because of the protection they offer from inheritance tax.”

Tax cost of taking a £50,000 taxable payment from a pension

| Income | Taxable withdrawal after deducting tax-free cash | Extra Income tax due |

|---|---|---|

| £25,000 | £50,000 | £15,000 |

| £40,000 | £50,000 | £18,000 |

| £50,000 | £50,000 | £20,000 |

Under 65s taking too much pension cash

The FCA pension drawdown data also shows that many under 65s are withdrawing too much cash from their retirement savings.

The Money Advice Service warns that taking a pension in one go while under 65 or taking too much from the fund could result in a large tax bill or running out of money too soon in retirement.

“It’s possible we could see more people in this age group accessing their pensions due to the current economic situation,” said McCann.

“It’s important to understand all the options before taking action to ensure you have a sustainable income during retirement.”

The industry rule of thumb is to take no more than 4% of a pension fund as income each year.

On the FCA’s 2019-20 figures, which means taking £39,058 a year instead of the £58,587 taken by 47% of retirement savers under 65 years old.

| Year | Taking 8% or more | Taking 6% or more |

|---|---|---|

| 2018/19 | £53,576 (43.6%) | £69,782 (56.7%) |

| 2019/20 | £58,587 (47.1%) | £72,580 (58.4%) |

£37 billion cash taken from pensions

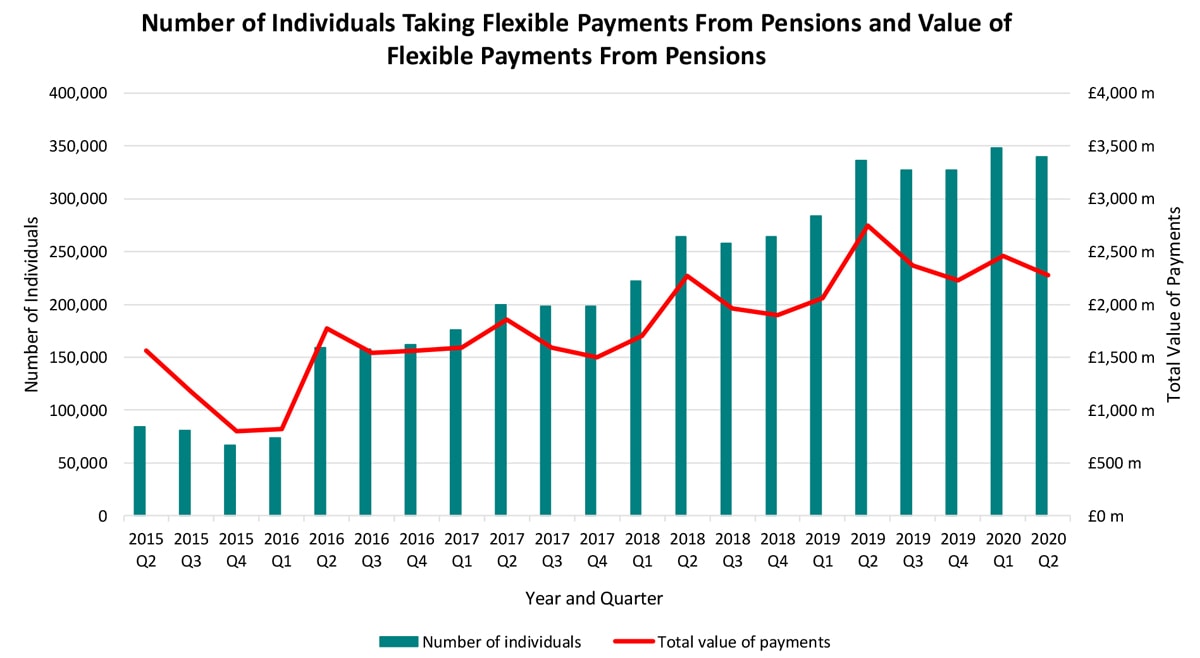

Around 350,000 pension withdrawals under flexible access rules are made each quarter, according to the latest statistics from HM Revenue & Customs.

In Q2 2020:

- £2.3 billion was made in flexible access payments

- 340,000 savers withdrew the money from their funds

- The average withdrawal was £6,700 – but many savers make multiple withdrawals in a quarter

Flexible pension payments – number and amount of withdrawals

Expat tax on UK pensions

How much tax expats pay on their pension cash depends on where they live.

If their main home is classed as in the UK, then UK tax is due on pension drawings other than tax-free cash.

The pension provider will take off any tax due before paying a retirement saver.

Expats who are tax resident in another country are unlikely to pay UK tax on pension drawings but may have tax to pay in the country where they live.

People decide where to live because they like the place, must work there or are close to family and friends – paying less tax is a benefit that comes with a move rather than the reason for the move.

Some pensions are exceptions to the rule – like UK civil service pensions which are always taxed in the UK regardless of where the retirement saver lives.

Minimising pension tax as an expat

A quick look at tax rates around the world reveals they are surprisingly similar from country to country – especially the favourite destinations of British expats.

Thousands of British expats have switched their UK pensions offshore to the Qualifying Recognised Overseas Pension Scheme (QROPS) or an international Self-Invested Pension Plan (SIPP).

Since 2015, one of the main reasons for the switch is moving a UK pension with a retirement age of 60 or 65 years to a QROPS expat pension that offers flexible access on the same terms as UK pensions – for instance the ability to withdraw funds from the age of 55 years old.

But moving the fund for this reason does not minimise any tax due.

Another issue with QROPS is few countries where expats offer the offshore expat pensions have lower income tax rates than the UK and the countries that have significantly lower tax rates don’t have QROPS.

SIPPs have the same problem as most are based in the UK, where providers deduct income tax at source.

QROPS centre income tax rates

Here’s a list of countries that host QROPS providers and their basic and higher rate income tax rates.

For comparison, the UK basic income tax rate is 20%, while higher rate taxpayers have a 40% rate.

If paying lower income tax is an objective for an expat, which is unlikely, only Latvia and New Zealand offer higher rates that are less than in the UK.

| Country | Basic rate | High rate |

|---|---|---|

| Australia | 19.00% | 47.00% |

| Austria | 25.00% | 55.00% |

| Belgium | 30.00% | 52.90% |

| Canada | 20.50% | 53.50% |

| Denmark | 27.16% | 55.90% |

| Finland | 6.00% | 51.10% |

| Germany | 0.00% | 47.50% |

| Ireland | 40.00% | 48.00% |

| Latvia | 23.00% | 31.40% |

| Luxembourg | 8.00% | 45.80% |

| Netherlands | 10.45% | 51.80% |

| New Zealand | 17.50% | 33.00% |

| Norway | 8.04% | 38.20% |

| Sweden | 20.00% | 57.20% |

| Switzerland | 0.77% | 41.70% |

| USA | 12.00% | 43.70% |

More information: OECD

Pension Cash Withdrawal FAQ

Under pension freedom rules were introduced in April 2015, retirement savers with a defined contribution scheme can access their savings from the age of 55 years old.

The money can be taken as a single lump sum, regular income or ad hoc withdrawals.

The worry is many pension savers are taking too much cash too soon from their funds, which could leave them short of money in their later years.

The rule of thumb is 4% of the fund on the basis that the fund will grow by at least that amount each year to cover the withdrawal.

According to recent research by Which? magazine, a retirement saver needs a pension fund worth £262,500 to get £25,000 a year from an annuity or £169,175 in the pot to drawdown a £25,000 a year income. The figures include a state pension of around £14,000 a year for a couple and assume 3% growth a year for the pension fund in drawdown.

Where you call your main home is the place where you are most likely tax resident and you are liable to pay tax on any income or gains you earn according to the tax rules of that country.

Residence status is complicated and a key financial issue for expats. If you are unsure of your tax residence, speak to a professional adviser straight away.

You must survive on the State Pension, if you are entitled to the payment, and any savings you may have. This could mean entering your final years on reduced means.

IFA web site Unbiased suggests at retirement advice on a £250,000 pension pot would cost £3,500

Related Information

Below is a list of related articles you may find of interest.