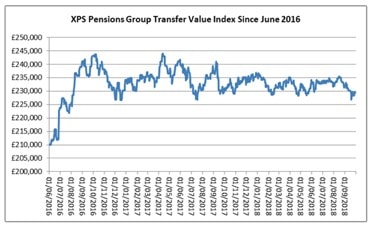

Pension transfer values lost some ground during September, falling to the lowest level for a year.

A drop in gilt yields was blamed for the fall, but the transfer values bounced back to end the month around the same level as a year earlier.

At the end of August, the average transfer value out of a workplace direct benefit pension stood at £232,000.

The figure dropped to £227,000 but recovered to £230,000 at the end of the month, said XPS Pensions Group head of DB growth Sankar Mahalingham.

“We have now seen a 12 month period of relatively stable transfer values,” he said. “The index at the end of September 2018 stands at the same value as it did at the end of September 2017, £230,000, and has fluctuated by only £9,900 or around 3% during that time.

Record transfer levels

“We have now seen a 12 month period of relatively stable transfer values.”

XPS’s index tracks the transfer value that would be provided by an imagined direct benefit pension scheme for a member aged 64 who is entitled to a pension of £10,000 each year, starting at age 65. It increases each year in line with inflation.

The latest official figures from the Office for National Statistics estimates 100,000 retirement savers transferred out of workplace direct benefit schemes in 2017, moving funds valued at around £34 billion and £10.6 billion was switched out in the first three months of 2018 – a record amount.

XPS cite high transfer values and the opportunity of accessing funds early through pension freedoms as the main drivers for savers to move their retirement money.

New rules for pension advisers

Market watchdog the Financial Conduct Authority published new guidance for pension transfers at the start of October.

The new rules up the qualification requirements of pension transfer advisers.

Christopher Woolard, the FCA’s executive director of strategy and competition said: “These new rules will mean advisers have greater certainty and confidence in what we expect when they offer pension transfer advice.

“We expect our interventions to improve the quality of advice which will help to reduce the number of complaints against advisory firms. We will measure consumer outcomes through our supervisory work.”

Source: XPS