Younger investors love cryptocurrency and NFTs and believe they offer the greatest investment returns over the coming decade, according to new research.

Table of contents

But baby boomers and many others are holding back as they are uncertain if the crypto bubble might burst.

The results come from two surveys – one by the gurus at Investopedia and the other by the world-leading expat financial firm de Vere Group.

Read on for the results and see how you slot into the investment generation game.

Alphabetical Order

First, you need to know how the generation game works. Each generation is considered a ‘cohort’, which is a fancy name for a group of people born around the same time.

You’ll be fine if you remember two things:

- Birth dates define generations, not the stage of life they have reached

- No one can move between generations, so baby boomers remain such for life

Except for baby boomers, generations are labelled with a letter, starting at X and going on through Y and Z to A.

Here’s a table laying out the information you need to know:

| Generation | Birth dates | Current age range |

| Baby boomers | Before 1965 | 58> |

| Generation X | 1965 – 1980 | 57 – 42 |

| Generation Y (Millennials) | 1980 – 1996 | 41 – 26 |

| Generation Z | 1996 – 2012 | 25 – 18 |

| Generation A | 2012 – 2025 | < 18 |

How Do The Generations Invest?

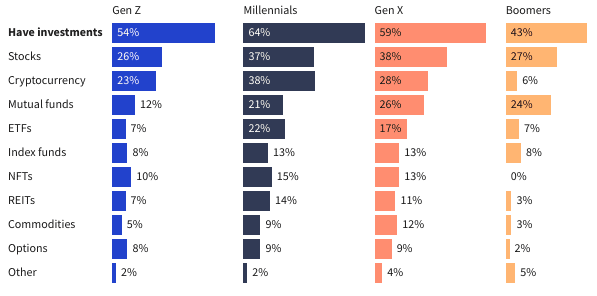

Investopedia’s survey revealed the investment preferences of each age group, except for Generation A, who are too young to worry about money.

Baby Boomers had the lowest appetite for investing, but many are retired and may have converted their pensions into income.

Around two out of three Millennials and Generation X invest, along with more than half of Generation Z.

No Baby Boomers invested in NFTs and just six per cent dabbled in cryptocurrency. Compared to this, a third of Millenials and one in four from Generations X and Z traded cryptocurrency.

Here’s the Investopedia research broken down by generation:

NFTs Explode Onto The Market

The results from deVere Group are similar. Their study found that more than half of millennials and three out of four Generation Z are keen to include NFTs in their investment portfolios.

deVere CEO and founder Nigel Green, a great advocate of cryptocurrency, has overseen the launch of the company’s NFT platform dv Gems.

He explained interest in NFTS exploded last year from hardly any sales at the start of the year to $41 billion 12 months later.

“The findings underscore that digital natives – those who have grown up immersed in a fully accessible digital life – understand that unique, highly portable and transferable digital assets have an intrinsic value. This trend will inevitably grow moving forward,” said Green.

“This groundswell of digital engagement creates new business models across many sectors.

“Sensibly, younger generations – who instinctively better understand it – appreciate it’s shaping the future of investing. They’re keen to have a stakeholding in this new financial ecosystem by including NFTs in their portfolios.”

Green also stressed diversifying portfolios across asset types, market sectors, regions, and currencies. is how younger investors can seize the opportunity NFTs offer.

“NFTs have a very low correlation to other assets, such as stocks and bonds, and can, therefore, lower your portfolio’s overall risk and volatility levels,” he said.

Young Investors Predict Profits From Cryptos

So, where do younger investors expect to earn the greatest returns over the next 10 years?

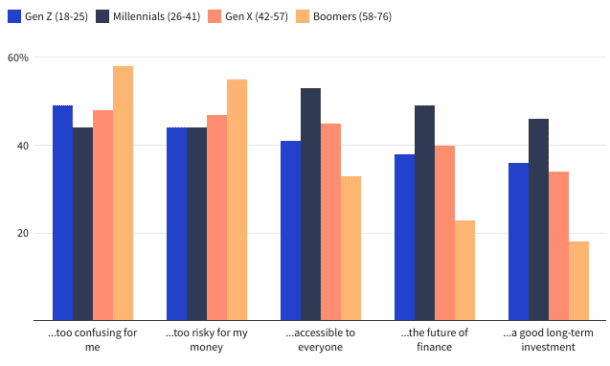

Most of their optimism lies with cryptocurrency, although a sizable number across all age groups avoid investing, says Investopedia. Although the potential profits from cryptos like Bitcoin are enticing, more than 40 per cent of investors are also worried about price volatility and the big falls in value that seem to follow price rises.

Crucially, fewer than 50 per cent of millennials can explain how cryptos work.

The levels are lower for baby boomers – with five per cent understanding the principles of crypto, and even fewer (three per cent) able to explain NFTs.

Analysis of the Investopedia data only reveals the different generations are in a muddle over cryptocurrencies and NFTs. Millennials are the crypto standard-bearers, with half considering blockchain technology and digital currencies the future of finance.

When asked if they agree or disagree with some key questions about crypto investment, these were the results (Ages in brackets):

UK Ready To Mint NFTs

Meanwhile, a move by British Chancellor of the Exchequer Rishi Sunak should inject more confidence into the cryptocurrency and NFT markets.

Sunak wants the UK to become a global crypto hub focusing on technology and investment.

His measures include new tax laws for stable coins, like Tether and Binance USD. Stable coins are pegged against another currency, usually the US dollar. Regulating the market would allow consumers to buy, trade and spend stable coins as if they were hard cash.

The Chancellor also urged the Royal Mint to create an official NFT by the summer.

Although interest in crypto and NFTs is rising, the Treasury reckons 0.1 per cent of the UK’s £14.6 trillion of wealth is held digitally.

Find out more about minting cryptos.

Global Crypto Hub

Launching the initiative, Sunak said: “It’s my ambition to make the UK a global hub for crypto-asset technology, and the measures we’ve outlined today will help to ensure firms can invest, innovate and scale up in this country.

“We want to see the businesses of tomorrow – and the jobs they create – here in the UK, and by regulating effectively, we can give them the confidence they need to think and invest long-term.

“This is part of our plan to ensure the UK financial services industry is always at the forefront of technology and innovation.”

The Chancellor also announced a new tax structure is on the way for DeFi loans. DeFi loans allow crypto owners to lend their tokens to others and earn interest on the loan.

DeFi is a catch-all term for decentralised finance, which is crypto-speak for the services offered to customers by banks.

Playing The Investment Generation Game FAQ

What are NFTs?

An NFT – or non-fungible token – is a unique digital file that cannot be altered with proof of ownership certified on a blockchain. Most NFTs are hosted on the Ethereum blockchain, but other crypto blockchains are moving into the market, like Soldana and Fantom.

What are stable coins?

A stable coin is a cryptocurrency backed by the value of another asset, like the US dollar or gold. The aim is to remove price volatility to give consumers and investors more certainty about their cryptocurrency. The most well-known stable coins are Tether and Binance USD. Both are pegged against the value of the US dollar.

Will the UK government go with Bitcoin?

The decision is unlikely as the Bank of England and HM Treasury are too concerned about manipulation of the value of Bitcoin.

Will retailers accept stable coins?

The aim is to interchange stable coins freely with the British pound, so the values are the same and consumers can make purchases with cryptocurrency.

How does DeFi work?

DeFi – or decentralised finance – is a bid to replicate the services banks offer customers on a blockchain through smart contracts. Smart contracts are hosted on blockchains like Ethereum. The global DeFi market is worth around $9 billion.

DeFii monetises crypto that does not earn interest while sitting in a wallet. Instead, lending crypto to a third party via a peer-2-peer deal generates interest.

Related Information

Below is a list of related articles you may find of interest.