The Financial Ombudsman has censured a pension provider for wrongly ordering a client to pay the QROPS overseas transfer charge.

The complaint was made by a client of financial services giant Scottish Widows, who has held up the transfer for more than two years because of the row.

The client – identified only as Mr B – was ordered to pay the overseas transfer charge even though he requested a transfer out of his UK pension into a QROPS before legislation changed on March 9, 2017.

Because he set the transfer in motion before the rule change, Mr B’s move was not subject to the overseas transfer charge.

Mr B asked for the transfer in February 2017, said the ombudsman.

Overseas Transfer Charge

Scottish Widows replied on March 2 with a request to supply several documents to ready for the transfer.

But before the QROPS transfer could proceed further, the law was changed and the overseas transfer charge imposed by HM Revenue & Customs.

The firm received then received the documents to allow the transfer to go ahead from the receiving QROPS scheme on April 5.

But Scottish Widows insisted Mr B should pay the overseas transfer charge, which amounts to 25% of the value of the funds switched from the UK pension into the QROPS.

Financial Ombudsman Daniel O’Dell reviewed the case.

What HMRC says about QROPS transfers

He said: “One of our investigators looked in to the matter but he didn’t think the overseas transfer charge should be applied. He said the request was made before 9 March 2017 and that the guidance published by HMRC, in respect of transfers to QROPS, made it clear that these weren’t subject to the charge.

The guidance doesn’t suggest it should be applied as a result of Scottish Widows’ requirements not being met by 9 March 2017. Mr B’s pension plan wasn’t transferred and he told us that this was as a result of the dispute about the 25% charge.

“Our investigator thought that had it not been for him being wrongly told that the charge would be applied, the transfer would’ve gone ahead. So he recommended that Scottish Widows cover the cost of the overseas transfer charge.”

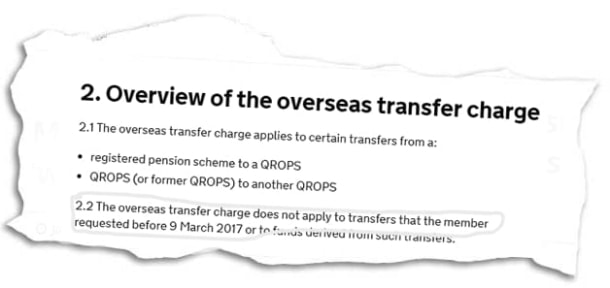

HMRC’s guidance on the overseas transfer charge seems quite clear that the charge only applies to requests to move money to a QROPS after March 9, 2017:

Source: HMRC Overseas Transfer Charge online guidance