Like the idea of retiring before you reach 45 years old? Of course, you do, together with one in eight other workers.

But the drawback is that 43 per cent of people have yet to save a penny to pay their way once they give up their jobs.

Most workers on a tight budget don’t have any spare money to save, and although they wish to retire early, few believe they will have the financial muscle to make their dream come true.

Table of contents

When Will You Retire?

The numbers come from pension provider Royal London, which asked a thousand expats in the United Arab Emirates about their retirement plans. The responses were interesting:

When do you expect to retire?

| Under 45 | 13% |

| 45 – 50 | 10% |

| 50 – 55 | 15% |

| 55 – 60 | 19% |

| 60 – 65 | 18% |

| Over 65 | 10% |

| Don’t know | 9% |

The survey also revealed that 43 per cent of workers have started saving for retirement.

The data shows a mismatch between worker expectations and retirement reality, says the company, as most workers ignore life expectancy data.

How Long Will Your Savings Last?

A retiree in the UK can expect to live until 81.7 years old. In the UAE, the figure is 78.5.

For someone retiring at 45 in the UK, that leaves an impossible 37 years to cover spending from savings including 10 years to the age of 55, which is the earliest workers can draw a pension.

The survey results clearly show that workers are leaving retirement saving too late.

When will you start saving for retirement?

| 5 years before retirement | 16% |

| 5 – 10 years | 22% |

| 10 -15 years | 18% |

| 20+ years | 25% |

| Don’t know | 19% |

More than half of couples with children (57 per cent) said they would wait until 15 years before retirement to start saving.

However, Royal London believes workers get the retirement they save for – and that can be a lot different from the twilight years they envisaged.

How Much Money Will You Need?

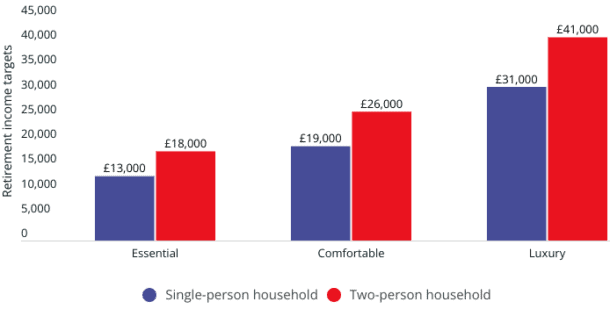

Data from consumer group Which? Estimates how much money singles and couples need to cover their spending for each year during retirement. The amounts are tailored to three levels of spending:

- Essential is enough money to cover basic spending

- Comfortable allows some cash for some extras, like a short-haul holiday

- Luxury covers long haul holidays and money for a new car

Although the Which? Figures are a reliable guide to how much retirees spend; the amounts are out of sync with how much people believe they will have.

The essential and comfortable lifestyle cash requirements fit pretty well with the expected needs of just over one in four retirees (27 per cent). However, spending £26,000 a year for a couple sits just outside the lowest savings band of £0 to £2,000 a month, while essential spending falls below with money to spare.

Around 61 per cent of workers feel they need £4,000 a month or less to live on, which is a pension income of £48,000 a year.

How much will you spend each month in retirement?

| Monthly income | 18 – 24 | 25 – 34 | 35 – 44 | 45+ | Overall |

| £0 – £2,000 | 12% | 26% | 30% | 31% | 27% |

| £2,000 – £4,000 | 22% | 25% | 26% | 30% | 26% |

| £4,000 – £6,000 | 23% | 18% | 12% | 13% | 13% |

| £6,000 – £8,000 | 12% | 7% | 8% | 6% | 8% |

| £8,000+ | 13% | 10% | 7% | 5% | 8% |

| Don’t know | 18% | 14% | 17% | 15% | 15% |

Where Will Your Retirement Money Come From?

As an expat, you can claim the UK state pension, which currently pays £9,627.80 a year (£802.31 a month). That leaves an expat to make up £1,200 – £1,500 a month from savings to cover living costs.

Money is sitting in the bank and earning little interest for more than half of savers (57 per cent). This money is also losing spending power as inflation takes a powerful bite each year.

Financial advisers would suggest switching the money into investments with inflation-beating returns to maintain spending power.

How do you save?

| General saving\bank deposits | 53% |

| Personal pension | 37% |

| Savings plan | 36% |

| Personal investments | 35% |

| Company pension | 20% |

| Property | 1% |

Which? calculates that a couple would need a pot of cash worth £265,420 to generate a guaranteed income of £26,000 a year from a joint-life annuity. This includes any state pension payments. The fund is smaller to get the same income from pension drawdown – £154,700.

For a luxury lifestyle, the numbers rise to a pot of £757,000 to generate a yearly income of £41,000, while the drawdown fund is £442,020.

What Does The Data Tell Retirement Savers?

The first unpalatable truth is if workers do not start saving early enough, they are unlikely to meet their financial target for retirement.

Everyone has a single pot of money that funds their lifestyle while working, and in retirement, and if a slice is not put aside for later years, the risk is poverty and a struggle to make ends meet.

For example, Royal London reckons that if someone wants to retire at 60 years old with a £795,000 pension pot, they would need to save £860 a month from 30.

The figures double up as savers get nearer 60:

| Age | Monthly savings |

| 30 | £860 |

| 35 | £1,226 |

| 40 | £1,802 |

| 45 | £2,840 |

| 50 | £5,052 |

But £795,000 is a dream pot of gold for retirement is unobtainable for most savers.

Provider Aegon calculates the average UK pension on retirement is £50,000 – an average of £73,600 savings for men and £24,900 for women.

So how much do these pension pots pay each year?

A £795,000 trove should fund a £28,700 a year income plus the state pension, making the total £38,300 a year for a single retiree and £47,500 for a couple.

However, a £50,000 fund generates just £1,800 a year income for retirement – rising with full state pensions to around £11,000 for a single retiree or £21,000 for a couple.

When Can I Retire?

Anyone can give up working whenever they wish, but they need a wad of cash to pay the bills from day one.

Two key dates affect when and how much pension is paid.

Most personal and workplace pensions, including QROPS (Qualifying Recognised Overseas Pension Scheme), the tax-efficient offshore pensions for expats, will not allow access to the fund before the saver reaches 55 years old.

The current State Pension Age is 66 years old, rising to 67 by April 2028. For some expats, the state pension is frozen at the level of the first payment.

Receiving retirement income is staggered for many people and does not let them entirely give up working until they pick up the state pension.

Another factor impacting retirement income for couples is if the partners have a wide age gap.

For example, if one partner is five years older than the other, the oldest will be 72 years old when the youngest reaches the state pension age of 67. This leaves a significant funding gap if both wish to retire together.

What’s The Best Way To Save?

Saving means deciding not to spend so much money on things that aren’t necessities.

The problem is defining a necessity means different things to different people.

How much someone can save depends on their income, financial status and personal circumstance, like buying a house and having children.

To save a few pounds, open a savings account. Set up a pension for the tax breaks after speaking to a financial adviser who can help you invest your money for the best returns to save more.

Related Information

Below is a list of related articles you may find of interest.