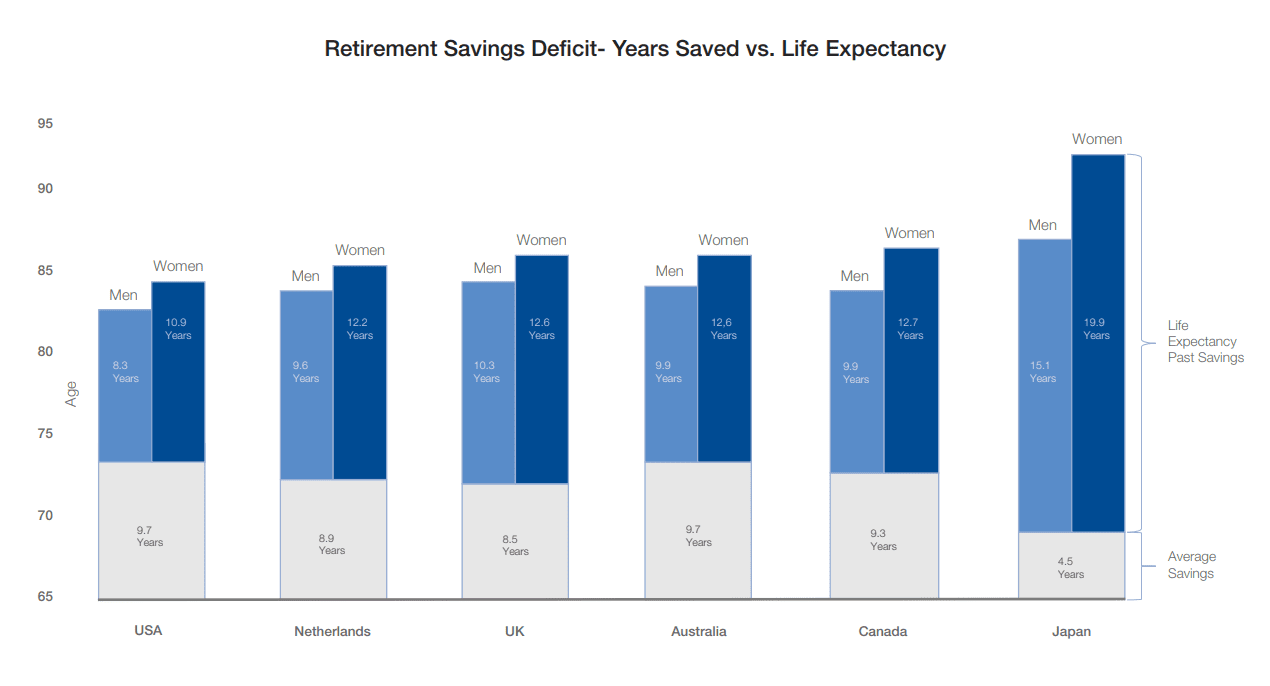

Retirees are on track to outlive their savings by a decade – and women may suffer even worse financially.

Strained government and workplace retirement pension schemes are blamed for leaving workers responsible for their own savings – with many finding what they save is inadequate for their needs.

The damning report from the World Economic Forum looked at retirement saving in Japan, Australia, Canada, Japan, the Netherlands, the United Kingdom and the US, concluding that no savers in any of the countries would outlive their savings.

Japan was the worst with a 20 year gap, but even the narrowest gap in the US was eight years between running out of money and death.

The WEF argues that governments must encourage people to save more for their retirements by changing policies that sometimes hinder savers.

Savers are too risk-averse

The think tank is also calling for more investment diversification to avert the risk of losing money due to poor economic performance.

“Many people are far too risk-averse in their retirement investing. While consistent saving is important to build retirement money, being mindful of long-term returns on retirement portfolios is crucial to ensuring that an individual doesn’t outlive their savings. Many young to middle-age savers should change their risk outlook, understanding that outliving their savings is a far greater risk to them than short-term investment risk,” says the report.

The WEF suggests that most retirement investment vehicles are based on traditional equity and fixed-income investments that have the advantages of being easy to value as well as having high liquidity.

Liquidity comes with a price

However, given the long-term nature of retirement savings, that liquidity comes at a cost. Although they require adequate understanding and sound financial advice, investment in alternative assets, particularly illiquid assets, can bring strong diversification benefits to a retirement investment portfolio.

“With populations around the world living longer than ever before, we need far more creative decumulation solutions for longevity protection” says Rich Nuzum, President, Wealth at Mercer. “There are some alternative solutions emerging such as pooled annuity funds, but older individuals are going to need a more diverse range of financial tools to help protect against longevity risk.”

Source: World Economic Forum