Pension pay-offs designed to encourage retirement savers to leave gold-plated workplace pension schemes ended the year on high.

Golden goodbyes are enhanced cash payments from a defined benefit workplace pension to a saver leaving the scheme.

The number of transfers out of workplace pensions was down, but more cases were flagged as possible scams, says a study by pension monitor XPS.

DB pension transfers remain controversial with the Financial Conduct Authority (FCA) warning savers can sign away valuable pension rights while employers continue to offer huge amounts of cash to those willing to leave their schemes.

What Is A DB Pension?

A defined benefit pension is typically a workplace scheme that offers a guaranteed retirement income for life based on final salary and length of service.

Sometimes the pensions are called final salary schemes.

Besides a guaranteed income, other benefits can include annual cost of living increases, enhanced annuity rates and spouse pensions.

The FCA reckons around 550 DB workplace pensions with more than 2 million members out of 5,550 current DB workplace schemes are still open to new savers.

Golden goodbyes end year on high

Pension pay-offs for savers transferring out of workplace final salary schemes were 8% up at the end of 2020, according to XPS Pensions Group.

The final figure was a pay-out of £259,000 – up from £239,000 at the start of the year.

The data revealed the number of transfers was down from 96 per 1,000 at the end of 2019 to 75 per 1,000 at the end of 2020.

But the firm warned half of cases (49%) raised a scam red flag with providers – up from 34% a year earlier.

“Over three-quarters of cases raised a red flag in December which is extremely worrying. This highlights that the risk of members falling victim to a pensions scam which reinforces the call from the regulator for trustees and the industry to pledge to protect their members,” said Helen Cavanagh, a consultant at XPS Pensions Group.

“Over half of all the scam warning signs identified over the month were fee related, including members lack of understanding of the fees involved, which could indicate members are transferring to arrangements that could be detrimental to their retirement outcomes.”

100,000 Savers Consider Cashing In DB Pensions

Separate data published by the FCA underlines concerns about outlawed contingent success fees.

Contingent fees are offered on a no transfer, no fee basis with a free pension review. They were banned by the FCA on October 1, 2020, after months of controversy over IFAs skewing their advice in favour of a transfer to win a fee.

“The FCA continues to believe that for the majority of people it is not in their interest to transfer out of a DB pension,” said the report.

“Where an individual seeks advice to transfer it is important that advice given is suitable and appropriate for their needs and situation. Where we find that firms are not meeting our expectations, we will take action to ensure firms put things right.”

The data showed between October 2018 and March 2020:

- 108,124 clients asked about pension transfers, with 20,633 deciding against taking further advice after an initial conversation and 87,491 clients going on to take pension transfer advice

- 49,456 clients were provided with a personal recommendation to transfer or convert their pension (57%)

- 38,035 clients were recommended not to transfer or convert their DB pension (43%)

- Of those advised not to transfer (insistent clients), 2,936 (8%) went ahead anyway

Why Transfer Out Of A DB Pension?

There are lots of reasons why retirement savers consider transferring away from a final salary pension.

The golden goodbye offered by employers who want to streamline or close their schemes are one factor.

But several other valid reasons can make pension transfers attractive, including:

- Retirement age – If the workplace scheme does not allow retirement before 60 years old, switching to a personal pension that allows flexible access from the age of 55 lets someone retire early or phase in working fewer hours

- Moving offshore – Expats may want to move their UK pensions to an offshore Qualifying Recognised Overseas Pension Scheme (QROPS) which offers tax and investment benefits

- Consolidation – Retirement savers may want to put two or more small funds into one pension scheme

- Worries about employer status – Many final salary schemes are in the red and several schemes have been picked up by the Pension Protection Fund as employers have gone bust, reducing expected pension benefits for savers

What were the values of pensions transferred out?

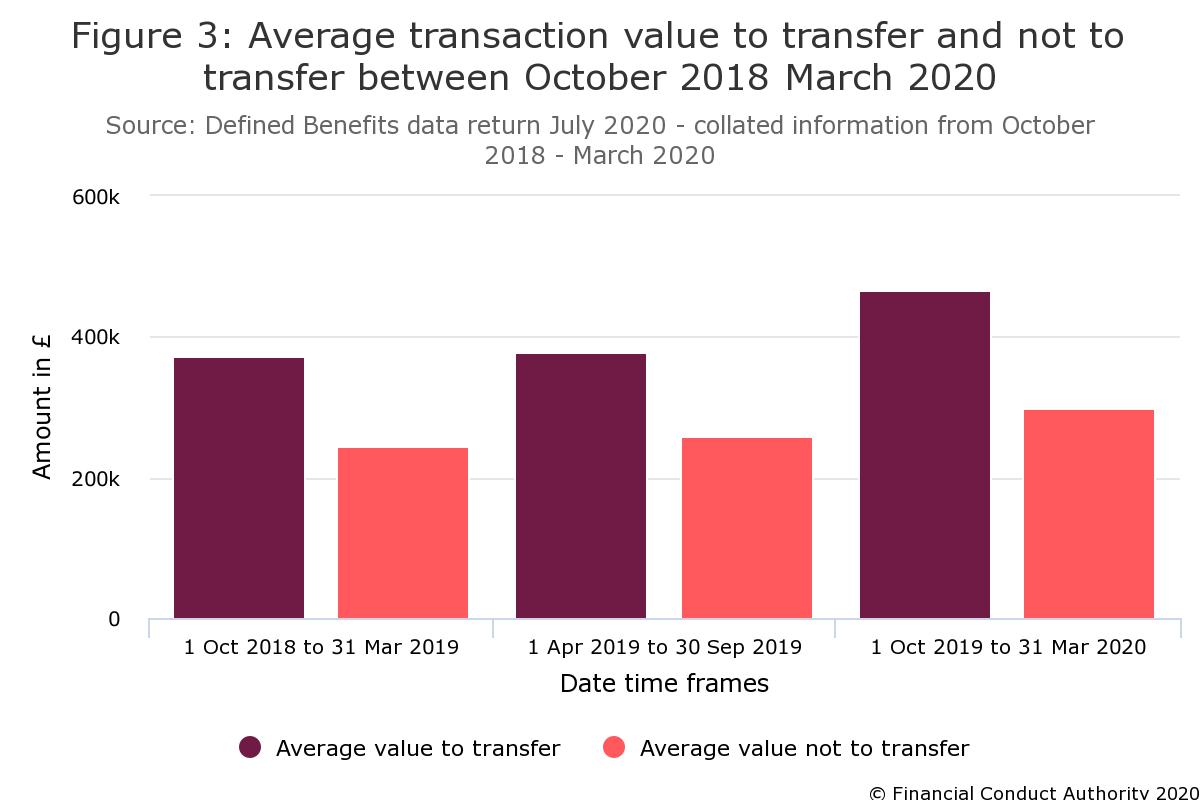

The FCA data shows the average transfer value of final salary pensions between October 2018 and March 2020:

Should I Transfer Out Of My Final Salary Pension FAQ

The argument about if a retirement saver should transfer out of a final salary pension rages on.

Without doubt, they can lose valuable benefits that are irreplaceable in a defined contribution (DC) pension, but some benefits gained like early retirement, lure savers to make the switch.

This article outlines the facts and figures about final salary pension transfers – and here are answers to some of the most asked questions about making the switch.

The Pension Protection Scheme (PPF) is a government-backed agency that runs Db pensions for firms that have gone bust.

Retirement savers do not get their expected pension incomes back from the PPF. Pensioners already receiving payments see no change, but those awaiting retirement will only get 90% of their pension payments and high-earners have a cap on how much they can draw that depends on several factors, like age on retirement.

Find out more about the Pension Protection Fund

A QROPS is a specialist offshore pension for British expats. In some cases, QROPS can offer tax benefits and more flexible investment options for expats than onshore pensions.

Yes. Defined contribution pensions are not included because retirement savers are unlikely to lose out financially when they transfer between schemes.

DC pension retirement pay-outs are based on fund size, not length of service or final salary. DC pensions are most personal pensions, SIPPs (self-invested personal pensions) and QROPS.

The FCA must walk a fine line between offering DB pension savers good, independent advice and taking control of a retirement saver’s money. After all, the money in a pension fund belongs to the saver and they have the final decision over what to do with it even if some of the choices may be financially less favourable than others.

Related Information

Below is a list of related articles you may find of interest.