Retirement savers who expect the state pension to cover their living costs are in for a shock, according to new research.

Paying for food, utility bills, council tax and other essentials costs £210 a week – and that’s £50.45 more than the full state pension.

Equity release company Key Retirement warns that the bills do not stop just because someone no longer works and workers approaching retirement really should have a plan ready to go from the first day they stop working to avoid getting into debt.

The state pension is designed to cover basics, but does not even do that anymore anywhere in the country.

The pension adds up to £8,296 a year and is due to rise by 3% to 8,545 in April.

London pensioners pay more than anyone else

But that’s still £45.67 adrift of the weekly bills total of £210 a week and does not include any increase in the cost of living forecast by Bank of England governor Mark Carney.

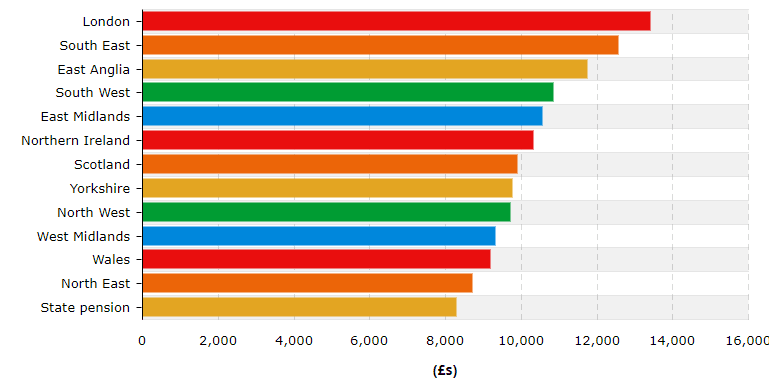

Where a pensioner lives will also affect their income in retirement. Although the state pension pays the same amount wherever someone lives, the cost of living varies from place to place.

Pensioners in London pay more in essential living costs than those elsewhere. The weekly cost of living is £257.69 in the capital and £241.73 in the south east.

“The basic cost of being a pensioner at around £10,830 a year demonstrates the importance of saving for retirement and generating income on top of state pensions,” said Dean Mirfin, technical director at Key Retirement.

The company’s analysis reveals an average retired household spends £1,500 a year on housing and fuel, £1,560 on food and non-alcoholic drinks, £1,200 a year on a car and public transport with any spare cash used for entertainment and eating out.

The cost of retirement where you live

Source: Key Retirement