The Swiss Pension Pillar System is regarded as one of the best in the world, with Switzerland being known for financial security, but one of the best kept secrets most expats don’t know is that they can have their Swiss pension savings refunded and transferred if they plan to leave the country to set up home elsewhere.

Expats flock to Switzerland for the high standard of living and good wages – but few realise how the Swiss pension system will affect them.

Brexit rules may see some changes for British expats – but the current rules allow workers from the UK to qualify for a Swiss state pension.

Understanding Swiss Pension Pillar system is a must for expats – so here’s a quick guide explaining the intricacies of the Swiss pension system and how to navigate the available pension options for expats – including how to reclaim your retirement savings.

Table of contents

- What is the Swiss Pension Pillar System?

- Swiss Pension Pillar 1 – The OASI/DI

- Swiss Pension Pillar 2a – Workplace pensions

- Swiss Pension Pillar 2b – Workplace pensions

- Swiss Pension Pillar 3 – Private pensions

- Pillar 1 Reimbursements For Expats

- Pillar 2 Pension Reimbursements For Expats

- Pillar 3 Pension Reimbursement For Expats

- Pillar 1 and Pillar 2 Pension Outcomes For Expats

- Taking Pillar 1 and Pillar 2 Cash Early

- What Happens To Pensions That Aren’t Reimbursed?

- Transferring a Swiss Pension

- How pension tax affects your fund

- Tax by Pension Pillar

- How To Access Your Swiss Pension

- Swiss Pension Pillar System And Transfers FAQ

- Related Information

What is the Swiss Pension Pillar System?

Anyone over 20 years old living and working in Switzerland, including the self-employed, must pay compulsory social security contributions towards their state pension, known as AHV Switzerland or OASI – the Old Age and Survivor’s Insurance.

They are entitled to a state pension after contributing for 12 months.

The payment depends on two factors – the number of qualifying years of contributions and the expat’s average wage over the contributory period.

Benefits are paid between a year or two before reaching the official retirement age and up to five years after if the expat keeps on working.

The full pension is only paid if an expat has contributed every year since the age of 20 to their Swiss retirement age.

OASI/DI is the Swiss social security scheme and is split into two parts or Pillars.

It’s possible to draw benefits from both at the same time. Besides the state pension, the OASI/DI covers disability pensions and spouse pensions.

Swiss Pension Pillar 1 – The OASI/DI

Often called an AHV or AHS, depending on which language you speak. AHV is short for Alters-und Hinterlassenenversicherung in German, while an AHS is the same as an AHV but in French or Italian.

Paying into the AHV is mandatory and like the UK State Pension, covers state benefits and the state pension.

OASI/DI protects everyone in Switzerland.

Contributions are uncapped and amount to 10.55% of total income each year split evenly between employers and workers.

OASI/DI is run by the government.

Swiss Pension Pillar 2a – Workplace pensions

Pillar 2a is another mandatory pension for employees. Workers and employers both pay into the fund, like auto enrolment in the UK.

Like auto enrolment, Swiss workplace pensions are designed to top-up the AHV in the same way auto enrolment complements the UK state pension.

Workers have to opt-in when their annual earnings top 21,150 Swiss francs (CHF).

Employers must offer these pensions by law.

Swiss Pension Pillar 2b – Workplace pensions

Pillar 2b is a system for voluntarily topping up savings.

Pensions also have a third Pillar:

Swiss Pension Pillar 3 – Private pensions

Pillar 3a and 3b pensions are popular with freelances and the self-employed, these pensions top up Pillar 1 and 2 savings. Contributions to a private pension are not mandatory and the responsibility of an individual.

Expats can retire in Switzerland if they have the money to live without claiming benefits and medical insurance, including cover for accidents.

Pillar 1 Reimbursements For Expats

Expats can apply for OASI/DI contribution refunds when they leave Switzerland or from overseas.

The opportunity is limited.

You can’t claim a refund but can apply for partial benefits if you move to a European Union state, an EFTA (European Free Trade Association) country or somewhere with a reciprocal social security agreement with Switzerland.

Generally, you can only apply for a refund up to five years after leaving Switzerland and any lump sum payment only covers the termination value of the state pension.

But to qualify, you must have paid into the system for at least a year, have moved permanently away from Switzerland and not claimed an OASI/DI pension.

The refund only covers contributions by you and an employer to the OASI scheme – DI contributions are non-refundable.

Married couples must make separate refund applications.

Any refund is paid into an overseas personal bank account.

Countries with social security agreements with Switzerland

How the pension is paid is covered by countries having bilateral social security agreements with Switzerland.

All countries in the European Union (EU) and European Free Trade Association (EFTA) have an agreement.

This is where Brexit may complicate the status of British expats in Switzerland on leaving the European Union. Switzerland has a social security agreement with the UK until December 31, 2020, when the UK leaves the EU as the transition period ends.

Switzerland also has social security agreements with several countries outside Europe: Australia, Chile, China, Bosnia and Herzegovina, India, Israel, Japan, Canada, Macedonia, Montenegro, Philippines, San Marino, Serbia, South Korea, Turkey, Uruguay, and the USA

The terms of some treaties may differ between countries

Claiming The Swiss State Pension

The OASI/DI state pension is not paid automatically.

If you live in the country where you were born, applications go to your local social security office.

If you live in another country, applications must go to the Swiss Compensation Office in Geneva.

Keeping OASI/DI benefits as an expat

If you have not requested a cash pay-out, you are still covered by the Pillar 1 scheme, which can pay benefits overseas.

Bear in mind refunds are only due if you move to a country without a social security agreement with Switzerland.

If you move to somewhere with no social security tie to Switzerland, you can claim benefits under the OASI/DI scheme.

These include:

- A reduced state pension on reaching retirement age

- A reduced disability pension if your condition is classed as a 50% or more disability

- Your family may have a claim for survivor benefits when you die

Pillar 2 Pension Reimbursements For Expats

If you did not claim a cash refund before leaving Switzerland, you can make an application from overseas at any time.

You can keep the pension open with a pay-out if you reach retirement age, which is 65 for men and 64 for women.

Claims for refunds should go to the company running the scheme.

Requesting a cash pay-out

Speak to your last employer who will give you an application form.

You will need paperwork to prove your date of departure from Switzerland and written permission from your spouse to stop the scheme if you are married.

Keeping Pillar 2 benefits as an expat

If you want to keep your Pillar 2 benefits, tell your employer at any time.

You will receive a pension or lump-sum on reaching retirement age.

Pillar 3 Pension Reimbursement For Expats

Pillar 3 pensions are savings plans offered by banks and insurance companies, which puts them outside the Swiss social security system.

Expats leaving Switzerland who have a Pillar 3 plan can cash in these pensions when they move overseas.

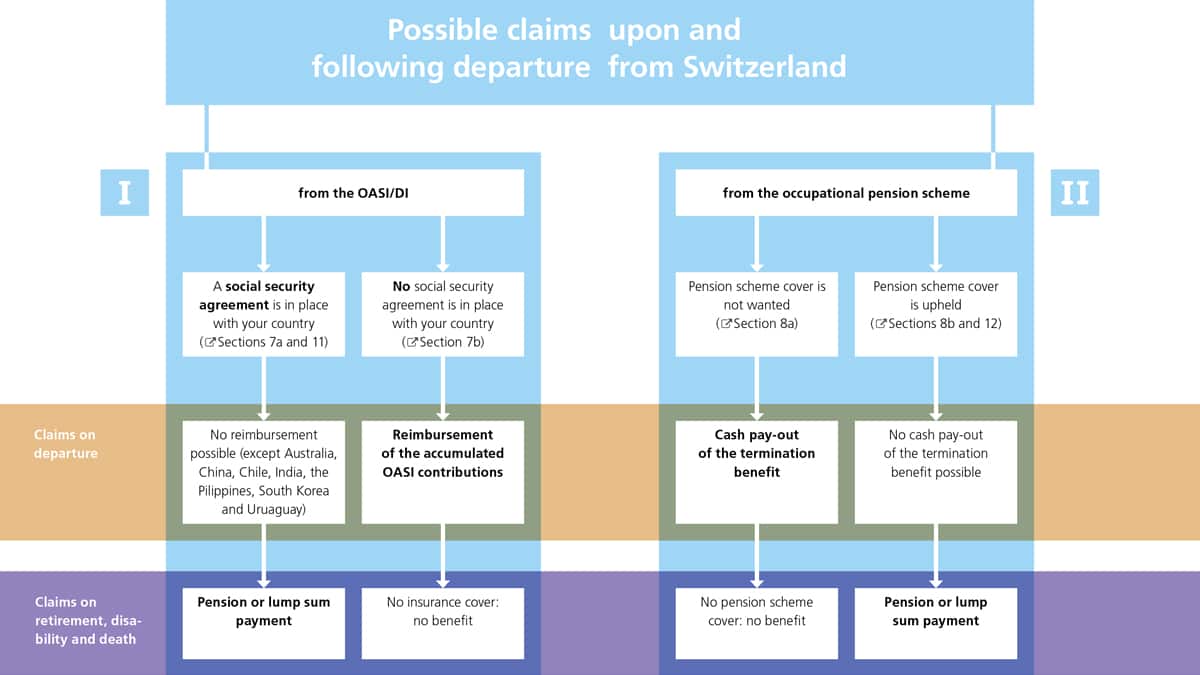

Pillar 1 and Pillar 2 Pension Outcomes For Expats

This chart summarises how expats can claim benefits or contribution reimbursements after leaving Switzerland.

Taking Pillar 1 and Pillar 2 Cash Early

In some cases, expats can ask for an early refund on money paid into the OASI/DI or workplace pension system. The triggers are:

- Buying a property – Up to the age of 50, savers can withdraw at least CHF20,000 once every five years to buy a home, repay a mortgage or to buy shares in a housing co-operative

- Starting self-employment – On becoming self-employed, retirement savers can switch their entire funds between Pillar 1 and 2 contributions to a Pillar 3 scheme or withdraw the money

- Expats leaving Switzerland – Pension transfers and refunds are a choice for some expats, depending on where they move to and if they have had any cash under the terms of the AHV or workplace pension.

The minimum early retirement age set by most pension providers is 58 years old, but vested benefit funds cannot be paid any earlier than five years before state retirement age (59 for women and 60 for men).

Speak to an IFA about the pros and cons of taking cash early from a pension as this will affect future benefits and leave a smaller fund to generate income on retirement.

What Happens To Pensions That Aren’t Reimbursed?

If you don’t claim a refund, the money is transferred to a vested benefits account with no investment potential that will start paying out on reaching retirement.

Transferring a Swiss Pension

Under Swiss pension rules, the money in a Pillar 2 or 3 scheme belongs to the expat holding the account.

To transfer a Swiss pension, the retirement saver must meet the conditions the SCO lays down to cash in the pension.

See Swiss Pillar 1 And Pillar 2 Pension Outcomes For Expats above

Where your pension provider is based can make a big difference to the tax you pay on stopping your pension.

Switzerland is a confederation divided into 26 cantons. Each canton has the power to set tax rates, so what an expat pays when they cash in their pension depends on the tax rates set by the canton where their pension is based.

Expats often live and work in the higher taxed cantons, like Geneva, Basel, or Zurich.

But expats have the right to move their pension to a lower taxed canton, such as Schwyz, before moving the money overseas.

This hugely affects the tax paid on lump-sum pension refunds.

Filing deadlines may also affect tax as they vary between cantons, leaving a lower rate for one while another rises.

Our experts have written a free guide for transferring your Swiss Pension. Get your copy now.

How pension tax affects your fund

| Canton | Pension value | Tax due | Remaining fund |

|---|---|---|---|

| Basel | CHF 500,000 | CHF 47,075 | CHF 452,925 |

| Zurich | CHF 500,000 | CHF 40,325 | CHF 459,675 |

| Geneva | CHF 500,000 | CHF 38,888 | CHF 461,112 |

| Schwyz | CHF 500,000 | CHF 22,825 | CHF 466,700 |

Tax by Pension Pillar

Many countries tax these pension refunds, so expats should consider drawing the money in Switzerland at beneficial rates before they leave.

Swiss Pension Pillar 1

Strict refund rules only allow a claim if an expat moves to a non-EU/EFTA country, where tax may be due in Switzerland and the expat’s new home.

Swiss Pension Pillar 2

A 2a pension is a mandatory pension and are not refunded if expats move to a country with a social security agreement with Switzerland or an EU/EFTA country.

A 2b pension is a non-mandatory top-up often taken by high earners. These are not mandatory contributions, so can be refunded wherever an expat moves.

Swiss Pension Pillar 3a

If the Pillar 3a scheme is insurance rather than a banking product, some expats may leave the pension invested.

How To Access Your Swiss Pension

An international IFA has the knowledge and experience to help you claim a refund and reinvest your retirement savings once you leave Switzerland.

Request advice using this form here to get started managing your Swiss pension options.

The IFA should tell you when and how much money you can access to make the best tax-saving.

Reinvesting the money could give you greater control over how your fund is invested and when you can drawdown.

For example, the Qualifying Recognised Overseas Pension Scheme (QROPS) and UK SIPPs allow drawdown from the age of 55.

However, closing a Swiss scheme means the loss of benefits like invalidity cover and a spouse’s pension if you die while married. Balancing the value of these benefits against the improved investment and drawdown options is part of the IFA’s job.

Cashing in a pension early always involves a financial trade-off between taking the money now and losing future retirement income and benefits.

Swiss Pension Pillar System And Transfers FAQ

The Swiss Pension Pillar system is generally regarded as among the best in the world, but this doesn’t make the workings any easier to get to grips with.

Here are the answers to some of the most asked questions about Swiss pensions:

These are benefits that are costly to replace if you move and stop leave the Swiss pension system. It’s unlikely a QROPS or SIPP will offer the same benefits, so ask your IFA about invalidity and life cover.

Depending on the type of pension you have, as an expat you can claim a refund on some of the social security and pension contributions you have made while working in Switzerland

Most pensions allow contribution refunds if you move to a country outside the EU/EFTA or to somewhere that has no social security agreement with Switzerland.

Retirement age in Switzerland is 65 for men and 64 for women. Under some circumstances you can access the cash from the age of 58.

A Swiss canton is one of the 26 political and geographical provinces that make up the Swiss Confederation. A canton is autonomous and can set tax rates but must follow federal law passed by the national government.

This depends on the tax rates set by the canton where your pension company is based, but you do have the right to change the canton, so you benefit from lower tax.

Pillar 1 is the state pension, Pillar 2 is workplace pensions and Pillar 3 covers personal pensions. Pillar 1 is compulsory, Pillar 2 can cover mandatory and non-mandatory pensions, while Pillar 3 is voluntary.

The process is to make a prompt application to the Swiss Compensation Office (SCO), which will value the fund(s) and check you have or are about to move away from Switzerland.

When the SCO pays out, the money then goes to the new pension or investment.

Your international IFA should handle the paperwork and transfer of funds for you.

You are the owner of your funds and can appoint an agent, usually an IFA, to act for you.

Related Information

Below is a list of related articles you may find of interest.