The big US shut down has come as a relief to currencies around the world struggling to hold their own against the dollar.

While Ben Bernanke’s decision to back more quantitative easing after wavering a few weeks back and seeing international markets drop in response, the dollar was strengthening.

But while the dollar was making gains, many emerging market currencies were sliding in response.

Now, the desperate plight of the Indian Rupee, which had slipped to a low against the dollar, and Brazilian Real are starting to climb out of their hole.

Other emerging economies have not been so lucky – Turkey and Indonesia are still suffering badly.

Sliding exchange rates

Good news from China showing the economy driving up a notch is also good news for resource based economies in Russia and Australia that supply the raw materials for the powerhouse nation’s factories.

Many currencies are bracing themselves for a fall, because sooner rather than later, the US budget problems will be resolved. Either President Barak Obama or Congress will blink first and then both sides will sit down to thrash out a deal to rescue the federal budget.

Then, the rest of the world will return to business as normal and the currencies feeling the strain will go back into seeing their exchange rates slide.

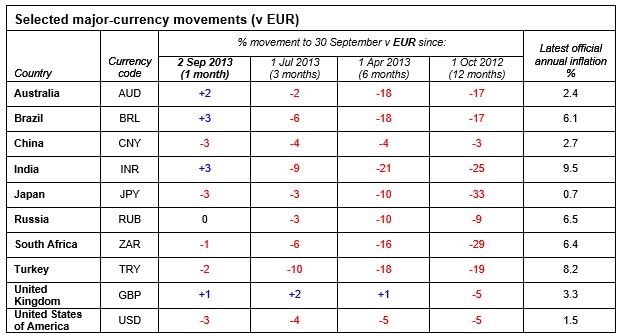

The facts and figures behind September’s major currency movements are collated in the table in the Money Moves blog by global benefits firm ECA International.

Nafka rate engineered?

“Other currency news includes the government of Venezuela hinting more than once that reform is on the way, but then nothing happened,” said Andy Payne, an economic analyst at ECA International.

“Local views would confirm the government wants to rework the exchange rate mechanism but is split over how to act. The consensus is nothing will happen until January, after local government election results are out of the way.”

Meanwhile, the biggest currency gain against the euro in September was the Eritrean Nafka – with an 18% shift upwards.

Payne explains the government is most likely manipulating the exchange rate to make imports cheaper in response to a large offer of development aid from China.

Source: Money Moves, ECA International