A debate raging in the financial services world is how much are consumers willing to pay for professional advice.

Many see financial advice as expensive and overlook the value a skilled IFA can add to their investments and savings.

The British government has rekindled the debate by announcing pension savers can access up to £1,500 tax free from their retirement pots in three tranches of £500 for regulated financial advice.

That rules out investment gurus offering dubious ‘wealth strategies’ but really making their money off seminars, courses and mentoring.

After all, if they’re really investment experts, surely they could make more by managing their money than they ever could from talking about it.

Pricing professional financial advice

Financial advisers are not keen on the government plan. Social media is full of IFAs complaining they can’t make a profit from a £500 session.

But that’s not the point. The government is not saying the £500 should cover the total cost of advice, just that it is a contribution towards the price of the package.

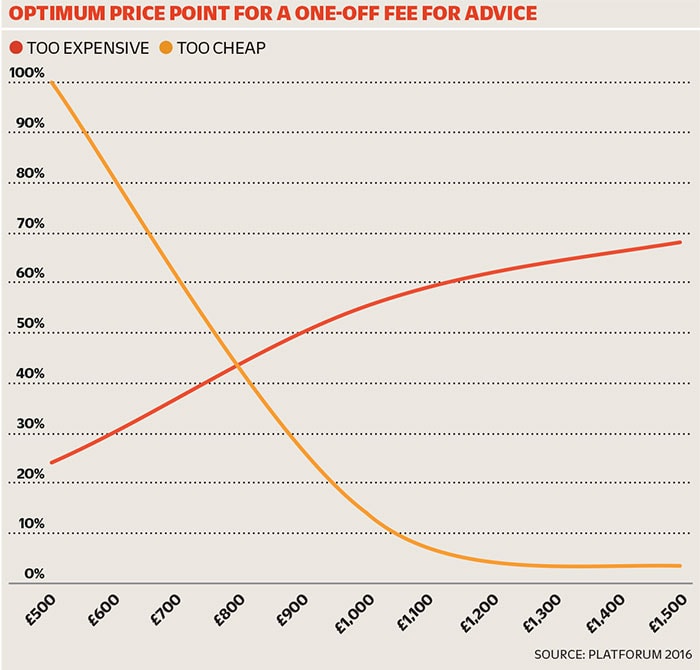

Research suggests the optimum price point for investment advice is £800 for a one-off life event and an ongoing annual management fee of 0.49% of any funds under investment.

The study also revealed these are the optimum prices for small portfolios (under £200,000) as well as for investors with larger portfolios.

“We think there is a big opportunity for advisers to offer in-person advice to retirees and to those saving for retirement,” said Heather Hopkins, director of research at financial research firm Platforum.

Added value of wealth managers

“We were heartened with this result because it is getting closer to the initial fees that advisers charge and flies in the face of claims that investors are not willing to pay a fair price for advice.

“Investors are willing to pay for advice for major financial planning events and are willing to pay fees in line with what many advisers charge. They want in-person advice – a service that advisers are best placed to deliver.”

DIY investors should also be cheered by the research.

Over a lifetime of saving that is likely to result in investments value at £100,000 or more, the value added by consulting an IFA or wealth manager seems cheap, especially when a hefty slice can come tax-free out of the pension pot.