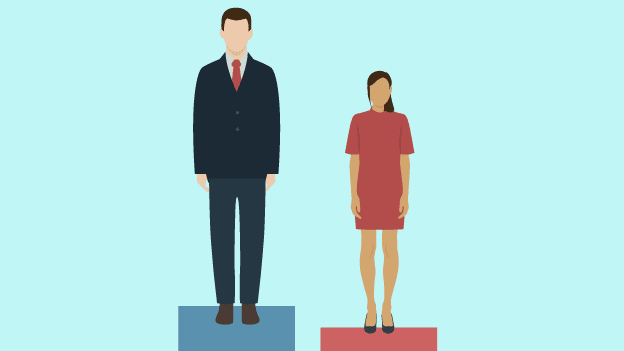

More women are saving for retirement but a huge gender pay gap means their pots are an average £78,000 lower than men’s, says a new study.

Although 57% of women are saving enough for retirement – the highest level in 15 years – and the money they manage to set aside has grown by 4.6% since 2007, thousands of women are still struggling with their finances.

Despite pots growing by £5,900 for every year in retirement, 37% of women on lower incomes have stopped saving into a workplace pension because of the demands of other financial commitments and 55% of women feel they could do better by saving more for retirement.

The data, from life and pensions firm Scottish Widows reveals that since 2007, 14.6% more women are paying into a pension.

Unacceptable gender gap

But men still have a fund of £78,000 more than the average woman on retirement.

The gain in women contributing to a pension is attributed to auto-enrolment at work., but the study shows women on lower pay, typically working in supermarkets, call centres, childcare and care homes are saving enough.

Just 47% of women earning between £10,000 and £20,000 a year have adequate retirement savings, compared to 65% of those with incomes of £40,000 or more.

Jackie Leiper, distribution director at Scottish Widows, said: “We’ve come a long way, but 15 years later there’s still an unacceptable gap between men and women. The groups who are often overlooked, such as lower‐middle income women, need more support to overcome the challenges they face in saving for the future.

Call for reform

“Scottish Widows want to see a series of reforms that allow for a more tailored approach to saving. Increased default savings levels, improving the scope of auto‐enrolment and managed access to pension savings to support a first home deposit or to overcome a period of financial hardship are just some of the ways we can make a real difference.

“By doing so, we can ease the financial stresses that disproportionately impact women, such as those that go alongside life events including starting a family and buying a first home.”

The firm spoke to more than 5,000 adults across the UK to derive the data for the 2019 Women and Retirement Report, which has been published annually since 2007-08.