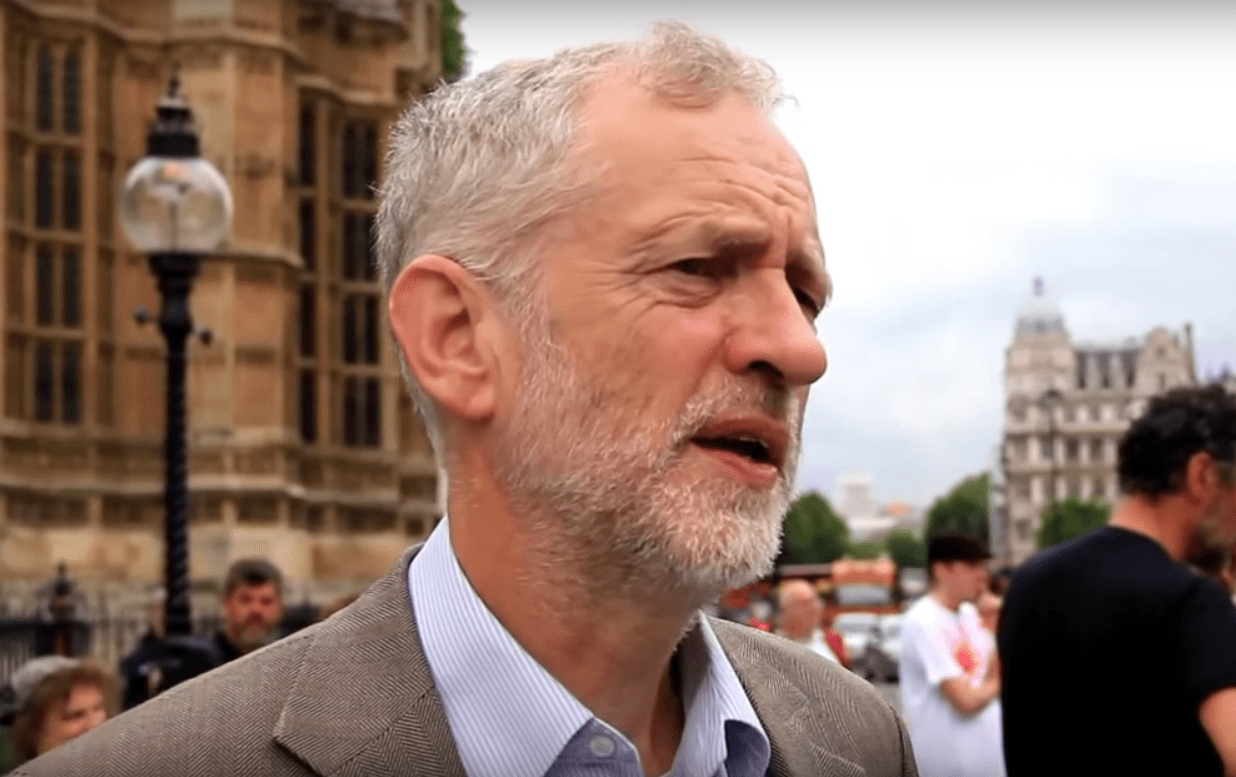

Labour leader Jeremy Corbyn frightens the money markets more than Brexit, warns expat financial expert Nigel Green.

He claims the thought of Corbyn gaining the keys to Downing Street ‘spooks financial markets’ .

Green, CEO of expat financial advice firm deVere Group argues Corbyn’s idea of a second Brexit referendum would likely be welcomed by voters, but not if the Labour leader gained power.

“The uncertainty surrounding Brexit is having a real impact on business in the UK, the EU, and those around the world that trade internationally,” said Green.

“This uncertainty has created a tangible lack of confidence, resulting in falling investment, spending and recruiting across Britain.

Sitting on the fence

His comments followed the disastrous results from Labour and the Tories in the European Parliament election.

Labour took just 10 seats and grabbed 14.6% of the UK vote – an 11.3% drop from the 25.9% the party gathered in the last EU Parliamentary election.

Commentators suggest Corbyn sitting on the fence trying to satisfy remain and leave voters meant he lost support from both sides.

But his change of heart to back the second referendum is likely to appeal to more voters.

“Corbyn’s new approach will in the eyes of many voters make his Labour party more electable in a general election than it has been in a long while. And this prospect could spook financial markets.

“As such, any positive impact of a second Brexit referendum on financial markets would be offset by a win by Jeremy Corbyn’s Labour party.

Abject failure

“Following MPs’ abject failure to so far find a way forward through the impasse, the next move has to be to have a second Brexit referendum in order to protect jobs and secure long-term, sustainable economic growth.

“A second referendum would likely be welcomed by financial markets for two reasons.

“First, it gives MPs a clear, unequivocal message either way, breaks the grinding deadlock, and reduces ongoing uncertainty.

“And second, it would increase the chances of a softer Brexit, which would have the effect of producing a relief rally in Sterling, UK financial assets, and also a spurt in economic activity in Britain, as delayed household and business spending is unleashed.”