Portugal’s golden visa has become even more attractive to expats trading cryptocurrencies.

Table of contents

- Why Seek A Portugal Golden Visa?

- What Is The 2022 Portugal Golden Visa Change?

- Portugal Golden Visa Tax Benefits

- Digital Nomad Destination

- Who Qualifies For A Portugal Golden Visa?

- How Does Portugal Rate As An Expat Destination?

- Portugal Golden Visa Alternative

- Golden Opportunity For Crypto Expats FAQ

- Related Information

Portugal has always had a pull for expats, with 60,000 Brits already living there.

The country has become even more popular in recent weeks. The government relaxed golden visa conditions, and expat crypto traders discovered zero tax is charged on their digital currency profits.

These factors only add to the appeal of Portugal, which has granted more than 10,000 golden visa applications since the scheme started in October 2012, raising a welcome shot in the arm of £5.5 billion of expat investment in the economy.

Read on to find out about the new golden visa rules and capital gains taxes in Portugal.

You should always seek regulated financial advice in Portugal to make sure you are making the best decisions.

Why Seek A Portugal Golden Visa?

The Portugal golden visa program is regarded as one of the most attractive in the world for expats.

- The visa offers a range of affordable investments and residency in Portugal

- Visa holders maintain their status by spending a minimum of seven days a year in Portugal

- The visa covers a family, not an individual

- British expats gain unlimited visa-free travel in the European Schengen Zone

- Expats can seek Portuguese citizenship after holding a golden visa for five years

- Crypto traders pay no tax on capital gains

Add to that the lifestyle advantages:

- Warm weather

- Low cost of living

- Charming locals

- A laid-back lifestyle

- Easy travelling distance to the UK and Europe

What Is The 2022 Portugal Golden Visa Change?

The biggest change is where expats with a golden visa can live.

The government has revised the list to exclude the capital Lisbon and well-populated cities like Porto and Setubal.

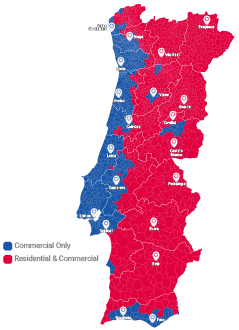

The visa only allows expats to buy tourist property as a home on the mainland or holiday isles like Madeira and the Azores. The minimum property investment is £295,000 (€350,000) if restoring a home or £421,000 (€500,000), although a 20 per cent discount applies to ‘low-density’ residential areas. These areas are more or less the entire country, less a narrow strip around the coast.

The map shows the golden visa residential property investment zone in red and the excluded areas in blue.

However, expats with a golden visa can buy commercial property in both zones.

Along with the rules about buying a home, most Portugal golden visa investment levels have increased.

- Capital transfers rise to £1.25 million (€1.5 million), up from £842,000 (€1 million)

- Business investments are up from £295,000 (€350,000) to £420,000 (€500,000)

Contributions to the arts remain at £210,000 (€250,000).

Portugal Golden Visa Tax Benefits

As a Portugal tax resident, expats pay taxes on income and interest according to local rules.

However, the golden visa comes with two tax benefits for expats:

- Cryptocurrency traders do not pay capital gains taxes on their profits, although crypto trading as a business is taxed. Some tax is due if expats pay for goods and services in Portugal with cryptocurrency

- Pension income from overseas is taxed at 10 per cent for 10 years

- The golden visa comes with a work permit which covers starting and running a business as well as working for an employer

- Full Portugal taxes are due if an expat becomes a resident, which means spending more than 183 days a year in the country

Digital Nomad Destination

Fast broadband speeds and a co-working culture can connect digital nomads seamlessly to the rest of the world, fulfilling an essential need for working expats.

The golden visa is great for expats who want to travel around Europe freely or do not wish to have a permanent home in the country.

Who Qualifies For A Portugal Golden Visa?

The good news is British expats resident outside the European Economic Area (EEA) can apply for a Portugal golden visa as an individual or for a family.

The opportunity came about at Brexit, when Britain left the EU.

How Does Portugal Rate As An Expat Destination?

Expats often vote Portugal as a popular destination thanks to the warm weather, cheap food and booze and relaxed lifestyle.

The Algarve, in the south of the country, is where most Brit expats tend to live. However, much of this beautiful coastline is now out of the allowed zone for buying a home for golden visa holders.

Because of this, many expats have switched their focus for the splendour of the Douro Valley. This celebrated wine-growing region follows the meandering Porto river inland towards the coast and city of the same name.

For retired Brits, the UK state pension is paid in Portugal and uprated each year in line with the cost of living.

The currency is the Euro and the exchange rate is 1.19 Euro to £1.

Portugal Golden Visa Alternative

Spain’s Start-Up Act is passing through Parliament in Madrid.

The act includes a new opportunity for expat digital nomads who would like to work from Spain but do not want the hassle of applying for a work permit.

The digital nomad visa lets expats live and work remotely from Spain without a work permit. However, freelancers rather than the employed can only earn 20 per cent or less of their annual income from within Spain.

If approved by Parliament, the visa will last for 12 months and becomes renewable every two years.

Living in the Canary Islands and Balearics is allowed under the visa terms.

Under the law, a digital nomad is someone from outside the EEA who works remotely for companies outside Spain.

Spain is offering visa holders a 24 per cent income tax rate for the first 183 days (six months) of the visa’s term.

Expats should take advice about how the visa might change their tax status in Spain before applying.

The Start-UP Act includes several measures to encourage business start-ups and attract talent from overseas.

Golden Opportunity For Crypto Expats FAQ

What is a golden visa?

Golden visa is a generic term for a residence or work permit granted with advantageous terms.

Most countries offer some form of golden visa for wealthy investors, entrepreneurs and retirees.

Portugal’s golden visa is considered one of the most generous and the new Spain digital nomad visa will be equally welcomed by expats.

Does the Portugal golden visa come with citizenship?

Yes. Anyone with a Portugal golden visa can apply for citizenship after continually holding the visa for five years.

Why have the Portugal golden visa rules changed?

The Portugal golden visa scheme opened to applications in October 2012 and remained pretty much unchanged until January 2022, when the government opted to increase the investment thresholds across the board and to restrict the places where golden visa holders can buy or build a home.

Can I rent a home in Lisbon and apply for a golden visa?

No. The application for a golden visa stipulates that expats must buy a home or invest in Portugal. Renting a home is not allowed if the investment criteria are not met.

Is the Spain Start-Up Act going to become law?

The Start-Up Act is passing through the Spanish Parliament, so the bill becoming law is not guaranteed.

Does the Portugal golden visa have a closing date?

No, the golden visa has been open for applications for nearly 10 years and the government has not announced any intention to close the scheme.

Related Information

Below is a list of related articles you may find of interest.