More Americans are cutting their ties with home than ever before because of tough tax rules imposed by the US government.

Since the Foreign Account Tax Compliance Act (FATCA) was introduced in 2015, Americans abroad have complained the foreign banks and financial firms are unwilling to do business with them.

The financial firms prefer not to have American customers because of the cost of complying with FATCA rules.

Under FATCA, foreign financial firms must report financial and personal information about any accounts controlled by American customers to the US Internal Revenue Service.

American expats must also file an FBAR form to let the IRS know about any foreign bank accounts they have with a balance of more than $10,000.

If they are in business, other tax complications must be observed.

Call to end citizen-based taxation

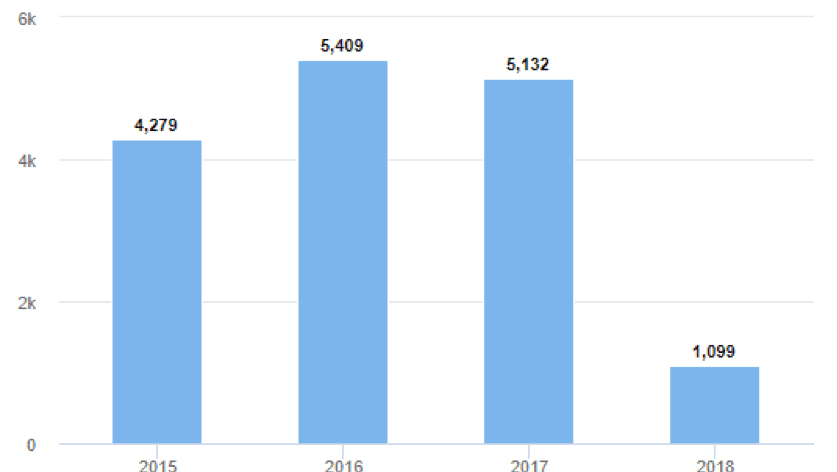

According to the IRS, the most recent data for the first three months of 2018 shows 1,099 Americans renounced their citizenship.

Expat groups on both sides of Congress blame the renunciations on FATCA and other tax laws.

Many are calling for a fundamental change in the US tax system away from taxing citizens wherever they live in the world to just those that live in the USA.

Moving from a citizen-based to territorial-based tax system would bring American into line with most countries.

Currently, the tiny African nation of Eritrea is the only other country operating citizen-based tax rules.

Under FATCA rules, foreign financial firms who fail to report on their American expats customers can face fines and sanctions, such as exclusion from trading in the USA.

Americans renouncing citizenship 2015 – 2018

Source: IRS

The IRS publishes a quarterly update of Americans who have renounced their citizenship in The Federal Register