Insurance is a way to manage risk for individuals and businesses.

Buying insurance is buying protection against unexpected financial losses

Most insurance comes as basic packages, like buildings and contents, cover for homeowners or public and employer liability for businesses.

Table of contents

Policies are then tailored to suit each customer by ‘bolting on’ add-ons that extend the cover. For example, a shop may add a goods in transit package to protect stock on the move to a warehouse or customer.

Insurance comes in a broad range of basic and bolt-on cover that allows buyers to mix and match the policies they need. The aim is to keep costs down and bring all the cover under one contract, which eases administration and renewals.

What Is Business Insurance?

Business insurance is a suite of insurances designed to protect a business from unexpected losses.

These losses can range from flood damage or a cyber attack that closes an online retailer to compensation if a customer decides to sue and many more scenarios.

Anyone who runs a business, is self-employed or a freelancer needs a basic package that safeguards them from financial loss.

Public liability

Public liability insurance covers the cost of compensation and legal fees if someone other than an employee decides to sue a business. Claims from workers are handled by employer liability insurance.

Public liability is optional for business owners, but employer liability is a legal requirement for a business employing staff.

Professional indemnity

Advice businesses should consider professional indemnity insurance. The main area of cover safeguards against the costs of a customer suing over poor advice or by making mistakes at work.

Typical businesses taking professional indemnity cover include architects, accountants and software engineers.

Cover can extend to fraud or malicious action by current or former employees, breach of confidentiality and loss or damage of documents.

Shop

Shop insurance is usually tailored to the needs of the retailer as not all shops are the same. After all, an online store has different requirements from a builders’ merchant. Optional extras include buildings and contents cover, public and employer liability, stock, cyber crime, business equipment and terrorism, to name a few.

Commercial combined

Commercial combined insurance is similar to shop insurance, offering a wide range of extras tailored for the specific needs of a business.

An advantage of commercial combined and shop insurances is both packages can cover a range of outcomes in a single policy. This keeps the cost down.

Motor – commercial vehicles

A business that lets employees drive their own vehicles does not need commercial motor insurance, but must make sure each driver has at least the basic cover demanded by law.

Like private motor insurance, policies come as third-party, third-party fire and theft or comprehensive with additional cover for requirements like goods in transit.

Fleet cover extends the cover to businesses running large numbers of vehicles.

Tool cover

Tool cover replaces tools damaged in a break-in, fire, theft or flood. The cover extends to tools left unattended that go missing.

What Is Landlord And Property Insurance?

Property comes in all types and sizes, from a plot of bare land to huge warehouses – and all these land and buildings need landlord insurance.

With investment property, the landlord covers the structure of the building while tenants have a separate policy for their belongings. Commercial let property is similar but covers business interruption, stock, equipment and vehicles.

Landlord

Buy to let insurance covers most needs for landlords. The policies can be customised to cover houses in multiple occupation (HMO), student accommodation, guest houses and holiday homes (See below)

Typical add-ons look after landlord contents in furnished and unfurnished homes, policies that pay if tenants fall into rent arrears and others that cover legal expenses.

Let holiday homes

Second homes and holiday home insurance cover private use or letting of a property that is not a main home.

Policies usually include public liability, landlord contents and damage while empty.

What Is Personal Insurance?

Personal insurance covers homeowners, tenants, drivers and travellers from any trouble that might lie ahead.

Business owners must not rely on personal insurance for protection – the premiums are cheaper, but the cover will exclude commercial cover.

The most popular personal insurance products are listed:

Household

Household or home insurance covers buildings and contents for your home. Often, both come together, but you can buy them separately. Tenants can also buy a special package to cover their belongings in a rented home.

Travel

Travel or holiday insurance looks after health and belongings while people are away from home.

Motor – private vehicles

Every private vehicle on the road must have at least third party insurance by law. Private motors are those not used for business. The package can come with extras, like breakdown cover, no claims discounts and protection and can be made cheaper by increasing the excess.

Breakdown

Breakdown insurance gets drivers back on the road if the engine stops working. The cover is often a bolt-on for motor policies.

GAP

GAP insurance for motor vehicles is short for guaranteed asset protection. The asset is the car and the protection is a payout to cover the replacement cost of the car in a total loss claim. GAP insurance covers the difference between the settlement from an insurer and how much the owner needs to pay for a similar replacement car.

What Is Specialist Insurance?

Specialist insurance is a tailor-made package to cover businesses or other one-off or continuing events that standard insurance policies can’t cover.

The list is limitless and includes dances, sports days, fairs and parties.

Most insurance brokers can arrange specialist insurance by taking an application to experts, which can make the cover more expensive.

Bespoke solutions

Bespoke insurance solutions are specialist policies customised for a customer’s needs. Catteries and archery clubs are examples.

Events

Events cover a range of occasions, from weddings to car boot sales.

Insurance Products Explained FAQ

Who pays for compensation of legal fees if my business has no insurance?

The business owners must dig into their personal funds to cover compensation or legal fees paid by a business.

How do I know how much cover my business needs?

Some cover is a legal requirement – like employer liability and motor insurance. The rest is optional. Deciding on the level of cover needed. Working out the best policy is generally the job of an all-of-the-market broker or an insurance provider’s customer service team.

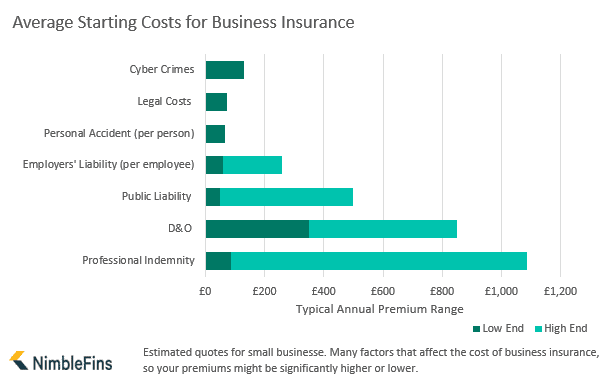

How much does business insurance cost?

The insurance cost depends on the size of a business, the business sector and a slew of other factors. The average policy cost ranges from £50 to £500 for public liability cover.

Source: Nimblefins

How much does landlord insurance cost?

Again, NImblefins has crunched the numbers and produced the average cost for landlord insurance for different types of property.

| Landlord Insurance Cost Calculations | Annual Premium |

| Semi-detached house | £150 |

| Terraced/End terrace house | £156 |

| Individual flat in purpose built block | £164 |

| Detached house | £179 |

| Individual flat in converted building | £200 |

| Average | £170 |

Source: Nimblefins

How much does home insurance cost?

Insuring a home with buildings and contents cover is not as expensive as many people might think. The average cost is around £150 yearly for both packages.

What is an excess?

An excess is an amount paid by a policyholder towards a claim. Because of the cash contribution, the risk is reduced for the insurer, making the policy cheaper. It’s common for motor and personal insurance policies to come with an excess.

Related Information

Below is a list of related articles you may find of interest.