Estimated reading time: 14 minutes

South Africa expat tax is the new way tax is charged by the South African Revenue Service on income earned outside the country. You can find out below what it means to you when you plan your finances and work out how much tax you are likely to pay

Table of contents

- South African SARS Expat Tax Explained

- Interaction with the Common Reporting Standard

- Interaction with South Africa’s double taxation agreements

- What is a ‘physical presence’ in South Africa?

- What does South African ‘ordinarily resident’ mean?

- Are you really a South African Expat?

- Who is impacted by the new South African tax?

- What options do South African expats have?

- Rebalancing income with employment benefits

- Other South African taxes expats must pay

- What about financial emigration out of South Africa?

South Africa is switching to a new way of working out income tax for expats which means they could pay tax on money that they earn abroad and never send home. The impending tax is due to start from March 1, 2020 and is already causing consternation for thousands of South Africans living and working overseas.

Expats in zero-tax economies, such as Dubai or Abu Dhabi, will feel the brunt of the law change as they will pay tax in South Africa on income earned, invested or saved even if they never set foot in their homeland but are judged ordinarily resident.

South African SARS Expat Tax Explained

South Africa’s SARS, South African Revenue Service, has introduced new rules about the reform of the foreign employment income tax exemption for South African residents overseas, which is often called ‘expat tax’ for short.

This guide takes an in-depth look at the timeline of the new tax rules and how they are designed to work.

The change is all part of the shift in South African from taxing income sourced in the country to taxing income earned worldwide by residents.

Those paying the tax are tested as ‘physically present’ or ‘ordinarily resident’ in the country.

The new rules drop the traditional expat tax exemption that was designed to stop South Africans paying income tax on their earnings at home if they were abroad for 183 days in any 12-month period, which must include a continuous absence of 60 days or more.

In Budget 2017, then finance minister Pravin Gordhan announced the abolition of the expat exemption from March 2019.

In Budget 2018, finance minister Malusi Gigaba confirmed the start date again, but public protest made him make the new rules subject to expats earning ZAR1 million or more – equivalent to US$55,600/GB£44,866 or AED204,100.

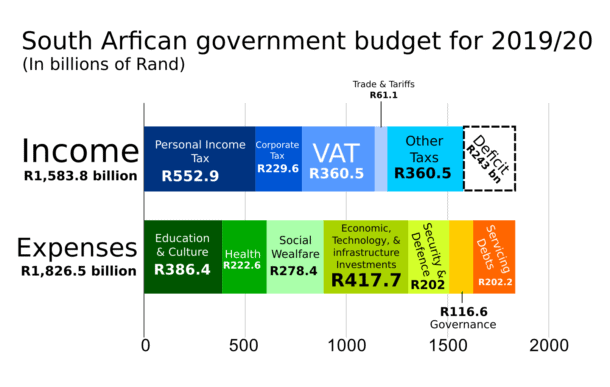

Income tax is payable on earnings of over ZAR1 million at rates of up to 45%.

In March 2019, another new finance minister at the Treasury, Tito Mboweni, again confirmed the new expat tax rules will start from March 2020 and that the government had no intention of ditching the legislation.

He did announce a public workshop to discuss some of the issues which led to a last minute change of heart about the earnings threshold before expats started to pay tax.

Mboweni decided in his Budget 2020, relating to the Income Tax Act, that expat tax rules were encouraging too many high-earning South Africans to leave the country to avoid the tax, so he relaxed the threshold from ZAR 1 million to ZAR 1.25 million (US$69,500/GB£56,000/AED255,135).

Another bombshell from Mboweni was the suggestion that financial emigration will be scrapped from March 2021 to stop the exodus of South Africans fleeing abroad to escape expat tax.

Interaction with the Common Reporting Standard

At the same time as announcing the new south african tax, like many other nations, South Africa launched a chance for taxpayers to come clean over undisclosed wealth while waiting for the Common Reporting Standard (CRS) to kick in with an amnesty.

CRS is a data-swapping network of the tax authorities of more than 100 countries. Each authority compiles a list of accounts and investments controlled by foreign nationals and sends the details to the expat’s home nation tax authority for comparison with their tax filings.

In return, other authorities in the network send financial data on expats back.

The CRS network is now up and running, so the South African Revenue Service (SARS) is already collecting information about the financial affairs of expats to cross-check against their tax returns.

The result is if the expat fails to disclose income, SARS will have data from elsewhere indicating possible tax avoidance.

Interaction with South Africa’s double taxation agreements

South Africa has double taxation agreements (DTAs) with more than 80 other nations.

The DTAs are agreements between South Africa and another country over who has the right to tax your income and gains.

The aim is to ensure expats are not taxed on the same income twice, although they may have to make a balancing payment if tax rates differ between each nation.

Under the new rules, SARS has stipulated any earnings by ordinary residents will be taxed in South Africa along with any foreign earnings.

SARS list of double taxation agreements

What is a ‘physical presence’ in South Africa?

The ‘physical presence’ test determines if someone is tax resident in South Africa by checking the number of days they spend in the country.

The test is in three parts. Someone must fail to meet the date limits in each part to prove non-residency for tax – the tests are:

- Did someone spend 91 days or more in South Africa during the tax year in question?

- Did someone spend 91 days or more in South Africa in each of the five tax years prior to the tax year in question?

- Did someone spend 915 days or more in South Africa during the five tax years before the tax year in question?

Anyone who meets one or more of the tests but who stays out of South Africa for 330 days or more is a non-resident from the last day they qualified as physically present.

Everyone else is taxed on their worldwide income and gains in South Africa.

To beat the physical presence test, expats should log the times and dates when they enter and leave South Africa to accurately record if they were physically present in the country – noting the time limits apply to full days, not part days.

SARS Physical Presence Test Diagram

The diagram can be found in the SARS document here

What does South African ‘ordinarily resident’ mean?

South African tax law determines non-residents are only taxed on their income from a source within the country.

The legal term ‘ordinarily resident’ is not defined in law, but a string of court cases over the years have shaped the legal meaning.

The lead case is Cohen v the Commissioner for Inland Revenue, dating back to 1946.

The case established that a person was ordinarily resident regardless of the time they spent away from South Africa if they still regarded the country as home and the place to where they would eventually return.

A briefing note issued by the government lays out the Cohen case and other important residence cases decided in the courts.

Issues that affect residence can include if someone owns a home in South Africa, has family and social ties to the country, repeatedly visits the country, holds a South African passport or owns a bank account.

Read more about court cases determining ordinarily residence

Are you really a South African Expat?

Like expats from other countries, South Africans abroad cannot decide they are non-resident at home and now resident in another country.

Non-residence is a matter of fact and law and the physical presence and ordinarily resident tests decide the issue for them.

That means expats can live in another country but still be ordinarily resident in South Africa if they have not taken care to break all ties with their homeland, leaving the expat open to receiving an unexpected tax bill.

The government reckons just over 900,000 South Africans live abroad, but only 103,000 can show they are non-resident in South Africa. That leaves nearly 800,000 South African expats facing tax bills when the new laws take effect from March 2020.

And if they are non-resident, any return to South Africa within five years of leaving can class them as failed emigrants and leave them open to financial penalties.

“An individual will be considered to be ordinarily resident in South Africa, if South Africa is the country to which that individual will naturally and as a matter of course return after his or her wanderings,” says guidance from SARS.

“It could be described as that individual’s usual or principal residence, or his or her real home. If an individual is not ordinarily resident in South Africa, he or she may still meet the requirements of the physical presence test and will be deemed to be a resident for tax purposes.”

SARS tax guidance for non-residents with income or investments in South Africa

Who is impacted by the new South African tax?

Any South African abroad earning ZAR 1.25 million or more from any source will fall into the South African tax SARS net.

Double taxation treaties may protect expats paying tax at an equal or higher rate than in South Africa, but anyone else should expect a bill from SARS.

Companies sending workers abroad on assignment will have to consider how the tax will affect them.

Gross earnings will not only cover salaries, but benefits like accommodation, cars, school fees and trips home as well.

Those in the Gulf States who pick up a tax-free gratuity at the end of their contracts will find they have tax to pay on these lump-sums as well. If you live in Dubai you will need financial advice.

The concern is employers at home and abroad will pick up the tab for expat workers by increasing salaries and benefit packages to cover the new tax, pricing South African workers out of overseas assignments.

What options do South African expats have?

The CRS is a major problem for expats as they have no choice other than to honestly file tax returns knowing that their affairs are open to scrutiny as banks and financial services organisations will disclose the details to the tax authorities.

Many will have limited options:

- Accept the tax reducing their net incomes

- Return to South Africa

- Become a financial migrant

- Looking for tax planning opportunities to reduce liabilities

Financial solutions, such as pensions and bonds may defer paying tax for a significant time, but as will all tax planning, the government close the opportunity by changing the law at any time.

Leaving South Africa to become resident elsewhere can lead to other tax implications on assets such as property or investments still in the country.

South African expats who can prove they are tax resident in another country are exempt from the new tax, but will still pay tax on income or gains generated in South Africa.

Another worry for expats is most assignments abroad are paid in US Dollars, a strong currency that has driven down the exchange value of the Rand.

For full information about what options are available download the free South African Expat Tax Guide informing you of the steps you can take to be in a better financial position.

Download the free guide by clicking here

Rebalancing income with employment benefits

The outcry over South Africa’s expat tax mainly comes from two types of overseas worker

- Those living in a zero tax or low tax country

- Contract workers with significant earnings from abroad

Up to now, these workers have had no incentive other than to take their income in cash as the tax consequences have never bothered them.

But the expat tax rules are forcing employers and South Africans overseas to review their income packages to switch to more tax effective financial strategies.

SARS talks about ‘adjusting contracts’ to help high-earners rebalance their incomes to minimise their tax burdens.

The point is reviewing and adjusting the way contracts are paid by looking at introducing more employment benefits, such as saving into a pension, will lead to a lower tax bill.

South African expats can benefit from an income tax exemption on foreign pension income, which means on retirement, any income from an overseas pension is tax-free.

The effect is a different way of looking at income as the whole amount won’t be available to spend as a portion will go into savings for retirement, which is really something many expats from other countries have had to do for years.

However, it’s important employers and expats do not come up with tax avoidance schemes that break South African law.

The key ruling says: “Employers and employees are entitled to structure salary packages as it suits them, and they are entitled to do so to achieve maximum tax acceptance… It is accordingly quite lawful for an employee to sacrifice salary in return for some quid pro quo from the employer which has the effect of reducing the employees tax liability”

That means organising finances to pay less tax is OK, providing any action taken is lawful and transparent.

South African expats should review their contracts and terms of employment to make receiving income more tax efficient sooner rather than later – and certainly ahead of the March 1, 2020 deadline.

Other South African taxes expats must pay

Besides the new income tax on earnings, expats also face capital gains tax and estate duties.

Capital gains are complicated to work out because they include an element of currency gain or loss and if several exemptions, allowances or losses are available to offset against any profits.

Taxpayers also have an annual allowance of ZAR40,000.

The tax is charged at rates of from 18% to 40%.

Donations and estate duty are imposed at 20% on the worldwide assets of residents and on South African assets of non-residents.

What about financial emigration out of South Africa?

The formal financial emigration process can trigger as many problems as an expat looks to solve.

If an expat tells SARS that they are filing formal financial emigration notice, the tax authority treats their assets in South Africa as if they are sold at market value, even if they are retaining them.

DARS will then issue a capital gains tax assessment and demand payment.

The trade-off is if SARS investigates your financial emigration notice and finds you are no longer ordinarily resident in South Africa, as an expat you are exempt from paying tax on your income from abroad in South Africa.

Related Information

Below is a list of related articles you may find of interest.