UK house prices are set to fall by a moderate three per cent over the next few months as interest rates have peaked and the cost of living continues to fall.

The latest five-year housing market forecast from estate agents Savills expects the bank rate to settle around 4.75 per cent, easing affordability stress for homebuyers and landlords.

The estate agent says property values held better than expected this year, with prices falling four per cent this year and dropping by an expected further three per cent in 2024.

But this market realignment will be followed by a boom that could see prices surge by 17.9 per cent by 2028, adding £45,500 to the cost of an average property.

UK rents seem more resilient than house prices, mostly due to a lack of suitable homes to let and a huge number of prospective tenants queuing for properties.

Table of contents

Record Rent Rise

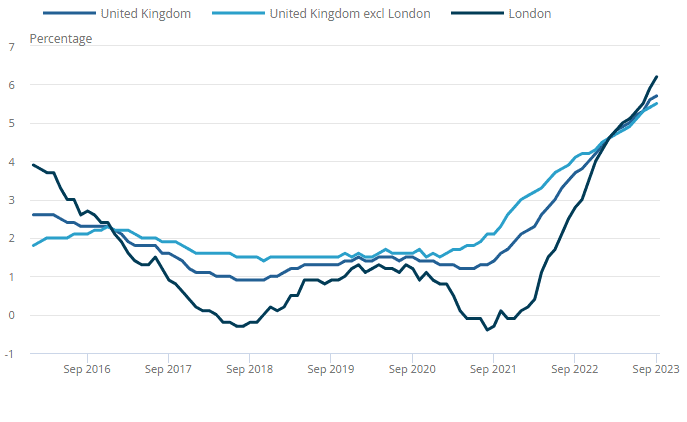

The latest data from the Office for National Statistics shows rents soared by 5.7 per cent in the year to the end of September.

Rents ticked up the highest in London, where landlords saw a 6.2 per cent increase. The lowest rise was 4.7 per cent in the North East. The hike in the capital was the highest since the ONS started keeping records in January 2006.

How rents keep going up

International Market ‘Resilience’

Looking at the global housing market, Savills explained property has shown surprising resilience despite economic uncertainty and higher interest rates.

“In any economic downturn, there is an underlying concern surrounding housing markets,” says Savills analyst Charlotte Rushton.

“This concern is again relevant following a sharp rise in global interest rates, leading many to be wary of the health of residential markets, especially after two years of historic house price rises. While house prices in some countries have dipped, the reality is more nuanced, and residential markets have proved resilient. This leads to the question: why?”

Traditional economics states house prices are determined by demand and supply. Where there is high demand and low supply, prices rise, while where supply is high, and demand is low, prices tend to drop.

But in recent years, mortgage payers have been loathe to move if that meant taking out loans at higher interest rates.

For example, 95 per cent of homeowners in the USA are locked into long-term fixed rates averaging 3.5 per cent when the new loan rate is nearer 7.5 per cent.

Property Prices In Top Expat Destinations

The table takes the ten most popular destinations for British expats and looks at property prices and affordability.

Price to income looks at how many years of income an expat would need to buy a one-bedroom apartment of 90 square metres. The lower the number, the better.

Yield is the return on investment when considering annual rent and the property price. The higher the result, the better.

Price to rent is the average cost of ownership divided by annual rent. Lower results suggest that buying is better than renting. The apartments measure 90 square metres in the city centre and 110 square metres in the suburbs.

For mortgage as a percentage of rent, the lowest figure is best, while the higher result scores best for affordability.

Where To Buy Or Invest

| Rank | Country | Gross Rental Yield City Centre | Gross Rental Yield Outside of Centre | Price To Rent Ratio City Centre | Price To Rent Ratio Outside City Centre | Mortgage As Percentage Of Income | Affordability Index |

|---|---|---|---|---|---|---|---|

| 1 | Portugal | 5.6 | 6.4 | 17.7 | 15.7 | 84.6 | 1.2 |

| 2 | France | 2.9 | 3.1 | 34.0 | 32.0 | 70.0 | 1.4 |

| 3 | Germany | 2.8 | 2.9 | 35.6 | 34.3 | 70.7 | 1.4 |

| 4 | New Zealand | 3.8 | 3.9 | 26.6 | 25.9 | 84.4 | 1.2 |

| 5 | Australia | 4.3 | 4.2 | 23.4 | 23.7 | 82.4 | 1.2 |

| 6 | Canada | 3.8 | 4.6 | 26.1 | 21.6 | 85.8 | 1.2 |

| 7 | Ireland | 6.7 | 7.5 | 15.0 | 13.4 | 53.7 | 1.9 |

| 8 | Spain | 5.0 | 6.1 | 20.0 | 16.5 | 47.4 | 2.1 |

| 9 | USA | 7.9 | 9.1 | 12.7 | 11.0 | 38.3 | 2.6 |

| 10 | South Africa | 10.2 | 11.3 | 9.8 | 8.9 | 36.8 | 2.7 |

| UK | 4.5 | 4.5 | 22.4 | 22.2 | 65.7 | 1.7 |

According to the Global Property Guide, which monitors property data worldwide, Ireland and Spain are the best places to invest.

Both countries have good yields for landlords based on average rents in several cities.

Global Property FAQ

Many expats rent out their UK homes while working overseas. If you follow the usual rules, like declaring any rent as income and properly licensing the property, letting out your UK home is OK if the local council requires it.

Every country has a set of laws about property ownership by foreigners, so speak to a property professional or independent lawyer before entering into any contract.

Buying a home depends on many factors that make somewhere suitable for one expat but a no-go zone for another, so it is difficult to say where the best place to buy might be. Currently, the best places to buy in the expat top ten destinations are France and Spain.

Inheritance laws differ between countries and are often widely different from those in the UK. The best advice for expats is to have a will in each country where they have property to ensure their wishes are followed and the people they wish to inherit do so.

For short-term stays, letting is best for expats. For the long term, many expats rent to get to know an area rather than buying a home to find out they are on the move shortly after the purchase.

Related Information

Below is a list of related articles you may find of interest.