Estimated reading time: 5 minutes

According to a major UK mortgage lender, the price of an average home has increased by 1,000 per cent over the past four decades.

That gives a home worth an average of £26,168 in 1983 a whopping £281,272 price tag in 2023.

Mortgages were much more expensive 40 years ago, with banks and building societies charging an 11 per cent interest rate.

A 90 per cent interest-only home loan against an average-priced property then costs £216 a month or 33 per cent of the average wage of £7,197 a year.

Today, homes are even less affordable despite an interest rate of 3.5 per cent – 7.5 per cent lower than in 1983. A 90 per cent interest-only loan against an average-priced home now costs £738 a month – or 41 per cent of a worker’s average take-home salary of £30,056 a year.

Table of contents

Lender Tracks Property Prices

Despite the years, The Halifax, one of the country’s largest mortgage lenders, has published data showing homes have increased in value by 974 per cent since 1983.

The most expensive homes were in London – costing an average of £38,056 compared with today’s £541,239. The cheapest houses were in Yorkshire, selling for an average of £20,332. Today, the same house is worth £205,466, and the cheapest region for homes crown has shifted to the North East, where the average property costs £169,980.

So, how much are homes worth now as the cost of living crisis grips the market?

All the major house price trackers confirm prices are falling with no imminent signs of revival.

The latest Halifax house price index shows the market has slowed in every part of the UK. Overall prices are down 1.5 per cent between November and December or 2 per cent year-on-year.

Cost Of Living Crisis Hits Market

“As we’ve seen over the past few months, uncertainties about the extent to which cost of living increases will impact household bills, alongside rising interest rates, is leading to an overall slowing of the market,” said Kim Kinnaird, director, Halifax Mortgages.

“The housing market will continue to be impacted by the wider economic environment and, as buyers and sellers remain cautious, we expect there will be a reduction in both supply and demand overall, with house prices forecast to fall around 8 per cent over the course of the year. It’s important to recognise that a drop of 8 per cent would mean the cost of the average property returning to April 2021 prices, which still remains significantly above pre-pandemic levels.”

Another of Britain’s largest mortgage lenders , The Nationwide, has released data showing prices have tumbled across the country – growing by an average 2.8 per cent in December, down from 4.4 per cent in November. Regionally, prices in East Anglia have increased the most in 2022, while those in Scotland fared the worst.

The lender estimates an average home is worth £262,068, down from £263,788 in November.

Andrew Harvey, Nationwide’s senior economist, said: “The biggest change in terms of housing affordability for potential buyers over the past year has been the rise in the cost of servicing the typical mortgage as a result of the increase in mortgage rates.

Mortgage Costs Surge 400%

“This trend began in earnest towards the end of 2021, with typical five-year fixed rates rising from 1.3 per cent in late 2021 to 2.9 per cent by mid-2022, as market interest rates that underpin mortgage pricing rose steadily, reflecting expectations that the Bank of England would have to raise rates significantly in the years ahead to help bring surging inflation back to its target rate of 2 per cent.

“But mortgage rates surged after the mini-Budget in late September, reaching their highest levels since 2010, over four times higher than the lows prevailing in 2021.

“While wider financial market conditions had stabilised by the end of 2022, with market interest rates falling back towards the levels prevailing before the mini-Budget, mortgage rates are taking longer to normalise.”

Government data showed year-on-year prices dropped 2.1 per cent from a 12.4 per cent increase in October to 10.3 per cent growth in November.

The Office for National Statistics reports an average UK home was worth £295,000 in November – a gain of £28,000 in 12 months, but was valued at £1,000 less in October.

London Prices Suffer

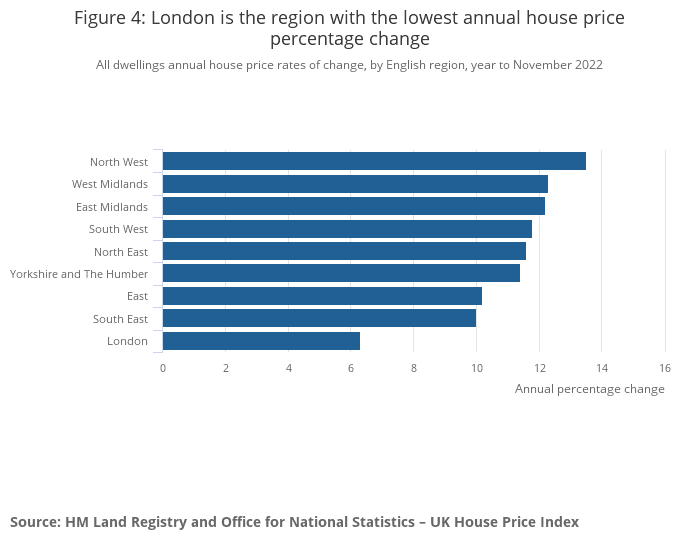

The North-West was the region returning the best price growth, rising 13.5 per cent during the year, while London had the most sluggish increase of 6.5 per cent.

“Recent annual percentage changes in house prices have been volatile because of volatility in prices in 2021. For example, the October 2022 annual percentage change was high, partly caused by a sharp fall in UK average house prices in October 2021, following changes to Stamp Duty Land Tax. This is known as a base effect,” said the ONS report.

The chart shows house price growth by region for the year ending November 30, 2022:

Estate agents say buyer demand is slipping away, leading to fewer sales, which in turn is pushing house prices down as more properties are competing for buyers.

Energy Efficient Homes Command Top Prices

“When separated, all regions across England are now seeing prices soften to some degree, with feedback pointing to East Anglia and the South East seeing the sharpest rate of decline in net balance terms,” says research from estate agent professional body the Royal Institution of Chartered Surveyors.

“Respondents across the UK envisage some pull-back in prices in the three months ahead. When asked if respondents are seeing greater interest from buyers in homes that are more energy efficient, around 40 per cent of the survey sample answered yes, although this was outweighed by 60 per cent who said they do not see this trend.

“Meanwhile, 41 per cent of respondents noted that sellers were attempting to attach a price premium on homes with a high energy efficiency rating.

“By the same token, 61 per cent of contributors stated that highly energy efficient homes were holding their value in the current market.”

Related Information

Below is a list of related articles you may find of interest.