Estimated reading time: 8 minutes

One of the largest Mediterranean islands, Cyprus is a popular destination with British expats, particularly retirees drawn by the warm climate, pristine beaches, relaxed pace of life and beneficial tax system, with low-income tax and zero inheritance taxes for residents.

Living costs are low, as are crime rates, and the culture and cuisine combine Italian, Turkish and Greek influences, offset by hundreds of historical and archaeological sites. The large expat community means English is fairly widely spoken by around 73 per cent of the population.

While the Cypriot government suspended its citizenship by investment programme in November 2020, the newly revised residence by investment initiative is open for applications. After a minimum number of years of continuous residency as a permanent resident, expats may become eligible to apply for citizenship.

Table of contents

About Cyprus

Currency

Euro (EUR)

Capital

GDP

Cyprus’s Gross Domestic Product (GDP) is $28.41 billion (£22.79 billion), with the Republic of Cyprus primarily operating in the services sector, alongside tourism, shipping, finance and property.

Nicosia is the capital city, also sometimes called Lefkosia, based in the middle of the island and famous for its 16th-century city walls. It acts as a divided capital, the only of its kind in Europe, bringing the governments of the north and south of the ‘green line’ border together in one central city.

Cyprus has been divided since 1974, with the northern Turkish occupied part of the island and the larger southern region, the official Republic of Cyprus and part of the EU.

Towns and cities

The largest cities in Cyprus include Nicosia, Limassol, Paphos, Larnaca, Morphou, Famagusta and Kyrenia.

Population

1.244 million

British expats

Estimates vary, but around 70,000 UK nationals live long-term in Cyprus.

Languages

The official languages in Cyprus are Greek and Turkish, depending on the region. However, English is also widely spoken, particularly in the popular tourist areas.

Climate

Cyprus is a Mediterranean country with hot, dry summers from May until October and mild winters between November and March. The annual average temperature is 17.5°C (63.5°F), but this can get considerably warmer in August, with an average daily peak of 34°C (93.2°F) and average lows of 24°C (75.2°F).

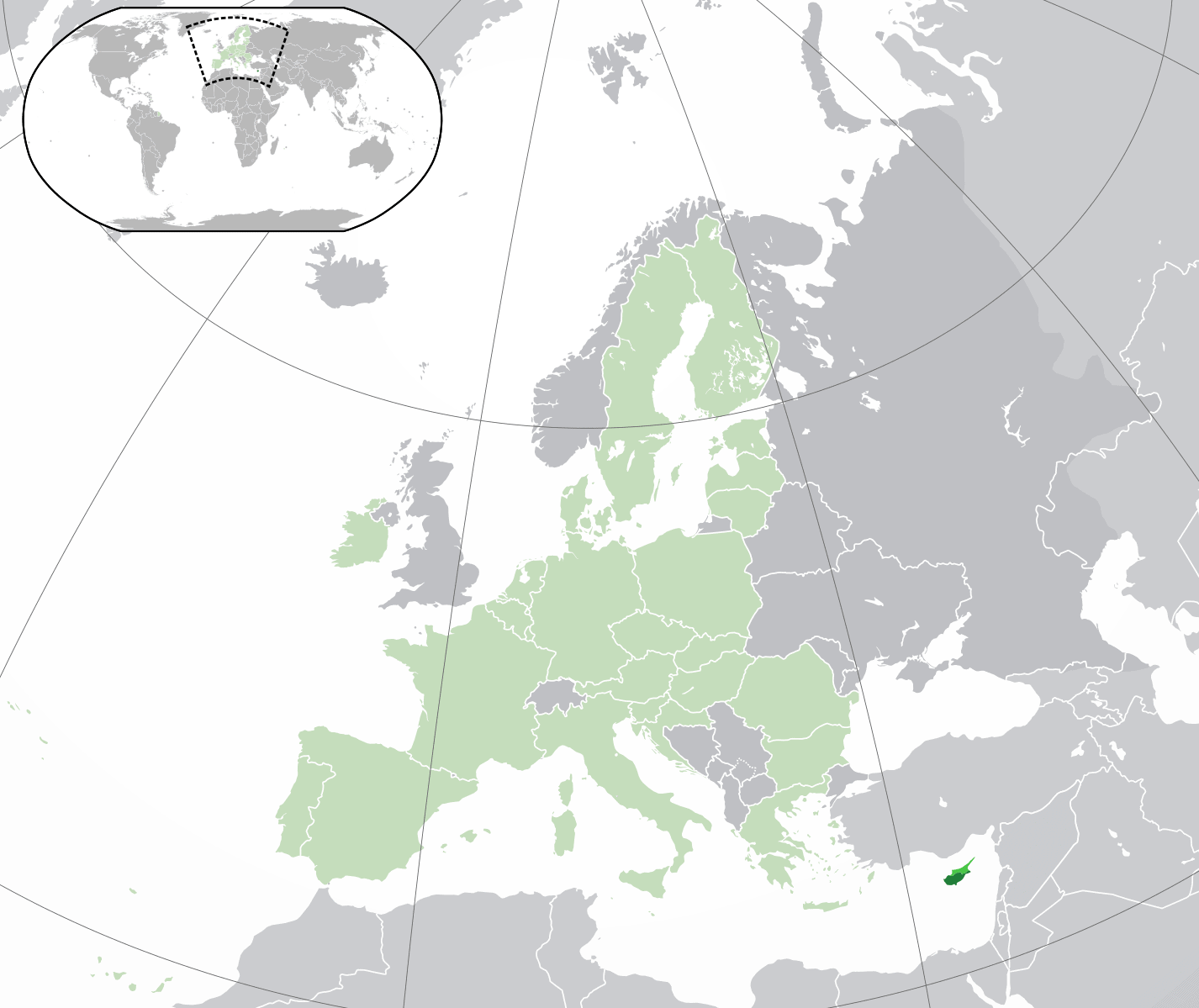

Map

Source: Google Maps

Cyprus is the third-largest island in the Mediterranean and is situated to the far southeast of Europe. The island is around 40 miles south of Turkey, 480 miles southeast of Greece, and 60 miles west of Syria, and is surrounded by the warm waters of the Eastern Mediterranean Sea.

Residence By Investment Options

Non-EU nationals can apply for Cypriot residency through the government scheme, officially called Regulation 6(2) within the Aliens and Immigration Regulations.

The scheme was revised in 2023 to introduce higher investment thresholds and annual minimum incomes, following the citizenship by investment programme being paused after extended disagreements within the EC.

Expats can apply for residency by investing at least €300,000 (£258,239) through one of the following routes:

- Purchasing a newly constructed home for at least €300,000 plus VAT, with the contract of sale submitted to the Cyprus Department of Land and Surveys as evidence of the acquisition, and applications permitted after payment of at least €200,000 (£172,159) toward the investment cost.

- Buying a home under the same conditions through a company that is registered in the applicant’s name or the names of the applicant and their spouse, provided they are the only shareholders.

- Investing at least €300,000 plus VAT in up to two non-residential properties, such as commercial buildings or developments.

- Purchasing shares worth at least €300,000 in a Cypriot company registered and trading in the country and employing five or more people.

- Investing €300,000 or more in eligible funds from the Cyprus Investment Fund Association.

Eligibility requirements include earning at least €50,000 (£43,040) from overseas, plus an additional €15,000 (£12,912) for a spouse included on the application and €10,000 (£8,608) for every other dependent. Residence by investment applicants must prove their income and the source of their funds, and although they do not need to live permanently in Cyprus must visit at least once every two years.

Travel

Cypriot permanent residency allows foreign nationals the right to live and study in Cyprus, but there are no further visa-free travel freedoms.

Timescale

Applying for permanent residency includes an application fee of €500 (£430) plus a €50 (£43) charge related to biometric data capture, after which the Cypriot migration authority reviews the application. If successful, an applicant will be informed within two months and then has one year to visit Cyprus with all dependents on the application to collect a physical permit.

Visas

British nationals can travel to the Republic of Cyprus without a visa for a maximum of 90 days in each 180-day period, with all travel to any EU country counted towards the threshold. Other visits and longer stays will require a visa, study visa or work permit.

Learn more about applying for a Cypriot visa or work permit.

Tax

The Cypriot tax regime is highly attractive, and expats who live in the country for 183 days per year or more are normally considered residents for tax purposes. Other criteria can also mean a foreign national is categorised as a tax resident, such as owning a Cypriot business or having their primary residential home on the island.

Tax residents are liable to declare and pay taxes in Cyprus on their worldwide income, with low-income tax rates, no inheritance tax, and limited capital gains tax only applied to certain gains arising within Cyprus.

Non-domiciles are foreign nationals who were not born in Cyprus and have not lived there for more than 17 of the previous 20 years. They are exempt from defence contributions – the alternative to income tax which the Cypriot tax office charges on interest income and dividend earnings.

Therefore, although residence by investment does not impose a minimum stay requirement, expats who choose to live in Cyprus do not normally pay any tax on interest or dividends for the first 17 years.

Need Help with your Finances?

Cost Of Living

Living costs in Cyprus are lower than in the UK, with consumer costs 9.5 per cent more affordable and property rental prices 8.9 per cent less expensive. An individual person requires a budget of around €792 a month (£681), excluding accommodation, and a family of four needs €2,751 (£2,367) on average.

Property

Property acquisition is one of the potential routes to apply for residence by investment, either by purchasing a residential property or up to two non-residential buildings. Qualifying investments must be worth €300,000 (£258,239), plus VAT or above, and residential investments should be new-build properties.

Otherwise, non-EU citizens are allowed to purchase property in Cyprus but require advance approval from the Council of Ministers.

Rental properties are also widely available, with many expats renting apartments in larger cities or tourist areas. Other housing options include stone-built homes in smaller villages, rural properties with generous outdoor space and condos in high-rise buildings.

| One-bedroom city centre apartment | €906 / £780 |

| One-bedroom apartment elsewhere | €697 / £600 |

| Three-bedroom city centre apartment | €1,718 / £1,479 |

| Three-bedroom apartment elsewhere | €1,370 / £1,179 |

View properties listed for sale in Cyprus via Rightmove.

Healthcare

The Cypriot national health provision is called the General Healthcare System (GHS), and permanent residents living in Cyprus as tax residents will usually be able to access services and treatments, provided they have registered with the local municipality.

Healthcare treatments are provided for all employees resident in the country who pay social insurance contributions, although some expats may not be eligible depending on their visa terms and conditions.

While the GHS is considered a good standard, and several medical centres in Cyprus specialise in advanced medicines or procedures, expats normally take out private health cover to ensure access to immediate treatments.

Discover more about applying for residence by investment in Cyprus.

Cyprus Residence By Investment FAQ

Once a foreign national has been granted permanent residency, this is unlikely to be revoked since the status applies for life and allows a spouse and dependents to become eligible for Cypriot residency. Permanent residents may become eligible to apply for citizenship after living in the country for five years.

The most common reason for a residence by investment application to be rejected is incomplete information, lack of evidence of funds or income, or failure to provide proof of a qualifying investment made into the Cypriot economy.

Changes to the residence by investment scheme in 2023 also mean that previously eligible dependents, such as parents, are now excluded, and applications submitted with ineligible family members may be rejected.

Depending on the airports you fly to and from, the average flight time between London and Cyprus is just over five hours.

The Republic of Cyprus is a member of the EU and uses the Euro (EUR).

As with all EU countries, UK nationals can visit Cyprus for up to 90 days, a maximum, within 180 days, without requiring a visa.

Related Information

Below is a list of related articles you may find of interest.

Resources

- Cyprus Investment Promotion Agency (CIPA) – Official government agency promoting investment opportunities in Cyprus: https://investcyprus.org.cy/

- Ministry of Interior – Government department responsible for immigration and residency matters in Cyprus: https://www.moi.gov.cy/moi/

- Cyprus Department of Land and Surveys – Official department overseeing property registration and transactions in Cyprus: https://www.dls.moi.gov.cy/

- Cyprus Tax Department – Official website providing information on taxation in Cyprus: https://www.mof.gov.cy/tax/

- Ministry of Health – Government department responsible for healthcare services in Cyprus: https://www.moh.gov.cy/moh/