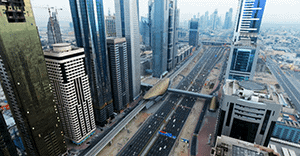

Dubai luxury property prices may be booming but they are still lagging their 2008 peak by almost a third.

Property prices are spiralling upwards in the United Arab Emirates city but are still far short of their values at the height of the market.

The Dubai Residential Review from international property firm Knight Frank shows they are still at least 30% below the levels set during 2008 before values plunged by up to 50%.

Nevertheless, year on year prices for luxury villas and prime flats are 21.4% higher in the second quarter of 2013 and in line with recovering prices, sales volumes are also increasing.

The trigger for improving property prices has been investors from outside the UAE looking to put their money into a nation considered an economic and political safe haven.

Outside investment

Much of the investment is coming from other Middle East or North African countries that are experiencing civil unrest.

Official figures from the Dubai Land Department shows that Indians (19%) were the most active buyers of homes in 2012, followed by Pakistanis (15%). The British at 14% and Arabs at 11% were the closing on their lead.

However, although Dubai attracts international investors, Gulf Co-operation Council investors still make up the largest category of buyers than any other foreign nationals.

The property report points out that the government is concerned that Dubai is heading for another property bubble with superheated prices fuelled by property speculation rather than buyers purchasing homes to live in.

As a result, the emirate is proposing to cap mortgage loan to values on homes to rent for UAE nationals and foreigners.

More growth predicted

“While capping mortgages would not impact at all on cash buyers, who make up a large part of the market, the move could make speculators consider their exit strategy if they needed to sell quickly,” said a Knight Frank spokesman.

A flood of expats is also pushing property rents up. In the year to June 2013, rents have soared by 15% with yields of between 4% and 6%.

The best areas for property investment are Dubai Marina, Downtown Dubai and Palm Jumeirah, says the report.

“Rents and values of prime residential property have risen over the past year and we expect them to continue to perform well,” said the Knight Frank spokesman.

“Local infrastructure is improving, which is boosting investor confidence and the number of well-paid expats looking from prime property.”