Holding widely-accepted credit and debit cards along with a fist full of US dollars is advised for expats with assignments in some countries.

In the latest currency report, expat pay and benefits consultancy ECA International looks at some of the problem economies.

Zimbabwe is highlighted as a potential financial risk for expats after a recent fact-finding trip.

ECA says the economy is becoming cashless – not intentionally but because the economy is still ravaged by the excesses of the Mugabe government and cash is in short supply.

Shops and businesses are offering up to 50% discounts to customers willing to pay in cash and sometimes even more for those paying in dollars.

Empty cash machines

“Cash machines are universally empty, according to reports and our researcher’s experience. So-called ‘bond notes’, the value of which is supposed to be at par with US dollars, are actually worth 50% less, but still attract discounts when used for payment,” says the report

“Credit and debit cards are generally the default form of payment in shops and restaurants likely to be frequented by expatriates, and holding widely accepted cards is essential for foreign staff. Having at least some of their pay delivered in hard US dollars would also be very useful.”

Continuing economic problems in Venezuela have seen the value of the main currency – the bolivar – shrink to new lows.

Foreign companies and their expat workers are pulling out as running a business becomes more difficult.

Shoppers take wheelbarrows of cash

“As the bolivar’s value has fallen to near worthlessness and hyperinflation has taken hold, Venezuelans have commonly been seen carrying bags or even wheelbarrows full of cash just to do fairly standard shopping,” says ECA.

Inflation is running at an estimated 500% in Venezuela – the world’s highest rate.

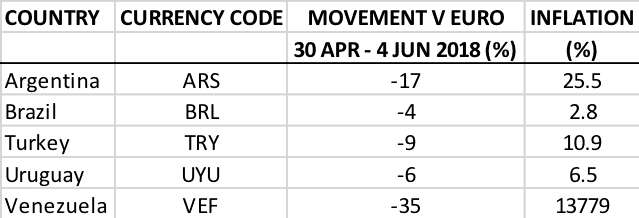

Elsewhere, the strong US dollar is inflicting damage on the currencies of Argentina, Brazil and Turkey, among others by stifling investment in the emerging markets.

The US Federal Reserve is expected to hike interest rates at this month’s meeting – taking them above the rate of inflation for the first time in several years.

Countries with largest currency losses in May 2018

Source: ECA International