Falling gilt yields are impacting on the values of pension funds, according to new data.

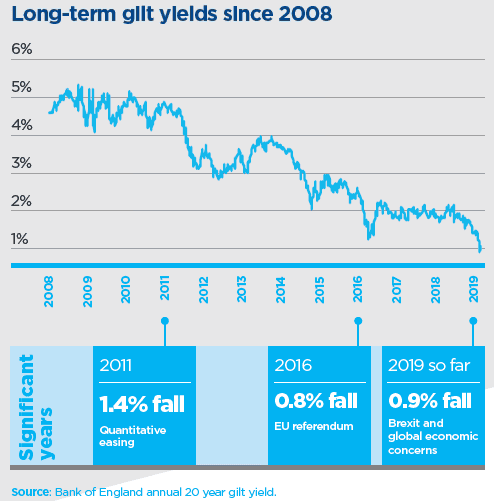

Long term gilt interest rates have dropped 0.3% since the start of August and 0.9% so far in 2019, says market monitor XPS Pensions.

For pension schemes that are not hedged, the fall in gilt yields increases the fund deficit.

For a pension funded at 90% and hedged at 80%, the deficit would have increased more than 50% in 2019, says XPS.

“Corporate bond yields have reduced too so balance sheets will see a similar impact,” says a report from the firm.

Gilt yields push up transfer values

“Even if your scheme is fully hedged, large reductions in rates may cause unexpected gains or losses, particularly if the hedge is approximate.

“If your funding valuation is in progress, your trustees are likely to raise the current deterioration in position. There are several approaches you can consider ensuring you aren’t committing to pay more cash than necessary.

“Low interest rates also mean transfer values are at an all-time high, which may increase member interest in transfers. You should check that transfers do not cause funding losses and the accounting impact is acceptable.”

Since 2008, gilt yields have shrunk from between 4% and 5% to 1% and even less in some circumstances.

What are gilts?

Gilts are government-backed bonds. Effectively, buying a gilt is lending the government money with a guaranteed interest rate over a fixed term.

At the end of the fixed term, the bond matures and the investor is repaid their capital.

Pension funds buy into gilts as conservative investments.

Gilts are not necessarily bought and sold at face value. A trader might sell a 1% £1,000 bond for £2,000. The yield is the interest rate based on the buying price (1% divided by £2,000 = 0.5%).

Investors can buy gilts through the government’s debt management office, through a stockbroker or the Bank of England’s brokerage service.