Estimated reading time: 6 minutes

Double-digit inflation is forcing expat investors to rethink their retirement plans. As UK inflation hits a 40-year high, the ripple effects impact expats and other retirees planning to give up work to survive on a fixed income.

But the savings target has shifted the minimum cost of day-to-day living upwards by almost 20 per cent.

The PLSA blames spiralling food and energy prices for the increase.

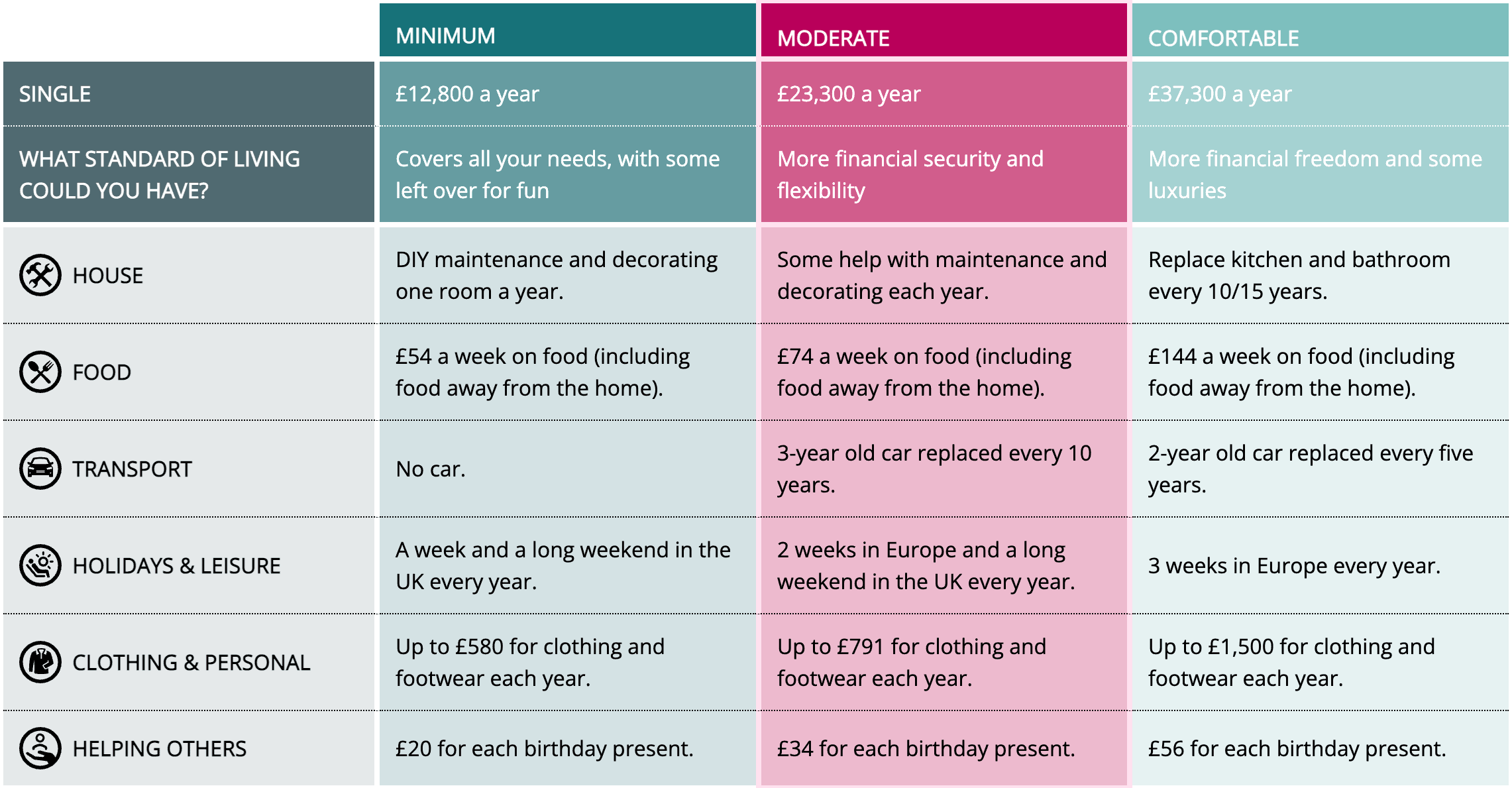

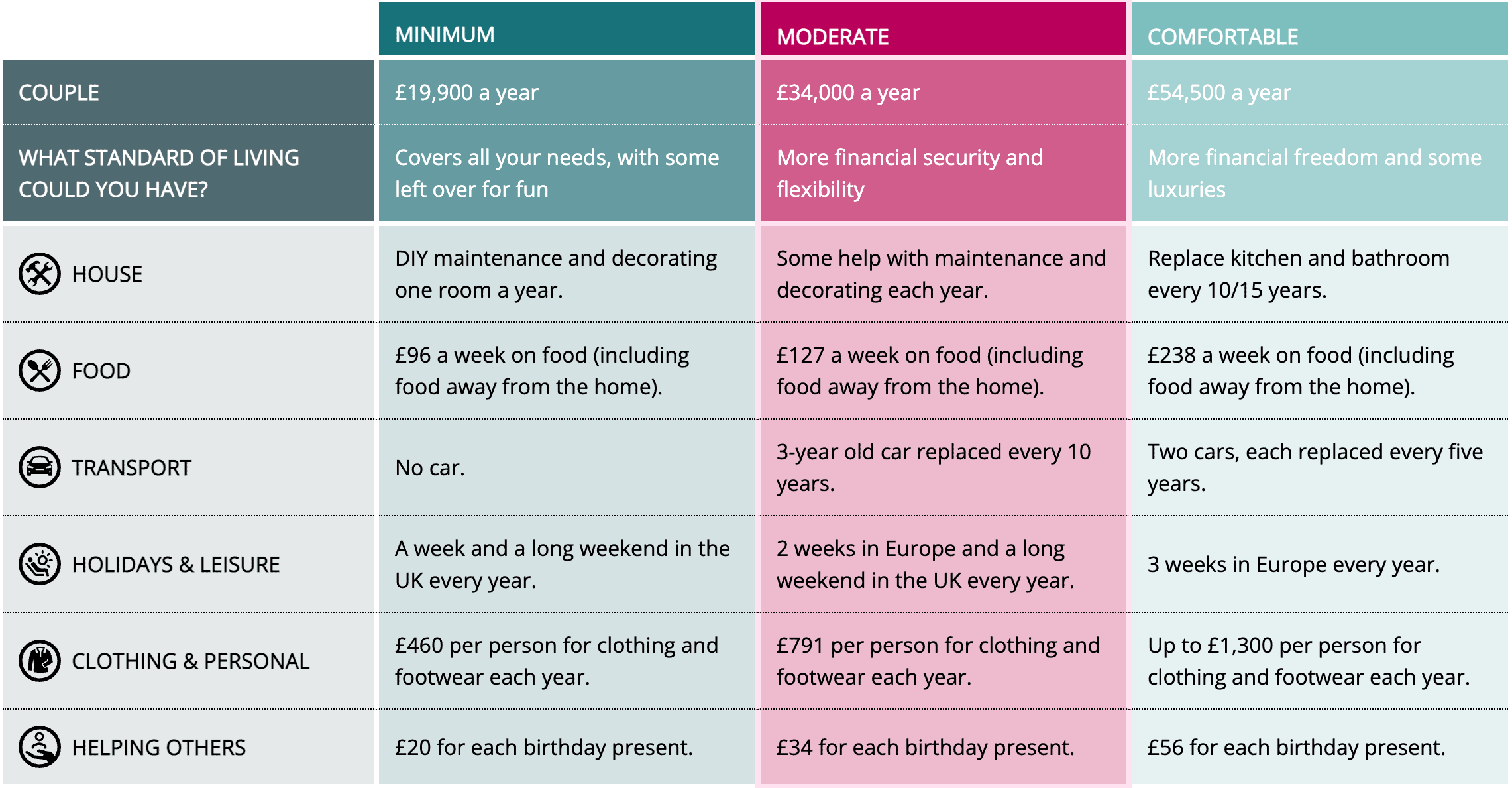

Financial firm trade body the Pensions and Lifetime Savings Association (PLSA) has calculated the least money a single retiree can get by on is £12,800 a year, up from £10,900. At the same time, a couple needs a £19,900 a year income, up from £16,700.

For a moderate lifestyle, the numbers rise 12 per cent to £23,300 for a single saver and 11 per cent to £34,000 for a couple.

The figures will change a great deal when looking at expat pensions requirements.

Table of contents

How Much Money You Need To Retire

The cost of a comfortable lifestyle has risen by a similar percentage – to £37,300 for a single and £54,500 for a couple.

The PLSA applauded the government for keeping the triple lock state pension promise as a scheduled 10 per cent increase in April will allow most retirees to afford a basic lifestyle.

The new state pension will rise to £204 a week (£884 monthly\£10,608 yearly), but the PLSA fears savers will need more financial help to reach a sustainable income to cover their years of retirement.

Protecting The Triple Lock

Nigel People, director of policy and advocacy at the PLSA, said: “The past year has been an enormously challenging one for many households in the UK. Inflation has risen to its highest rate in 40 years, with the cost of essentials and domestic fuel soaring, putting substantial pressure on incomes for working-age and retired households, particularly those on low incomes.

“These figures underline why the government was right to increase the state pension in line with the triple lock in the Autumn Statement.

“The jump in the retirement living standards underscores the need for the government to adopt the PLSA’s recommendations on pensions.

“These include the need for the government to adopt clear national objectives for retirement income, to ensure the state pension protects everyone from poverty and, later this decade, once the cost-of-living crisis has passed, to increase the scope and level of automatic enrolment pension contributions.”

Inflation Destroys Retirement Hopes

Financial experts maintain inflation is the main problem for retirement savers.

The target pot becomes bigger – £350,000 for a moderate retirement and £750,000 for someone looking for a more comfortable later life.

Those already retired must make savings or increase their drawings to cover the increased cost of living, which can threaten their ability to fund their entire retirement.

Where Your Retirement Money Goes

Here’s how basic, moderate and comfortable lifestyles break down for singles:

Here’s how basic, moderate and comfortable lifestyles break down for couples:

Fuel For Thought

The soaring energy cost is pinpointed as the most significant factor in smashing millions’ retirement savings plans.

“Between 2021 and 2022, the weekly cost of domestic fuel rose by around 130%. The increase in the weekly cost of domestic fuel accounts for between 30-40% of the increases in the overall budgets for a minimum, the moderate and comfortable living standard in retirement between 2021 and 2022,” says the PLSA study.

“Increases in the costs associated with motoring at the moderate and comfortable RLS over the past year – driven by increases in the cost of second-hand cars and in the cost of petrol/diesel – have resulted in this element of the budgets increasing by 16%.

“At all levels, higher interest rates will help to alleviate the cost pressure of higher prices as savers are able to get more attractive rates on annuities for their retirement pots than in recent years.”

Analysing how the rising cost of living impacts retirement saving and spending shows:

- Food and fuel prices are going up the fastest and account for a third of a basic budget but only a quarter of moderate and comfortable budgets

- A fifth of budgets are spent on social activities

- Basic budgets assume savers will get around on public transport but allocate money for a car to the other budgets

The budgets do not include rent or mortgage costs, as most retirees have paid for their homes by the time they leave work.

How Are Savers Doing?

Even without inflation increasing pension saving goals, around half of the pension savers will fail to put enough money aside to pay for even a basic retirement budget, says the PLSA.

The PLSA wants the government to increase contributions for savers outside automatic enrolment.

The body is also calling for reform to the State Pension, so everyone receives the equivalent of the basic retirement living standard in a bid to eliminate pension poverty.

PLSA data shows savers may have lost their way in setting aside what they need in retirement.

Although an impressive eight out of ten are on target to meet a basic retirement living standard, the figure drops to only one in three will reach the moderate spending level, and one in 12 will afford a comfortable retirement.

Inflation And Retirement Saving FAQ

The retirement living standards are three levels of spending designed to show pension savers what they can afford to spend in retirement. The three budgets are basic\minimum, moderate and comfortable.

Automatic enrolment is workplace pension saving deducted from wages automatically unless the earner opts out.

Inflation is a general increase in the price of goods and services. When prices rise, retirement savers lose spending power as money buys less.

The consumer price index monitored by the Office for National Statistics reports the annual inflation rate each month. At the time of writing, the annual inflation rate is 9.2 per cent against a target of two to three per cent.

PLSA stands for the Pension and Lifetime Savings Association, a trade body representing more than 100 financial firms in the UK. The group advises on policy for the government and the pensions industry.

Yes, the PLSA targets include all income, such as the state pension, investments, annuities and any money from private pensions.

Related Information

Below is a list of related articles you may find of interest.