Estimated reading time: 7 minutes

Jersey is the biggest of the Channel Islands and a UK Crown Dependency, although the island’s parliament can make laws. The island blends French and British culture with sweeping coastal landscapes, hiking trails, quiet beach coves, golf courses, water sports and abundant history.

The location and lifestyle are relaxed, with a healthy and affluent economy, high GDP, low taxation and idyllic backdrops, with the island’s preserved countryside offsetting the ancient castles and Jersey War Tunnels dating back to World War II.

Popular with expats from across Europe, and UK nationals, Jersey has a modern airport with direct flights from London, France, Ireland, Paris and Zurich, with ferry services running to and from France and England.

Jersey’s generous tax system attracts businesses, entrepreneurs, investors and high net-worth individuals, with banks and financial institutions regulated by the Jersey Financial Services Commission. While UK citizens can relocate freely to Jersey, other domiciles can apply for residency by investment by purchasing a property worth at least £1.25 million and paying a minimum annual tax contribution of £170,000.

Table of contents

About Jersey

Currency

Jersey has the Jersey pound (JEP), but GBP is also widely accepted, and all major cards can be used to pay for goods or withdraw cash from ATMs. The two currencies are equal, so one JEP is the same value as £1.

Capital

The capital is Saint Helier, one of twelve parishes in Jersey and the only town on the island.

Towns and cities

Aside from St Helier, the only other area with a quantifiable population is the village of Saint John, home to 3,000 people.

Population

103,100

British expats

Around half of the Jersey population is local, with 30 per cent of residents UK nationals and the remainder international expats.

Languages

The official language of Jersey is Jèrriais, although the main spoken language is English, and people also speak French.

Climate

A small island between England and France, the weather in Jersey is similar to that in the UK, albeit slightly warmer in sheltered bays with more hours of sunshine per year. The warmest months are July and August, with highs of 20°C (68°F) and lows of 14°C (57°F), compared to January, when the temperature varies between 8°C and 4°C (46°F to 39°F).

GDP

Jersey’s primary industries are financial and legal services, which comprise around 39.5 per cent of the country’s Gross Domestic Product (GDP). According to the Government of Jersey, GDP in 2020 was £4.5 billion. The world’s income per capita is among the highest, given the small population.

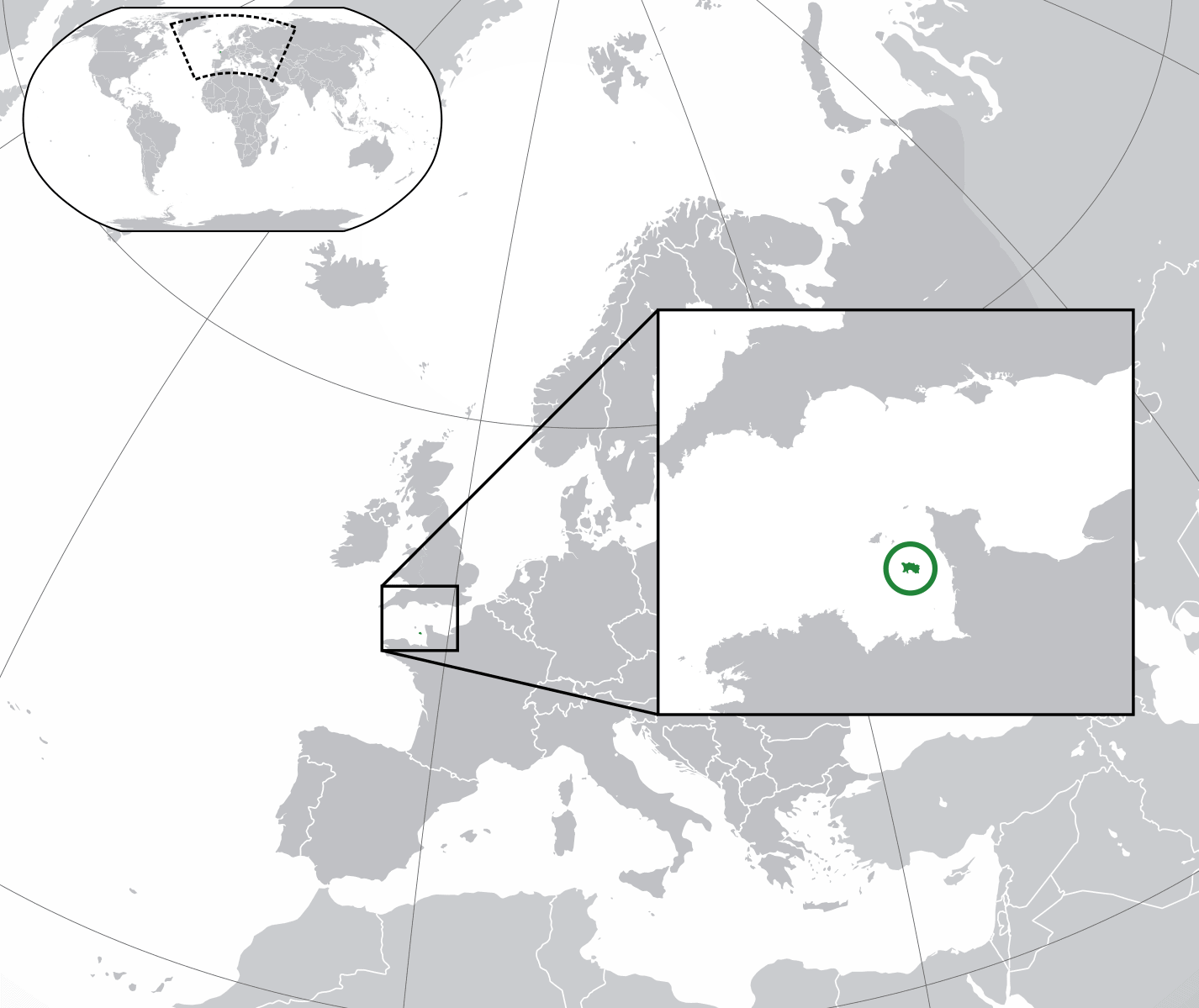

Map

Jersey is part of the Channel Islands, located roughly 14 miles from the French coast and 120 miles from the southern coast of England. While the island is closest to France, it remains a British Crown Dependency.

Residence By Investment Options

British passport holders do not require a formal visa to live, work or study in Jersey. Still, UK residents who have relocated from other countries may need a visa or permit, depending on whether they hold pre-settled status.

Many opt to apply for residence by investment to take advantage of the beneficial tax treatments. While the EU does not consider Jersey a tax haven, it has a lower income tax rate than the UK and does not charge taxes on private estates.

The High Net Worth (HNW) programme, also called the 2(1)E Licence, allows investors to gain residency by making significant contributions to the local economy, with an annual tax obligation of roughly £170,000 yearly. Applicants pay the standard 20 per cent income tax on income up to £850,000 and one per cent on earnings above that.

Applicants must:

- Provide evidence of their finances and income to demonstrate they would make this level of tax contributions.

- Apply for consent to purchase or rent an apartment worth over £1.25 million or a house worth £2.5 million or above.

Residents can then move to Jersey, launch a business, employ a workforce or take up an employment position of their choosing but must fulfil minimum physical stay requirements to be treated as tax residents for taxation purposes.

Travel

No other visa-free travel freedoms are associated with Jersey residency, but tax residents benefit from the low tax regime.

Timescale

Processing times vary but can take as little as one month unless further information is required.

Visas

Jersey is a Crown Dependency, so British nationals do not need a visa to visit or to live and work in Jersey. However, the island has an independent government, so visa rules for third-country nationals may vary. It is also not an EU member, although it is part of the UK/EU Economic Cooperation Agreement. European citizens can travel without a visa for up to six months but need approval for longer stays.

Learn more about visas, permits and entry conditions for Jersey.

Tax

Jersey has an autonomous tax system, with a maximum personal tax rate of 20 per cent, with no taxes on inheritances or capital gains. Non-UK passport holders can be taxed differently through the High-Value Resident (HVR) programme, which grants housing licences for investors to purchase or rent a property.

HVR applicants are taxed at 20 per cent on income from property and 20 per cent on other income up to £850,000, with a one per cent tax applied to any additional earnings.

To be categorised as a Jersey tax resident, expats must live on the island for at least half of the year or maintain their primary home in Jersey and show they have made substantial annual visits lasting at least three months at a time.

Cost Of Living

Living costs in Jersey are around 30.3 per cent higher than in the UK, with renting a home 77.4 per cent more expensive. The average family of four needs a budget of £3,369 per month, excluding accommodation, and a single person requires roughly £945.

However, lower taxes and an average monthly post-tax salary 4.2 per cent higher than in the UK means most expats find their cost of living largely unchanged.

Property

UK nationals can buy property in Jersey without any specific approval. However, non-British expats will need permission from the Housing Minister, normally applying through their solicitor or estate agent.

Registered residents without a UK passport normally must live in Jersey for ten straight years before they become entitled to buy or rent any property. High-Value Residents must rent or purchase a property above a minimum value to remain eligible for their visa.

Housing varies from luxury coastal mansions and rustic cottages with sea views to modern apartments in Saint Helier and family homes.

| One-bedroom city centre apartment | £1,428 |

| One-bedroom apartment elsewhere | £1,322 |

| Three-bedroom city centre apartment | £2,614 |

| Three-bedroom apartment elsewhere | £2,495 |

View properties in the Channel Islands for sale on Rightmove.

Healthcare

Jersey has a high-quality healthcare system, although it operates separately from the NHS in the UK. Residents who have lived on the island for at least six months can apply for a health card that reduces the cost of health treatments, doctor’s appointments and clinics, with free prescriptions.

Emergency care is free of charge, although non-residents may need to pay for hospital stays and treatments for non-urgent care. Residents may need to travel to Guernsey or the UK if certain treatments are unavailable.

While UK residents are entitled to free healthcare through the Reciprocal Health Agreement, private insurance is widely available and advisable to avoid waiting lists or delays.

Jersey Residence By Investment FAQ

Residency by investment in Jersey is available through the High-Value Resident (HVR) licence, with conditions such as making minimum tax contributions to the Jersey economy. Other residents relocating through different visa routes may be subject to other eligibility criteria and often must live in Jersey for five years to be categorised as residents.

The Jersey government could withdraw residency due to criminal wrongdoing, a failure to maintain a rental or purchase residence over the minimum value, issues around tax affairs, or making the minimum annual economic contribution.

Applications can be rejected for several reasons, such as insufficient evidence of the source of funds used to make an investment, inconsistencies or errors on the application paperwork, or a failure to include copies of ID documents and other paperwork.

Flights between London and St Helier take around one hour – a ferry from Southampton takes roughly ten hours, depending on the route.

The official currency is the Jersey Pound (JEP), but British pounds are accepted.

Jersey is a Crown Dependency, so UK citizens do not need a visa to relocate to Jersey. However, they must comply with physical stay requirements to be considered tax residents in Jersey.

Related Information

Below is a list of related articles you may find of interest.

Resources

- Government of Jersey – gov.je

- Jersey Financial Services Commission – jerseyfsc.org

- Bank of England – bankofengland.co.uk

- Office for National Statistics (UK) – ons.gov.uk