The British taxman’s crackdown on fund transfers to QROPS expat offshore pension schemes is cooling after several months of intense scrutiny.

Table of contents

Since November, HM Revenue & Customs has delisted 227 plans from the Qualifying Recognised Overseas Pension Scheme (QROPS).

The crackdown coincides with a hasty change in QROPS transfer rules on November 30 in a bid to deter scammers.

The measures raise an early warning for trustees that fraudsters may be involved in the transfers before cash in UK pensions moved offshore to become irretrievable.

Although few of the delisted QROPS were scams, many were flagged for breaking pension administration rules.

Industry experts suspect crooks steal £10 billion of the yearly £30 billion switched between pensions since 2015.

An average of £1.5 billion a year is scammed from pensions, equivalent to the life savings of between six and 10,000 people a year. However, research shows no more than half of the pension savers would spot a scammer trying to steal their cash.

What Are The New QROPS Transfer Rules?

The new QROPS transfer rules aim not to police the fund owner but to reduce the risk of a scammer getting a hand on the cash or diverting the money to a high-risk investment.

Most of the new QROPS transfer rules relate to the transferring pension trustees carrying out due diligence on the receiving scheme to verify the pension is not a scam.

The first step is showing beyond reasonable doubt that the receiving pension is a public service scheme or authorised master trust on a list supervised by The Pension Regulator (TPR).

Next comes a list of administrative red flags.

- If the transfer has no red flags, the switch to the new QROPS can go-ahead

- If the transfer is red-flagged, the transfer stops

- If the transfer is amber flagged, the retirement saver must consult the Money & Pensions Service for free guidance before the transfer can proceed

Why Do Pensions Need New Transfer Rules?

The reasons for the QROPS rule changes are embedded in the long-running Adams v Carey Pensions case. Russell Adams argued his self-invested personal pension provider lost his retirement money by allowing him to invest in high-risk storage space.

The crux of the case was if the pension provider could stop the transfer of money to a high-risk investment if the retirement saver had the legal right to decide how to invest.

The new QROPS transfer rules do not remove the freedom of choice from the saver but allow the transfer scheme’s trustees to hit the pause button if their due diligence uncovers red flags.

The idea is if concerns are flagged, the retirement saver and receiving scheme must provide requested information to the satisfaction of the transferring trustees, or the money must stay onshore.

How Are QROPS Transfers Affected?

The new transfer rules for QROPS have triggered a massive spike in the number of QROPS disappearing from the official list and reappearing as soon as a week or two later.

Delisting is important for providers as transferring schemes must not send money to an unlisted QROPS.

A red flag does not necessarily mean a QROPS is a scam. The flag can arise from a paperwork error or missing information and suspected criminal activity.

However, transferring trustees must believe the information from the saver, and the receiving scheme is genuine.

Red flags would include a sudden surge in transfer requests from a specific source or suspicions the transfer would fund an unsuitable investment.

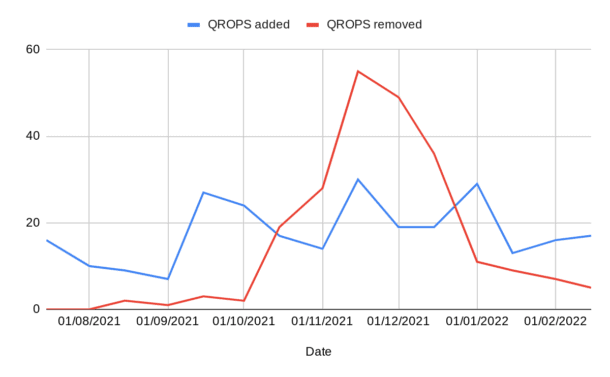

The chart shows the huge increase in delisted QROPS in November and December last year.

QROPS added and delisted August 2021 – February 2022

The table below reveals the details of the data for the chart above.

| Date | QROPS added | QROPS removed |

| 15/07/2021 | 16 | 0 |

| 01/08/2021 | 10 | 0 |

| 15/08/2021 | 9 | 2 |

| 01/09/2021 | 7 | 1 |

| 15/09/2021 | 27 | 3 |

| 01/10/2021 | 24 | 2 |

| 15/10/2021 | 17 | 19 |

| 01/11/2021 | 14 | 28 |

| 15/11/2021 | 30 | 55 |

| 01/12/2021 | 19 | 49 |

| 15/12/2021 | 19 | 36 |

| 01/01/2022 | 29 | 11 |

| 15/01/2022 | 13 | 9 |

| 01/02/2022 | 16 | 7 |

| 15/02/2022 | 17 | 5 |

| Total: | 267 | 227 |

In fact although 267 QROPS were added to the list, the balance only increased by 40 as 227 were delisted.

Don’t Punish Scam Victims

Industry experts are united in the view that HMRC should not punish scam victims who invested their money in a way that they would not have done normally if they were not cheated by fraudsters.

They are also calling for social media companies to better control pension advice advertising by restricting the service to providers on the TPR database or the QROPS list.

Lastly, the pensions industry wants to share intelligence about known scammers to expose their frauds.

Taxman Eases QROPS Crackdown FAQ

What is a QROPS pension?

QROPS is short for the Qualifying Recognised Overseas Pension Scheme. These pensions allow expats to move their retirement savings offshore when they settle abroad for tax and investment efficiencies.

Do the new rules stop QROPS transfers?

No, transfers from a UK pension to a QROPS and transfers between QROPS can still go ahead as normal. The rules mean more checks for the transferring schemes, which won’t release any cash until they are completely satisfied the receiving scheme is not a scam.

How many QROPS transfers take place every year?

The latest HMRC figures for 2020-21 show expats transferred 3,000 pensions worth £416 million into QROPS during the year.

By March 2021, more than 135,000 expats had moved £12.3 billion into QROPS since the pension scheme started in April 2006.

How do I report a scam?

If you know or believe you are a scam victim, tell the Financial Conduct Authority (FCA), the UK’s consumer watchdog.

Either call 0800 111 6768 or go to the online reporting form

Find out more about QROPS transfer rules

QROPS transfer rules are laid out in a technical piece of legislation called the Occupational and Personal Pension Schemes (Conditions for Transfers) Regulations 2021

Related Information

Below is a list of related articles you may find of interest.