Wherever you live in the world, state pensions or benefits will not provide enough money for a comfortable retirement, according to new research.

Relying on a government pension no longer makes sense as the schemes only offer a minimum income to cover basic expenses.

That makes private pensions more important because no matter where you live you are likely to face a gap between what the state pays and what you need to live, says a report from Swiss bank UBS.

The only way to bridge the gap, says the bank, is to start saving for retirement as early as you can.

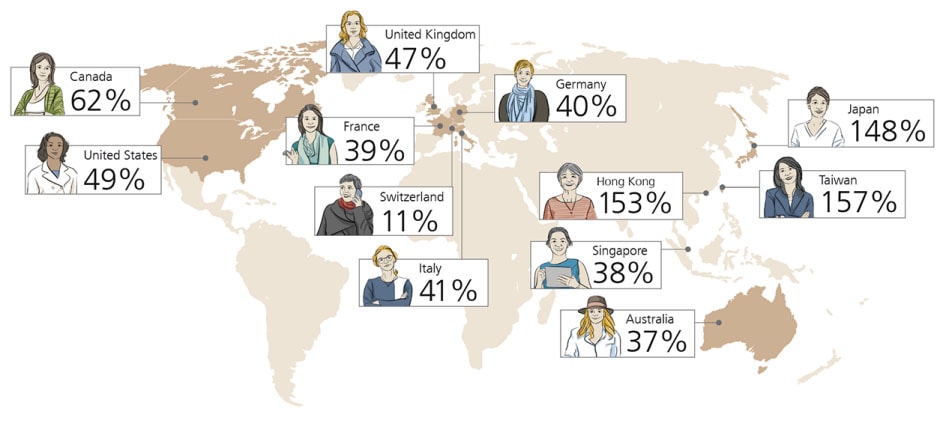

To illustrate the pension gap for different countries, the bank has worked out the difference between the projected state retirement income for a 50-year-old expat who works full-time earning an average wage but no savings.

Where the pension gap is widest

“We found that no matter where the representative expat lives, the mandatory pension system will not provide them with enough income to lean back and relax. To close the pension gap, they would need to start saving a certain percentage of their income each month,” says the report.

The study explains that retirement income is influenced by the same three factors in each country:

- People living longer and needing to save more to cover their increased lifespan

- Public finances restricting the amount of money available for social care and pensions

- Low interest rates pinning back savings growth

The widest pension gap is in Hong Kong – with a 153% difference between state provision and savings required to fund retirement.

Don’t forget tax incentives

The narrowest gap was in Switzerland, with a difference of 11%.

“While it is never too late to start thinking about your pension, the earlier you start, the better your prospects for a secure and enjoyable retirement. Over the numerous years that you spend in the workforce and can save for retirement, the compound interest effect will be substantial,” says the report.

“As your savings grow, it’s important to invest them in a smart and diversified way.

“Don’t forget about pension systems all together – many provide additional voluntary savings options, combined with tax incentives.”

Download the full report

The gap between state pensions and retirement spending

Source: UBS