Estimated reading time: 6 minutes

Expats in The Philippines who have retirement savings locked in a Swiss pension scheme can transfer the money but must follow some strict rules.

Switzerland has a three-tier pension system that allows expats to access or move their money under certain circumstances.

The first pension transfer step is figuring out where the money is.

Expats can shelter retirement savings in more than one Swiss pension with different rules applying to transfers from each.

This guide is specifically for expats in The Philippines and briefly explains the Swiss pension system and how to transfer any retirement savings.

Table of contents

The Swiss Pension System

Switzerland offers a three tier or pillar pension system for expats living and working in the country.

The pensions aim to deliver a basic standard of living for retirees, like the British State Pension, which is topped up with a workplace or personal pension.

Pillar 1 – The AHV, OASI/DI, or AHS

This is the Swiss state pension and benefits. Much like National Insurance in Britain, paying into the AHV is compulsory and in return, the government offers a state pension and other state benefits.

Pillar 2 – Workplace pensions

Workplace pensions are like the UK’s auto-enrolment. Workers and employers must pay into 2a pensions, while both can contribute to non-mandatory 2b top-up pensions

Pillar 3 – Personal pensions

These pensions give freelances and the self-employed somewhere to save for retirement. Offered by banks or financial services companies, Pillar 3a and 3b pensions are not compulsory.

Swiss Pension Options For Departing Expats

Switzerland is reckoned to offer some of the best pensions in the world, but expats will find their money dumped into a ‘vested benefits account’ with no growth and reduced benefits on retirement.

Most expats want to avoid this by transferring their retirement savings to another pension where they have more control over how the money is invested.

Taking Swiss Pension Cash Early

Swiss pensions keep a tight grip on pension cash, only allowing early withdrawal if you are:

- An expat leaving the country to live permanently elsewhere

- A home buyer who can take CHF20,000 from the fund every five years to spend on buying a home, paying down a mortgage or investing in a housing co-operative

- A newly self-employed saver starting a business who can transfer their retirement savings from a Pillar 1 or 2 pension to a Pillar 3 fund

Tax on Swiss Pension Transfers

Tax on cashing in a Swiss pension depends on where your provider is based as cantons in Switzerland can set their own tax rates. This makes living in some cities more expensive than others.

Talking to a financial adviser to plan your Swiss pension transfer could save you a pile of cash.

Researchers at global expat financial firms worked out that moving a CHF500,000 Swiss pension between the Basel and Schwyz cantons before cashing in the pot could save up to CHF 13,775 in tax.

Learn how to find financial advice in The Philippines.

Pension Transfer Options To The Philippines

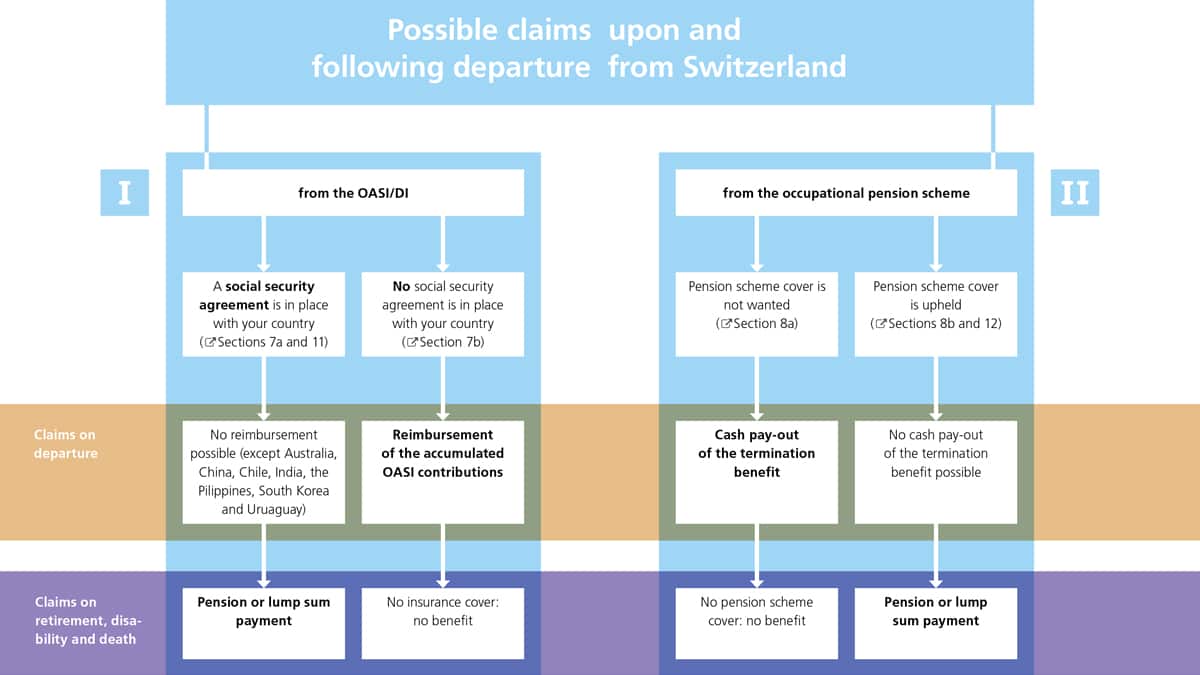

A social security agreement between The Philippines and Switzerland puts the Asia Pacific country on a special standing for expats who want to transfer a Swiss pension.

In brief:

Pillar 1 – The AHV, OASI/DI, or AHS

Expats can claim a contribution refund or leave the pension invested to draw a pension or lump sum on retirement.

Pillar 2 – Workplace pensions

Workers can choose to keep their pension benefits or cash in the fund to the value of the termination benefit, which may not be the same as the amount paid in.

Pillar 3 – Personal pensions

Any money in a personal pension belongs to the saver, so they can cash in or keep the fund as they see fit.

QROPS

The Qualifying Recognised Overseas Pension Scheme (QROPS) is unavailable in The Philippines.

SIPP

British expats can transfer their Swiss pension to an international SIPP but lose any tax breaks as UK non-residents.

However pension freedoms that let retirement savers spend their pot as they wish allow access to the cash for any reason from the age of 55 years old – years before the Swiss scheme allows early retirement at 58 years old.

Transfer A Swiss Pension To The Philippines FAQ

The Philippines is a favourite destination for many retirement-saving expats, but too many delays claiming a refund until they have left Switzerland, only to face paying more tax than necessary and reducing their pot.

Timing is everything in the world of pensions and taking transfer steps promptly and in the right order is essential.

Here are some of the most asked questions about transferring a Swiss pension to The Philippines.

State retirement age for men in 65 years old, while women can retire a year earlier at 64. Early retirement is available from the age of 58.

This is an account where money in inactive workplace pensions is held after an expat leaves Switzerland. Funds earn preferential interest but are not invested for growth.

Speak to your IFA, but the rule of thumb is to think about moving cantons and claiming a refund before leaving Switzerland so you do not incur tax on the fund in Switzerland and the country where you move to. Double taxation treaties between Switzerland and your new home may minimise the bill, but it’s best to sort this out before you leave Switzerland.

Not now as The Philippines does not have a QROPS provider recognised by HM Revenue & Customs. The transfer would be considered unauthorised and liable to tax and other penalties.

No. The transfer amount is worked out according to the contributions you and, if appropriate, your employer have made.

Related Information

Below is a list of related articles you may find of interest.