Expat retirement savers who have lost track of their UK pensions can stake a claim for a share of billions of pounds languishing in bank vaults waiting for an owner.

Around 1.6 million savers need reuniting with £19.4 billion of lost pensions, according to the latest research by pension provider trade body the Association of British Insurers.

The main reason for the mountain of money sitting unclaimed is because only 1 in 25 people bother to tell their pension providers when the move home, says the ABI.

And as most people move home eight times in their lives, the chances of tracking them down is almost impossible for the providers. The chances are even slimmer for expats.

Moving as we change jobs an average 11 times in our working lives and companies fold or merge, the problem is magnified.

Employers and pension trustees transferring information or switching from paper to digital records can easily lead to data loss that breaks the link between a saver and their money.

The average missing pot is worth £13,000 and could make a real financial difference to the retirement incomes of many.

A lifetime of pension saving amasses an average pot of £61,897, so that £13,000 could increase the fund by almost a fifth to a more respectable £75,000 that boosts pension income for life.

Government figures suggest lost pension problems are worsening and that the number of unclaimed pots could swell to 50 million by 2050.

Pension providers do try to link savers with their money. In 2017, they tried to contact 375,000 missing customers, leading to £1 billion handed back.

Undoubtedly the best way for retirement savers to keep their pensions alive is to tell the provider when they move home.

What is a lost UK pension?

Pensions are either lost or misplaced.

- A lost pension is when there is little chance of reuniting the saver with their money.

- A misplaced pension is when the provider has a good chance of finding the customer.

In the trade, missing savers are called ‘gone aways’ and their pensions are ‘dormant accounts’.

At some stage, your pension provider may have sent a letter asking that you verify your name and address.

This is a query from a provider who is trying to contact a ‘gone away’ customer.

The letter could come from a company you do not know. This is not a bid for your business but means another company has taken over the company you worked for.

Some providers do not log a pension customer as ‘gone away’ until they 75 years old, so although you may have lost track of the fund, the company still lists the pension as active. The date is the deadline for someone making tax-relieved contributions into a pension.

Is your UK Pension Lost?

The answer to this question decides if you have lost or misplaced pension savings.

Over time, some savers simply forget they have no rights to the money that they thought they had.

For example, savers who spend less than two years in a workplace pension may take a refund of their contributions – but not those made by an employer and only if the scheme rules allow refunds.

The rules of thumb are:

- If you left your job before April 1975, you probably had your pension contributions refund. If you paid no contributions, you are unlikely to have any pension benefits

- If you left your job between April 1975 and December 1985, you have a pension if you were 26 years old or over and spent at least five years paying into the fund. If not, you are likely to have had a refund and have no further rights

- If you left your job between January 1986 and April 1988, you may have a pension if you completed five years paying into a pension, regardless of your age. Your contributions were probably refunded if you left the scheme before five years were up.

- If you left your job on or after 6 April 1988, you would have a pension if you paid into the scheme for more than two years. If you left before clocking up two years in the job, you probably had a refund of your contributions when you left.

How to Find Your Lost UK Pension?

If you have any lost private or workplace UK pension pots, the first step in how to find them is becoming a lost pension detective and start by searching your own records.

Pension providers issue a statement every year detailing the value of your fund, so you may have one to hand.

Old bank statements will also show who you made pension payments to.

Do not forget to search your email archive as many providers deliver messages and statements online.

If you are in touch with old workmates, asking them about their pensions could point you in the right direction.

Armed with this information, you can pull together some details to contact the provider.

The ABI publishes a useful contact list for 142 pension providers online if you manage to find who holds your money.

The provider profiles include the names of pension funds they manage.

If you prefer to write rather than contact the provider in person, the government’s Money Advice Service has a free template letter you can download and use.

To help the provider track your missing money, it is helpful if you supply as much of the information listed below as you can:

- National Insurance number

- Date of job started

- Date you left your job

- Date you joined the pension scheme

- Date you left the pension scheme

Tracing a workplace pension

Employers offer either workplace pensions they run directly or a route to a personal or stakeholder pension run by a scheme administrator for them.

If you cannot find any clues to where your lost pension money is in your own records, speak to your former employer.

For personal or stakeholder schemes, they should know the name of the administrator, who is the new port of call.

UK Pension Tracing Service

The UK government’s Pension Tracing Service is a free tool aimed at putting retirement savers in touch with lost workplace pensions.

Beware if you search for service online. Similar web sites that charge a fee for doing a job you can easily do yourself spring up all the time. These bogus sites are often scams, although some will do what they say.

The Pension Tracing Service is a comprehensive database of 242,000 workplace and personal pensions designed to reunite retirement savers with lost money.

The web site handles more than 1.25 million searches a year.

The service is a bridge to finding lost pensions. The response will not confirm you have a lost pension or the value of the fund but will tell you who to contact to fill in the details.

The Pension Tracing Service may not offer the results you are looking for. The search results are as good as the information loaded into the database, which can hold errors, but that does not mean it is not a quick way to find lost pensions for most people.

Contacting the UK Pension Tracing Service

You can also request information about your pension from the Pension Tracing Service by phone or post:

By phone:

Telephone: 0800 731 0193

From outside the UK: +44 (0)191 215 4491

Textphone: 0800 731 0176

Relay UK (if you cannot hear or speak on the phone): 18001 then 0800 731 0193

The call centre opens Monday to Friday between 9.30am and 3.30pm (UK time)

By letter:

The Pension Service 9

Mail Handling Site A

Wolverhampton

WV98 1LU

How to use the online Pension Tracing Service tool

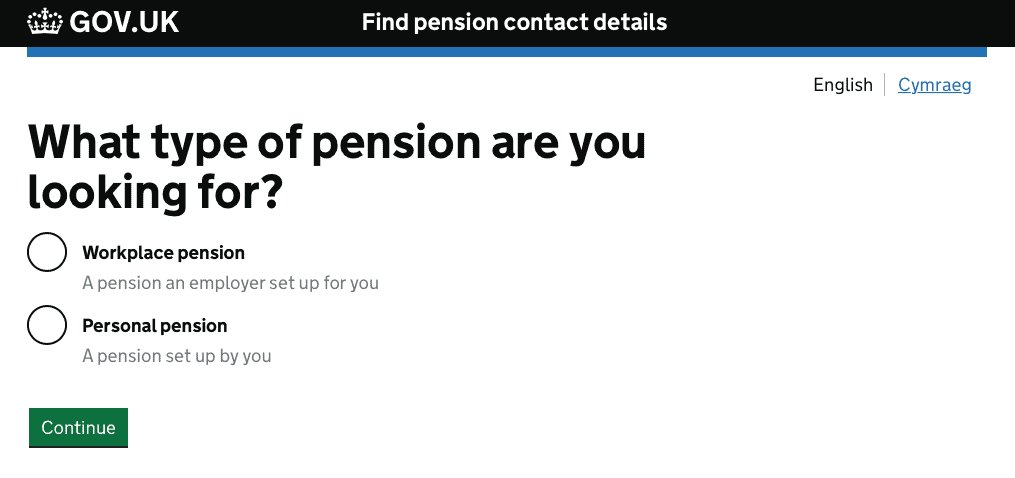

This guide will take you through the pension tracing tool step-by-step. If you are looking for more than one type of pension you can always search more than once.

- Click start and complete the declaration

- Pick the type of pension you are looking for – answer ‘yes’ for a NHS, civil service, teacher, or Armed Forces pension, ‘no’ for any other pension. If you answered ‘yes’, the tool shows a list of contact details

- Choose from the workplace or personal pension options

Workplace pension searches

If you are looking for a workplace pension, the next steps are:

- Answer ‘yes’ if you know the name of the employer who set up your pension and search the database

If the answer is ‘no’, the tool will ask the name of the workplace scheme and search the database

Personal pension searches

For personal pension searches you need to enter the name of the scheme.

How long does a Pension Tracing Service search take?

An online search returns an instant result, but a search trigged by phone or letter may take several weeks or months to resolve.

Pension Tracing Service returns no results

If you do not know the name of your employer or pension scheme, no search takes place.

Should this happen, try contacting government’s free Pension Advisory Service

If the employer running a workplace pension has ceased trading, the government’s Pension Protection Fund may have taken over the scheme.

The PPF has a full list of schemes under supervision online

If you are unsure of your employer’s name, check out Companies House which lists their address and any change of name.

Other places to look include the Unclaimed Assets Register put online by some pension providers.

Searching the database costs £25 for each attempt and only returns results from a limited number of providers compared with the Pension Tracing Service.

The Policy Detective is a free service, but you will need the name of the provider who issued the policy.

It is unlikely either search will add anything to the results returns by the Pension Tracing Service.

What if I find more than one missing pension?

If you recover more than one pension fund, you should consider if combining them into a single pot has advantages.

As an expat, you can also opt to transfer the money to the offshore Qualifying Recognised Overseas Pension Scheme (QROPS), which may offer tax and financial benefits a UK pension cannot match.

What to do depends on several factors, like the size of your pots, where you live and your age.

Don’t lose track of a pension again

If you find a lost pension, then give the provider your up-to-date contact details straight away – and keep them current if you move again.

Don’t forget you can also claim your UK state pension as an expat too.