Wealthy expats are often misunderstood when tax authorities discover they prefer to use offshore banking and financial services.

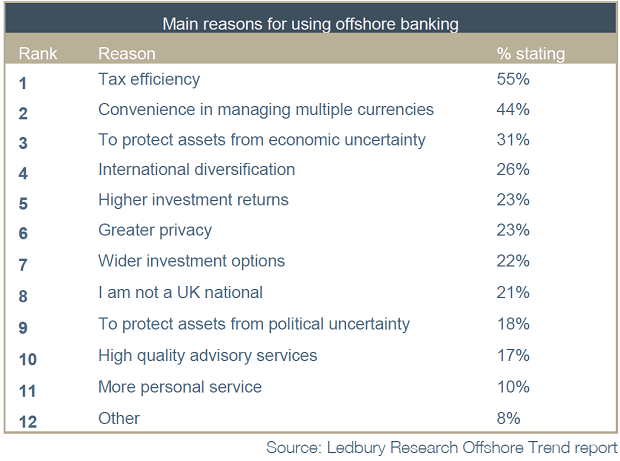

The suspicion is high net worth individuals only favour offshore financial services is to avoid tax, but a study by international market researchers Ledbury revealed lots of other reasons.

Although paying the right amount of tax is important to the wealthy, a wide range of other reasons also influence their decision making.

“We found three reasons dominate the thinking of high net worth individuals, and while tax effectiveness is high on the list, the others are just as important to them,” said a Ledbury spokesman.

Three key offshore finance drivers

The study lays out the three main drivers leading the wealthy to take their money offshore:

- Performance

Performance includes tax efficiency, seeking better yields on a broader range of investments and a more personal service

- Global considerations

Many wealthy individuals have global financial interests that are better managed in an offshore financial centre. Many also share their time between more than one country, so tax residency can become an issue.

Holding offshore bank accounts also lets the wealthy hold multiple currencies and minimise the impact of exchange rate fluctuations on their cash and investments.

- Safe havens

Offshore accounts can offer a measure of protection from economic and political instability in some nations – for example, the recent Arab Spring social unrest has led many Middle East and North African customers to hold their wealth offshore

“Offshore banking and financial services offer the wealthy benefits and advantages that are often unavailable elsewhere,” said the Ledbury spokesman.

Taste for property

“Nevertheless, the wealthy and the companies that wish to manage their wealth must make sure that they choose the right offshore jurisdictions.”

Meanwhile, Ledbury research also points out that offshore wealth, especially sourced in China, is going into property.

Poor equity returns and government tinkering in prices is leading Chinese property investors to look further afield for high yield property opportunities.

“A strong currency is making overseas assets more affordable, but other key reasons for the investments include moving families to places with better education, high-quality housing and wealth protection,” said the spokesman.

The main property destinations for wealthy Chinese investors are the US, Canada, Australia and Britain.