Estimated reading time: 11 minutes

Banks and finance house design fintech apps for consumers, savers and investors living in one country but do not cater for expats making cross-border transactions.

Expats embrace the freedom and opportunity of living and working where they want, while international borders trap their money even when many fintech apps boast 24/7 access from anywhere in the world.

The truth is while expats are mobile, their money is not.

Even though fintech apps let expats track their accounts. Financial regulators restrict what they can do with their cash from overseas for many expats.

Juggling finances in more than one country is also a challenge for many expats, so the list of apps includes some that will help with running a busy expat life.

Table of contents

What can expats do with fintech apps?

Fintech does away with visiting a bank branch, talking to a call centre, or posting forms whenever an expat wants to access their cash.

Fintech conveniently divides into several categories:

- Banking – From paying bills to transferring cash to a foreign currency, fintech allows consumers to manage and track their money 24/7 from wherever they are in the world

- Stock trading and investing – Expats can trade funds, stocks, shares, and even stake cash into a crowdfunding bid with fintech.

- Cryptocurrency – Dealing with online digital currencies like Bitcoin or Ethereum is only possible through a fintech app

- Mobile payments – The fear of spreading COVID-19 on bank notes and coins has triggered a boom in cardless payments and online money transfers.

- Insurance – More consumers are buying life, travel, car, and home insurance online than ever before as financial firms turn to comparison sites to broker their deals

Fintech Apps That Make Life Easy For Expats

Here are some of the most useful fintech apps for expats:

ATOM Trust

The ATOM Trust App gives expat investors an easy way to set up an offshore trust to manage their wealth without face-to-face meetings with lawyers, tax experts and financial advisers.

An intuitive form guides expats through set-up in a matter of minutes. Then, a personal access code unlocks a 24/7 dashboard for viewing and managing the account.

ATOM Trust offers financial and tax benefits linked to exclusive investment opportunities with some of the world’s leading international investment houses and banks.

The app is useful as a starting place for planning wills and dispersal of wealth as well as managing money.

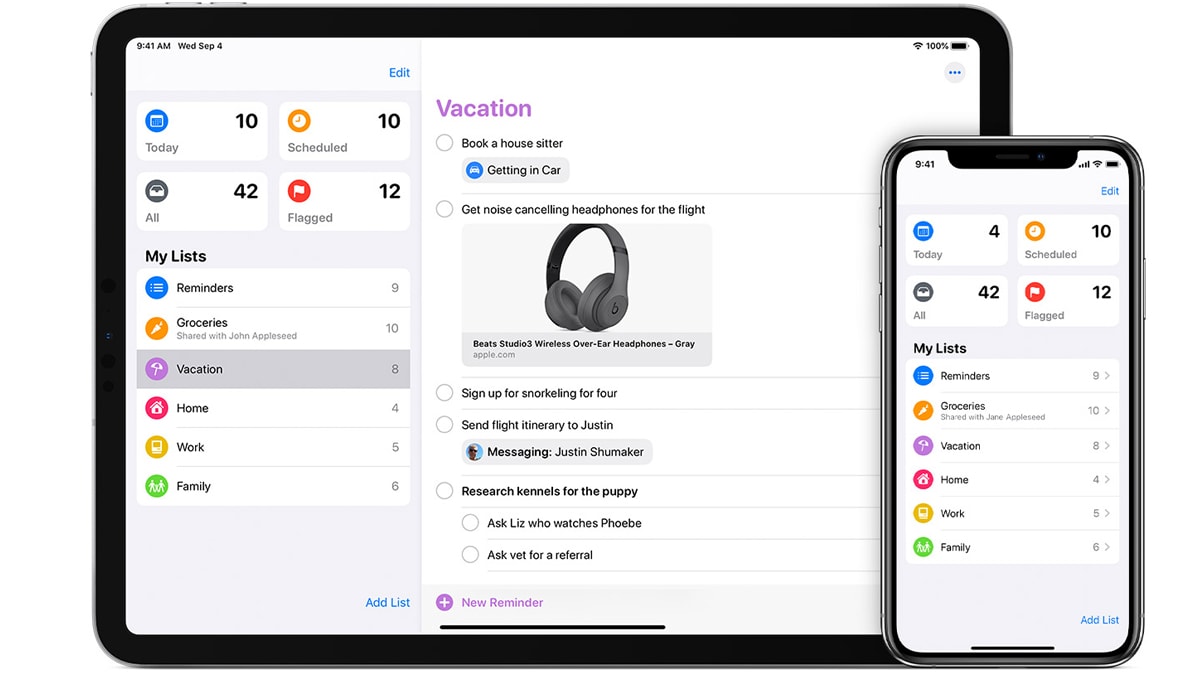

Apple Reminders

Apple Reminders is a boon for expats with money and assets in more than one country and time zone.

Remainders is a default app bundled with iPhone that tracks and flags alerts.

The app means expats never have to worry about forgetting to pay a bill or missing an appointment again.

Configuration is easy and has lots of unseen uses – for instance, avoid overstaying when a visa runs out or expats have spent to much time in one place, triggering the chance of an unnecessary tax bill.

Android users have dozens of similar apps to choose from, including Google Calendar, which does much the same as Apple Reminders and can download to iPhones and iPads as well as Android devices.

Open Banking

Open Banking is a UK innovation fintech app for expats that allows providers access to your financial information.

Any expat with a UK mobile current account can link the data across apps and websites.

Hundreds of providers have signed up to Open Banking. The app can compare deals, handle payments, and easily access your financial data.

Open Banking through a UK banking app is an easy way to track account balances and spending.

Some international banks , such as HSBC Expat, have apps for mobile banking, but no one has developed international open banking for expats.

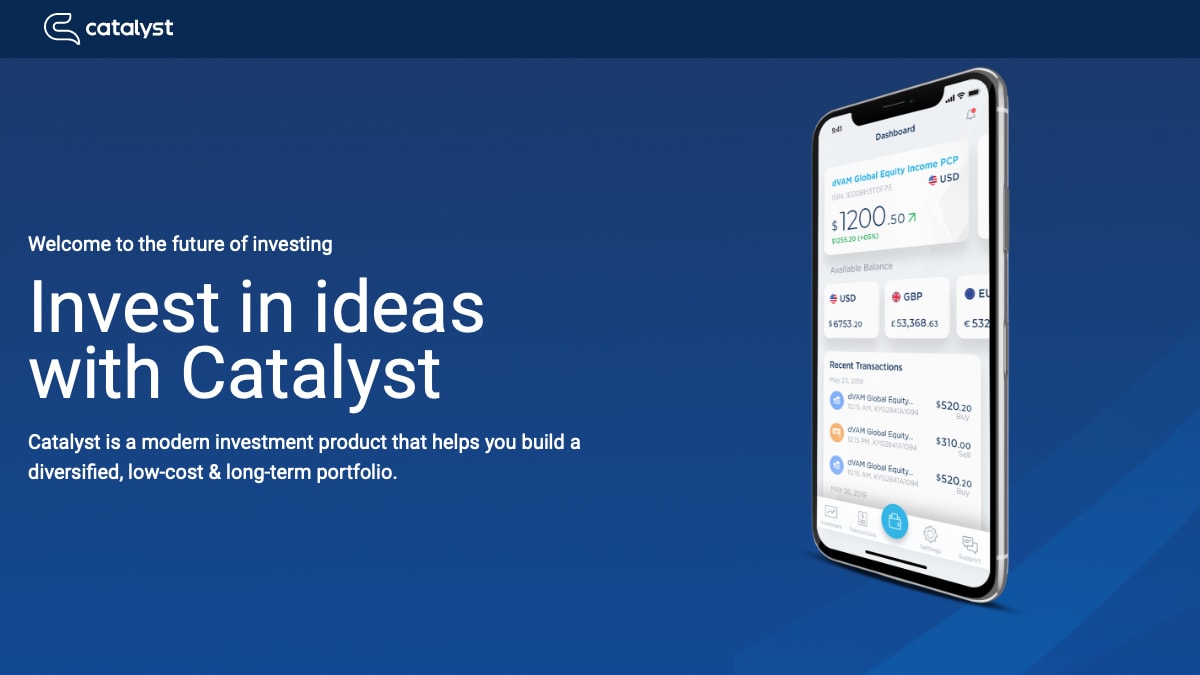

deVere Catalyst

deVere Catalyst makes investing easy for expats and international workers.

The aim is to let the fintech app for expats take the strain off investing for busy people.

deVere Catalyst trade funds and choose how much to save, when to invest and the risk they are ready to take without tying up money for a fixed term.

Once investors have completed their profile and chosen their funding path, investments are watched over by professional managers.

Another benefit for users is a fund managers discount on set up and management costs.

Catalyst does not replace tax efficient savings like pensions but is somewhere to consider for expats to park their spare money.

Google Translate

Google Translate can speak for you if you are stuck for words in a foreign country.

The clever app can translate voice, text, or images between 108 languages.

Available for iPhone or Android phones, Translate seems never lost for words even if you are.

Another cross-platform option with the same features is iTranslate Voice, although the app is limited to 40 languages, including all the most used.

Evernote

Keeping receipts to claim business expenses is essential for expats on assignments and the self-employed.

Evernote Scannable uses an iPhone or Android device camera to log and store bills in the cloud for instant recall when filling in expense claims or preparing tax returns.

Plenty of other apps do the same – FreeAgent accounting and tax software is one of several that will take the snaps from a smartphone and catalogue them into accounts in a jiffy.

Unlike receipt cataloguing apps, Evernote is also a place to keep notes, links images and documents safely online.

HMRC also publishes a list of accredited software developers with business record-keeping apps

deVere Vault

deVere Vault is a money transfer app for expats and international workers.

Vault can send money between users, bank accounts, or third parties.

Each account also comes with a credit card for up to three users.

Accounts are set up in one of five major currencies – Sterling, US dollars, the Euro, Swiss Francs or Polish Zloty – and move money between 22 other currencies.

deVere Vault is a cheaper and quicker way to convert foreign currency than a bank.

The app also alerts users when a foreign currency hits the best rate for transfer.

Another bonus feature is that the app sets out a clear and concise conversion rate and fees before any currency exchange, giving users control over their funds transfer.

Money Dashboard

Money Dashboard is a leading fintech budgeting app for expats.

The app takes in open banking data and automatically works out spending to present a personal financial overview in a single screen.

Money Dashboard can pinpoint spare cash for saving, set financial goals and check if your plan is on track.

Available for iPhone and Android, the app can set budgets and send alerts if your spending is more than expected.

Mint is another popular budget tracking app that also includes a handy tool for unlimited credit score checks

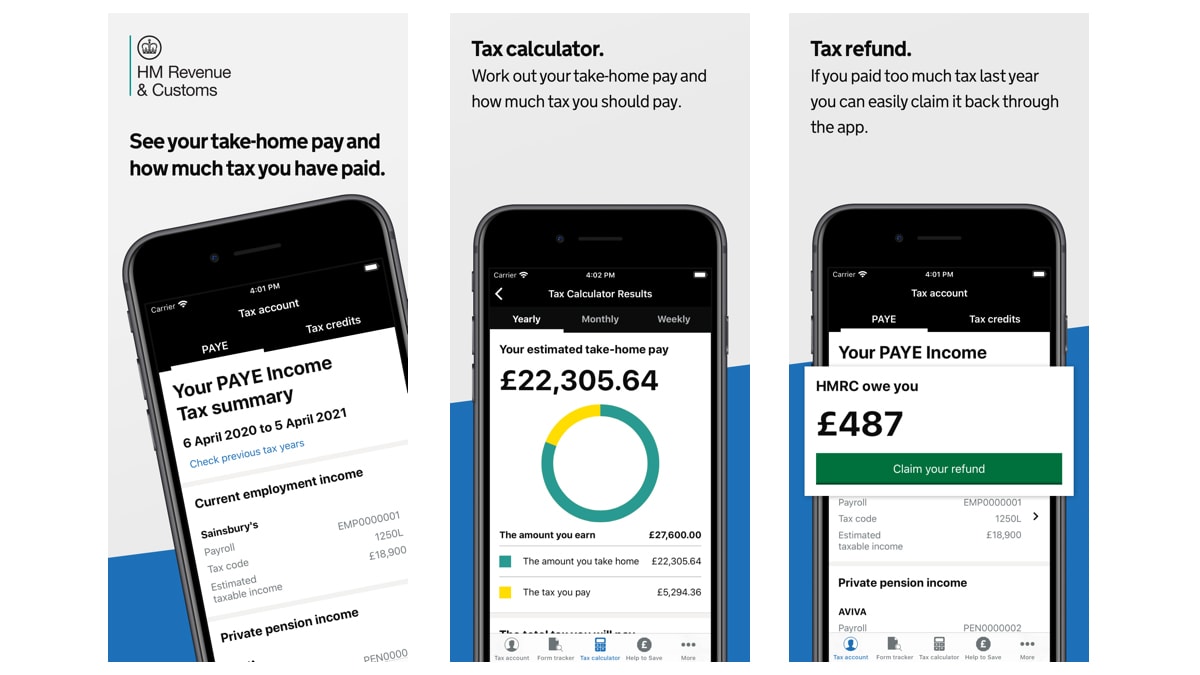

HM Revenue & Customs App

The HMRC app links in with a personal tax account and shows how much tax HMRC thinks you should pay each year.

The account shows essential data, like national insurance and unique taxpayer references, tracks form and letters filed with HMRC and can even claim a tax refund.

HMRC also offers a separate tax calculator app that works out the tax someone should pay and reveals how the government spends the money on public services.

Crowdfunding apps

Crowdfunding is when a group of small investors pool their money to fund a project. The money can buy shares in a company or receive rewards in recognition of the donation, like free gifts or discounts.

The crowdfunding market is diverse with dozens of apps vying for investor cash.

Apps specialise in funding businesses, charities, creatives and deserving cases, to name but a few.

The big names are Kickstarter and Indiegogo in a world where hundreds of platforms worldwide are standing should to shoulder vying for investment.

deVere Crypto

deVere Crypto is an electronic wallet for buying, selling, and trading cryptocurrencies.

Digital investors can load the app with hard currencies, like the euro, pound or dollar and buy a range of cryptocurrencies, such as Bitcoin, Ethereum, Ripple XRP, Litecoin, Dash and many others.

The app securely stores cryptocurrencies and has a tool for tracking market position and performance.

A special ‘stop’ feature allows deVere Crypto to put a hold on transactions to avoid risk and possible losses.

Mobile payments

Besides banking apps for mobile payments, several dedicated apps are available.

Many are well-known – PayPal, Apple Pay and Google Pay are leading examples, along with Samsung Pay.

Apple Pay only works with iOS devices, while Google Pay does the same for Android and Samsung Pay is tied to Galaxy smartphones.

These services boost contactless payments to more than the £45 UK banking app and card limit.

Fintech Apps For Expats FAQ

Fintech is a technology revolution that has touched the lives of almost everyone linked to the internet.

The big change has come in the way customers interact with their banks with the popularity of mobile banking but fintech has many other applications that make life easier.

If you want to find out more about fintech apps for expats, here are some answers to the most asked questions.

Fintech is short for financial technology. A Fintech App is software on a smartphone, tablet or laptop that allows a user to connect with a financial service online.

Fintech is short for financial technology.

Fintech apps cover a range of online services, from making payments to transferring money between currencies, trading stocks, managing international trusts or cryptocurrencies.

Banks in the UK have embraced an open banking platform that lets customers see all their accounts in one place, so a NatWest customer can view their accounts alongside their Barclays Bank accounts in the same app.

Lots of accounting and money tracking apps link with bank accounts and credit cards to download and analyse data in a single app in the UK

Financial regulators and tax authorities can only make rules for their own jurisdictions. Even though banks and financial firms are international, they must follow the rules in the countries where they do business, and these rules can vary greatly between jurisdictions. The same goes for expats. If they have assets in the UK and Australia, they must obey the rules in both countries.

Online security is important to fintech app providers, so security is important in developing an app. Companies must follow data protection rules in the country where they are based. Most rely on two-step security that involves linking your smartphone to your app account as an extra layer of protection with a code issued when you want to withdraw or transfer money.

Related Information

Below is a list of related articles you may find of interest.