Estimated reading time: 6 minutes

Paying the bills is a struggle each month for many people as the rising cost of living takes an ever larger bite from their pay.

The media is full of warnings about rising interest rates and the increasing cost of living, so how do the two interact?

Many governments have handed the responsibility for controlling inflation to their central bank.

In the UK, it’s the Bank of England; in the US, it’s the US Federal Reserve. Both would like to see inflation of between two and three per cent, but in the US, it’s currently six per cent and in the UK, eight per cent.

Both promote a low, increasing cost of living as good for the economy and much better than zero or falling inflation that can create havoc in the economy.

Interest rates tend to follow the same path as inflation but with a time delay as policymakers consider how to manage the economy.

Table of contents

How Do Governments Measure Inflation?

Each central bank has a preferred measure of inflation. In the UK, it’s the CPI or Consumer Price Index. In the US, it’s the PCE or Personal Consumption Expenditures price index.

The indices monitor changing prices in many sub-groups, like food, clothing and energy costs.

The index has a base point – usually 100 or zero – which was set at the start of monitoring prices. The inflation rate is how the base rate changes in percentage terms over time.

The two main inflation measures are taken over one and 12 months. So, an inflation rate of 8.2 per cent over 12 months shows the index has increased by that amount over a year. The underlying prices could change by more or less, but the index takes an average of all the sub-groups in the ‘basket’.

The basket is an imaginary monthly shop holding the data.

How Do Changing Interest Rates Impact Inflation?

Interest rates act as a throttle on the economy’s money supply. Raising interest rates closes the throttle, pushing prices and limiting spending on luxury goods.

Dropping the rate lets more money flow into the economy and encourages spending people could not afford in times of austerity.

For ordinary people, lifting the rate makes goods in the shops more expensive and discourages the purchase of anything but basic items.

Policies And Inflation Out Of Step

The big problem with controlling inflation with interest rates is timing.

Policymakers tend to collect data and weigh the evidence before deciding to raise or drop interest rates – and those decisions then take time to impact the economy.

This often leads to policymakers having to guess best how inflation will move in the coming weeks, months or even years. The problem is past performance is no guarantee of future rate levels, and shocks happen – like the COVID-19 pandemic and Russia’s invasion of Ukraine.

“If making monetary policy is like driving a car, then the car has an unreliable speedometer, a foggy windshield, and a tendency to respond unpredictably and with a delay to the accelerator or the brake,” former Federal Reserve chair Ben Bernanke said.

Why Is Inflation A Bad Thing?

Inflation is OK in small doses. The US Federal Reserve calls inflation of around two per cent the Goldilocks zone, where rising prices do not damage the economy.

But what happens in some countries, like the UK, is damaging.

The Bank of England has steadily increased interest rates to push inflation down for a year.

But as interest rates rise, so do rents and mortgage costs, making inflation grow, necessitating another rise in interest rates. The spiral continues until someone is brave enough to call a halt to their behaviour.

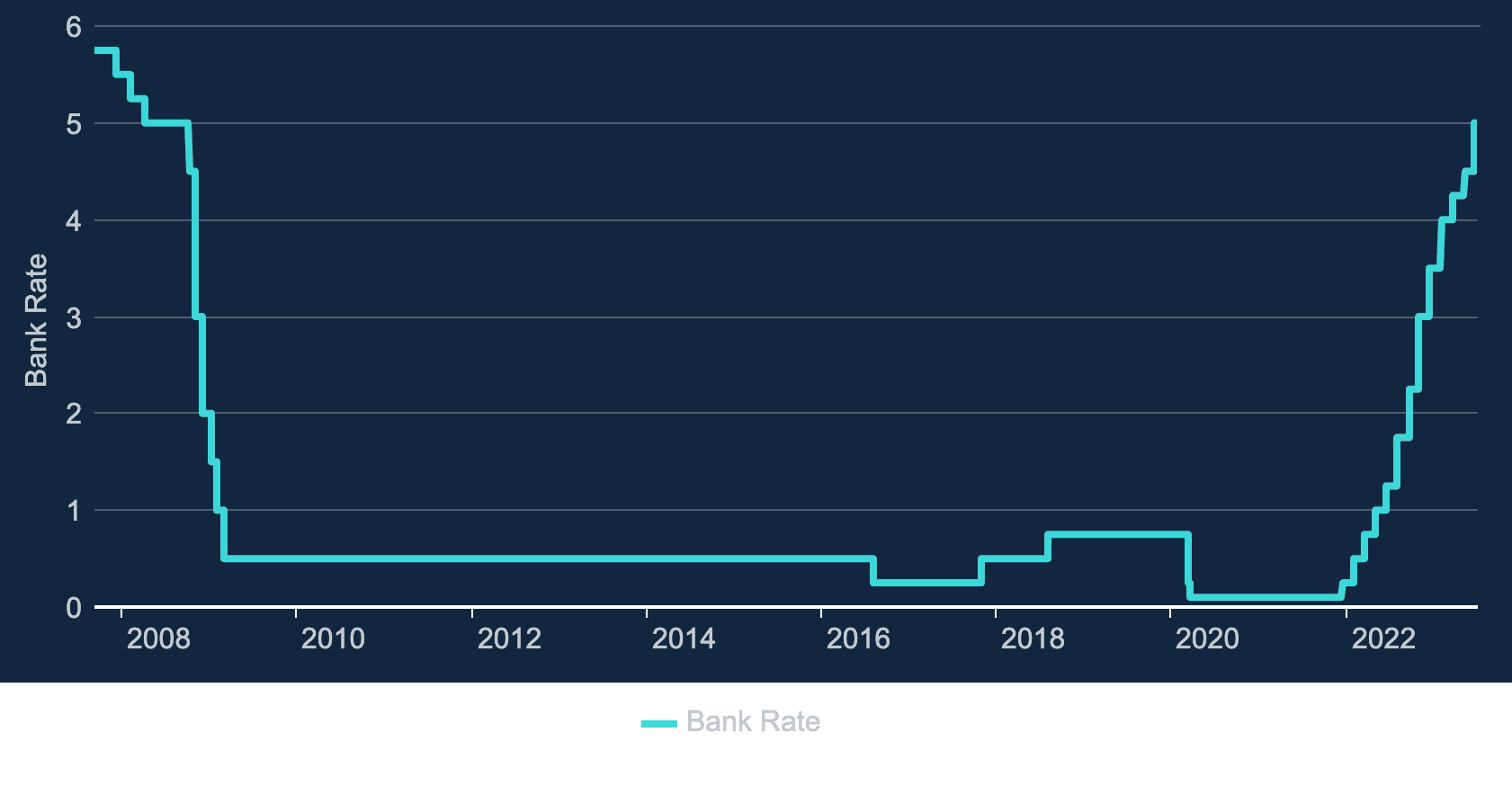

The Official UK Bank Rate

The rate rapidly dropped from five per cent to 0.5 per cent or less, where it sat for over a decade.

Since late 2021, the rate has gradually risen to five per cent.

Inflation And Bank Rate FAQ

The official interest rate, or bank rate as it’s often known, is the interest rate paid to banks that deposit cash with the Bank of England.

Commercial banks in the City or on the high street set customer rates based on the official interest rate. They do not have to charge the same rate – they decide what to charge borrowers and pay savers.

Sometimes the rate is expressed as ‘bank rate plus one per cent’, which means a borrower pays the BoE base rate plus one per cent.

It’s impossible to set one international base rate for many reasons because different countries have economies that perform at different levels. The more advanced economies in North America and Europe tend to have a lower inflation rate than younger nations.

Stagflation is an unwelcome mix of slow economic growth, high unemployment and rising prices. Until recently, stagflation was considered possible in theory but unlikely to occur, but since the 1970s has repeatedly happened in developed economies.

The Bank of England usually sets the bank rate each month by the monetary policy committee members. In the USA, it’s the board of the Federal Reserve. In both cases, the government has no sway in the committee votes.

A central bank manages the currency and money supply for a government. The main objective is to set monetary policy designed to stabilise inflation and prices.

Monetary policy is what central bankers do to influence borrowing costs and the amount of money circulating in an economy.

The Bank of England has two main tools – adjusting interest rates and quantitative easing (QE). QE involves creating more cash for the central bank to buy government or corporate bonds to stimulate an economy.

Quantitative easing (QE) is a central bank monetary policy tool to stimulate the economy when traditional measures are insufficient. It involves the central bank buying government bonds or other financial assets from commercial banks to resell, injecting money into the economy.

Energy costs, such as the prices of oil, natural gas, and electricity, are significant components of production and consumption in modern economies. When energy costs increase, it can lead to higher production costs for businesses, which pass to consumers as higher prices for goods and services.

Related Information

Below is a list of related articles you may find of interest.

Resources

- Bank of England – bankofengland.co.uk

- US Federal Reserve – federalreserve.gov

- Office for National Statistics (UK) – ons.gov.uk

- Bureau of Economic Analysis (US) – bea.gov