An investment scheme offering generous tax breaks has raised more than £799 million for start-up companies, according to the latest data.

The Seed Enterprise Investment Scheme (SEIS) has helped 8,840 companies since April 2012, says HM Revenue & Customs, which supervises the scheme.

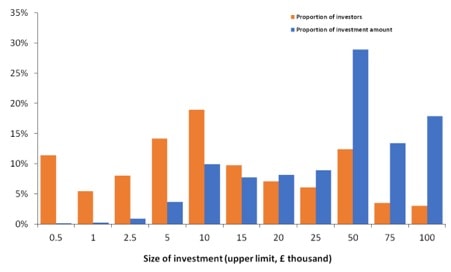

In 2017-18, 7,860 investors claimed SEIS tax breaks, with 58% claiming less than £10,000.

The most common investment size was £25,000 or more, which made up 60% of the total.

SEIS was aimed at raising money to help entrepreneurs who could not source funding from banks after the global financial crisis.

High-risk investments

These businesses were considered high risk as they had no trading history and either failed because they lacked investment or were dragged down financially as loan repayments drained cash flow.

SEIS changed the market by offering investors tax advantages in return for buying shares in start-up companies.

The capital raised stays with the business as no loan repayments are due and investors can sell their shares after three years without paying tax if a gain is made.

HMRC revealed 2,320 companies raised £189 million under SEIS in 2017-18, in line with the year before, when 2,425 raised £187 million.

More than 1,700 companies raised funds through SEIS for the first time, garnering £157 million from investors.

Where the money went

The biggest slice of the money – £69 million or 37% of all funds raised – went to companies in the information and communications sector.

Businesses in London and the South East raised the most money – £117 million or 67% of funds raised in the tax year.

The next four largest sectors (manufacturing, wholesale and retail trade, professional, scientific and technical, and administration and support services sectors) accounted for £75 million of investment (40% of the total).

SEIS investors gain a 50% refund on income tax paid on investments of up to £100,000 in a tax year.

Any capital gain from share growth after three years is exempt from tax. If the investment fails, loss relief is also available.

SEIS investors and tax breaks claimed 2017-18

Source: HMRC