Trust is the main driver that makes gold such a glittering prospect for so many investor around the world.

Gold is precious to most people, with nearly half of investors and consumers having bought the precious metal at some time in their lives.

In the world’s two most populous nations of India and China, the number of gold investors is phenomenal – 68% of Indians and 73% of Chinese.

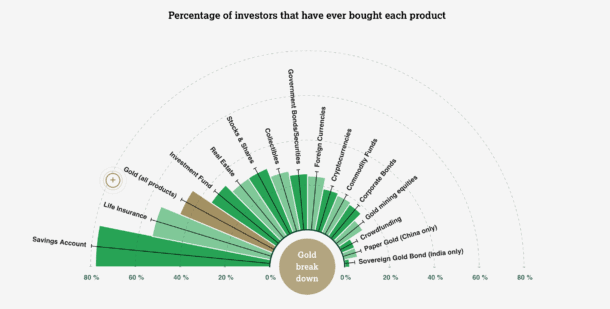

For investors, gold is more popular that real estate, stocks and shares, bonds and cryptocurrency, says new research from the World Gold Council.

The only investments that top gold worldwide are cash savings, which are held by around 75% of investors and life insurance, bought by nearly 55%.

Why do investors buy gold?

“Gold creates a feeling of safety and security. Most retail investors and fashion and lifestyle consumers trust gold more than the currencies of countries,” says the latest gold retail market insight from the World Gold Council.

The study reveals two out of three investors sees gold as a safeguard against inflation and currency fluctuation. A similar number believe gold holds value in the long term, owning the precious metal makes them feel secure and is more trusted than most currencies.

“It is prized for more than just its inherent value. Retail investors and jewellery buyers alike feel that gold brings back lots of happy memories and can bring good luck,” says the report.

The study also looks at why people buy gold and found that desire for gold increases with income for investors as well as lifestyle consumers buying jewellery.

They were prompted by a desire to move to lower risk investments (44%), on advice from an IFA or friend (31%) or because the price was low and purchase seemed an opportunity to make a gain (29%).

How investors stake their cash

Source: World Gold Council