Estimated reading time: 7 minutes

The straight answer is no one knows, and the amount of money needed varies for different people.

But for most of us, the surefire answer is more cash than we have got unless we seriously start saving as soon as we can.

Research by the UK’s Pension and Lifetime Savings Association (PLSA) reveals that only around one in six of us can determine the amount of money we might need.

The problems are too few of us understand how inflation reduces a retirement pot, and at least half of us are too immersed in our current needs rather than saving for the future.

To help with the calculations, the PLSA has set a series of retirement living standards for singles and couples. The figures allow savers to aim for a financial target rather than hoping for the best.

The standards benchmark spending levels for retirees with varied incomes.

Table of contents

What Are The Retirement Living Standards?

The standards take a deep dive into retirement spending gathered from interviewing thousands of people about their savings and how they plan to spend their pension and investment cash.

Analysts crunched the numbers from this data and came up with 12 amounts.

| Single | Couple | ||

|---|---|---|---|

| Minimum | UK | £12,800 | £19,900 |

| London | £14,300 | £22,400 | |

| Moderate | UK | £23,300 | £34,000 |

| London | £28,300 | £41,400 | |

| Comfortable | UK | £37,300 | £54,500 |

| London | £40,900 | £56,500 |

How Much Do I Need To Save?

The saving targets, including the full State Pension, are not as bad as they seem.

The State Pension is currently £203.85 a week or £10,600 yearly.

Government figures show that the average pension pot for an individual is £361 a week, totalling £18,722. That will get you by but is not enough for a comfortable retirement.

To get that £18,722, deduct the State Pension (£10,600) to see the gap you must bridge with savings (£8,122).

How much you need to save depends on several variables. Such as when you start saving, how much you save, when you plan to stop working and whether you qualify for the full State Pension.

The rising cost of retirement, especially after rampant inflation, has gripped the economy and thrown many people’s finances into disarray.

Pension savings of £200,000 could give you that £8,000 extra income if you take four per cent of the pot a year without opting for tax-free cash.

The minimum pension aims to provide everything you need for a basic lifestyle, covering household bills, food and leaving a little over for luxuries. The budget won’t stretch to a new car or holidays overseas.

A moderate retirement income pays the bills and offers a week’s holiday in Europe, plus a little extra for clothes and food.

A comfortable retirement won’t give you a millionaire lifestyle but is enough to quell some of those money worries. The budget will give three weeks’ holiday a year and more to spend on food and clothing.

How Long Does My Pension Money Need To Last?

On average, a 65-year-old man is expected to live until 85, while a 65-year-old woman should live to 87 years old.

That means a typical retirement lasts 20 years – from age 66 until 86.

The uncertainty of how long you will live means you need to think about eking your money out across your lifetime. If you live longer than expected, you could run out of money, but you don’t want to live more frugally than you have to.

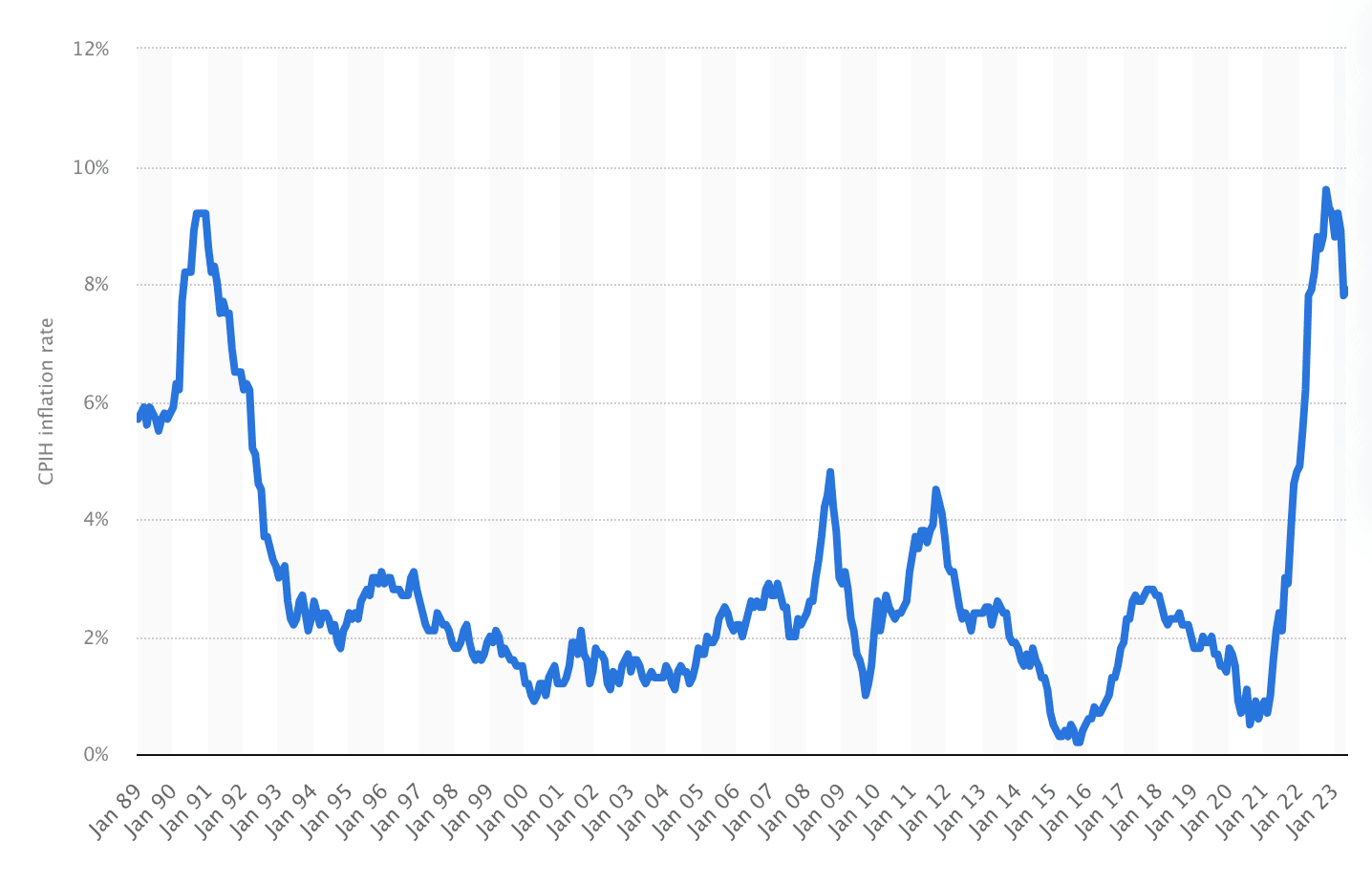

Inflation is the hardest factor to consider. The government target is for the cost of living to rise between two and three per cent a year. However, the recent Consumer Price Index high was 9.3 per cent in November 2022.

To keep savings on track, you need to increase the amount set aside each month by 9 per cent.

This is how inflation has impacted the cost of living since 1989:

How Do I Work Out My Retirement Funding Gap?

Your retirement funding gap is the difference between your State Pension payment and the retirement living standard you would like to achieve.

For example, a couple who are both 35 years old need to pay 12 per cent of their salary into a pension and qualify for the full State Pension to amass a retirement income of £40,300 a year from the age of 67.

Don’t forget the gap is bridged by the income your retirement savings pay, not the size of the pot.

How Do People Spend Their Retirement Money?

If you want to draft a budget for your likely spending in retirement, here are the categories the PLSA concentrated on:

Home

- Household utilities, like water, electricity and council tax

- Mobile and phone bills

- Decorating and maintenance, including cleaning and gardening

- Furniture and appliances

- Saving for a funeral plan

Food

- Groceries, eating out and wine and beer

Transport

- Paying for a car

- Taxis

- Rail travel

Leisure and holidays

- TV and gadgets

- TV licence and subscriptions

- Internet

- Hobbies and activities

- Holidays, including spending money

Clothing and personal spending

- Clothing and shoes

- Cosmetics and personal grooming

- Dentists and opticians

Charitable donations

- Gifts and either donations to charities and others

Saving For Retirement FAQ

The PLSA – or Pension and Lifetime Savings Association – is a finance industry-funded think-tank representing pension schemes managing £1.3 trillion in funds for 30 million people.

You can ask for a State Pension forecast online at any time. The forecast will disclose how much you should get when the payment starts and how to increase the amount if possible.

Click here to check your State Pension forecast

The government’s online pension tracing service will not tell you if you have a pension or what it’s worth but will confirm if you have a workplace pension and gives the details of the trustees administering the scheme.

Click here to start tracing a lost workplace pension

Inflation affects how much you save to reach your retirement cash target and the money you draw from a pension. Inflation reduces the amount your pension can buy by increasing consumer prices. The State Pension and most workplace pensions are adjusted each year in line with inflation to maintain spending power.

The government’s Money Helper website has stacks of free advice, tips and guidance about saving and budgeting for retirement. If you need help figuring out your options, you can get in touch by phone, online inquiry forms or live chat.

The website also includes an online pension calculator

You can retire when you wish but cannot access the State Pension until you are 66. This lifts to age 68 for anyone born after April 6, 1978. You can draw from a workplace or private pension from the age of 55, but this raises to 57 from April 6, 2028. The government has signalled these age limits will rise but has not suggested when.

Related Information

Below is a list of related articles you may find of interest.

Resources

- Pension and Lifetime Savings Association (PLSA): The official website of the PLSA, a UK finance industry-funded think-tank representing pension schemes, providing research and information on retirement savings and planning. (https://www.plsa.co.uk/)

- Office for National Statistics (ONS): The UK’s largest independent producer of official statistics, including data on inflation, life expectancy, and other economic indicators. (https://www.ons.gov.uk/)

- UK Government’s MoneyHelper: The government’s official website providing free advice, tips, and guidance on saving and budgeting for retirement, including pension calculators and retirement planning resources. (https://www.moneyhelper.org.uk/)

- UK Government’s State Pension: The official government website providing information on the State Pension, including eligibility, calculation, and how to request a State Pension forecast. (https://www.gov.uk/browse/working/state-pension)

- UK Government’s Pension Tracing Service: The official government service that helps individuals trace lost workplace pensions and provides details of the trustees administering the schemes. (https://www.gov.uk/find-pension-contact-details)